Will IRS Change Tax Filing Deadline? | 2021 Tax Day Date Change

The IRS may be forced to change the tax day deadline date for 2020 tax returns. Two major CPA and Tax Accounting Organizations have filed formal request to the IRS the change the tax season 2021 tax filing date from April 15th to July 15th.

DISCLAIMER

This video is intended for educational purposes and should not be taken as legal or tax advice. You should consult with your financial professionals about your unique financial situation before acting on anything discussed in these videos. Freedomtax Accounting and Multiservices Inc. is providing educational content to help small business owners become more aware of certain issues and topics, but we cannot give blanket advice to a broad audience. Freedomtax Accounting and Multiservices Inc. or its members cannot be held liable for any use or misuse of this content.

The AICPA and the NATP Government Relations team submitted a request this week to the IRS for guidance on several tax return filing concerns. The request stated that with tax season underway, anxiety among practitioners is heightened due to a lack of clarity necessary for accurate and timely tax preparation. The topics we addressed include:

In addition to a request for guidance, additional concerns were addressed, including:

- The effect on the current tax season by prior tax filing season unread/unprocessed mail

- Incorrect IRS notices resulting in unprocessed payments, late filing penalties, missing refunds and overpayments

- Challenges because of current filing due dates for flow-through entity returns

- Challenges because of current filing due dates for farmers and fisherman

When we receive feedback from the IRS on the noted concerns, we will promptly update you. #tax #taxes #taxday #taxseason2021 #taxduedate

Video transcript:

Hello from FreedomTax Accounting, we are an accounting firm where we have been providing quality tax and accounting services now for over 20 years. We wanted to do this quick video because the IRS may be forced to change and push back the tax filing deadline and that’s what we’re going to talk about in this video.

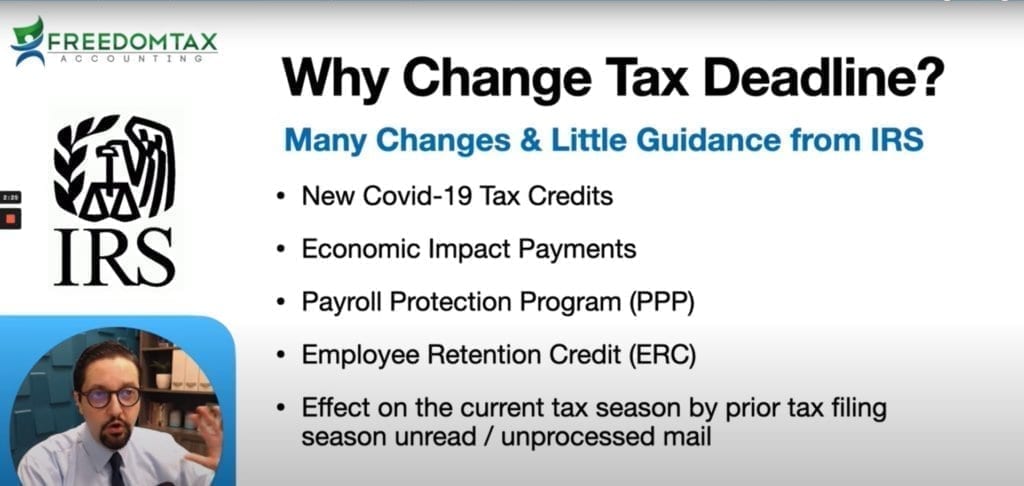

Now two of the biggest tax accounting CPA organizations in the US both have filed formal requests to the IRS suggesting that they push back the April 15 tax filing deadline. The AI CPA, which is the American Institute of Certified Public Accountants, and the NATP, the National Association of tax professionals, both organizations have filed formal request to the IRS to push back the April 15. Tax deadline. Now, why are they asking the IRS to push back the tax deadline, because of COVID and because of the new stimulus bill that was approved, back in December of 2020, there are a lot of tax changes? But there’s a little guidance from the IRS for some details in most of these programs, and how US tax professional CPAs tax attorneys, how we should move forward and do proper tax planning with all of these tax changes due to COVID. Remember, there are new COVID-19 tax credits, there’s economic impact payments, there’s changes to the PPP loan program, there’s big changes to the employee retention credit, which is a big, big topic for small business owners at this time right now, where if they got PPP, now they can also get the employee retention tax credit and also not mentioning that the IRS has still not processed 1000s and 1000s of tax returns from 2019.

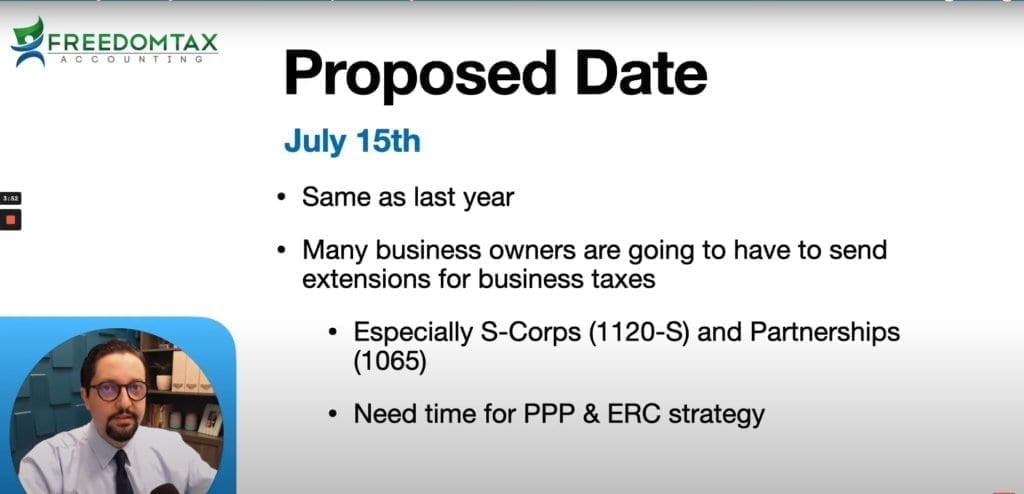

So, the IRS is still behind processing last year’s tax returns. There are a lot of people who haven’t still received their 2019 tax refund. So all this that’s in the tax industry in the accounting industry, all these changes in such little time and with little guidance, we really feel the IRS should push the date back. So it gives them time to put out further guidance and it gives us tax professional CPAs tax attorneys, accountants the guidance necessary to properly tax plan to our clients. Okay, now, the proposed date is July 15. Okay, and this hasn’t this hasn’t been done before. Last year, this was pushed back to July 15. So, the IRS did this last year. But many small business owners are going to have to send an extension for their business taxes, especially escort owners and partnership owners. If you file an 1120 s, you are an S Corp. If your business files a form 1065, you’re a partnership, your due date is in less than a month, that’s March 15.

So, and if you are using the PPP and the employee retention tax credit strategy, your accountant needs time to properly do a strategy to use PPP and the ERC. So that time that your CPA needs to do a good tax plan or a good strategy to use the PPP funds and get the employee retention tax credit. That program is very technical, and it requires a lot of time. So the best thing would be to set an extension, push the date back and in order for your accountant to be able to do a good strategy to get the maximum credit and the maximum forgiveness for PPP and the ERC for your business. Now will the IRS change the date we need to wait and see. We really feel that the IRS is going to be forced to change the date to July 15. Same as last year but as of today, today’s February 19.

The filing dates are as follows March 15 is the tax deadline for s corpse meaning your business files at the 1120 S if your business files at 1065 is a partnership return your filing date is also March 15 and April 15 is the 1040 are the personal tax return the schedule C’s and the C corpse which file the form 1120. But if anything changes, we will let you know we really hope that the IRS listens to the recommendations by these two very influential organizations from the tax accounting industry, because we feel it will bring a lot of benefit for small business owners to provide time to tax professionals to properly tax plan for their clients.

Okay. Now, thank you for watching this video. Remember, it is tax season, and we are a full-service accounting firm. We are authorized by the federal government to prepare personal tax returns and business tax returns for individuals and businesses that are located in any of the 50 US states.

So this is our contact information:

- Address: 1016 E Osceola Parkway, Kissimmee, 34744, Florida, United States

- Telephone: 407-502-2400

- E-mail: [email protected]

And remember that we are part of Freedom Group, we are a group of four companies where we do tax accounting.

So we can help you in many ways.

Thank you for watching this video. Remember to subscribe to this channel and if you have received value out of this information like this video and share it with someone that can take advantage of this information.

Thank you for watching. God bless you. Bye-bye.