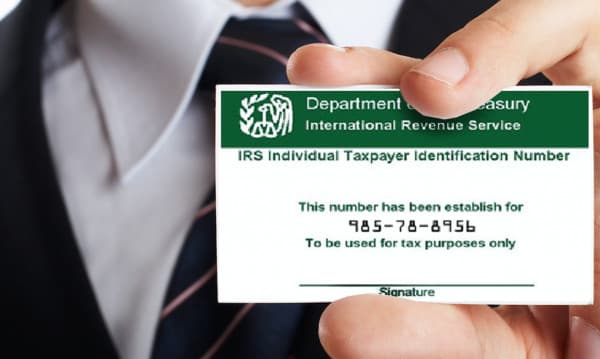

ITIN – Individual Taxpayer Identification Number

GET ITIN NUMBER FAST & KEEP YOUR ORIGINAL DOCUMENTS

The Fastest & Safest Way To Get Your Tax Id Number

If you are an immigrant in the United States and don’t have or qualify for a Social Security Number, you may apply for an ITIN Number in order to:

- File an Income Tax Return

- Get ITIN for Dependents

- Own a Business

- Establish Credit

- Open a Bank Account

- Own Real Estate

Why Apply For ITIN Number With Us?

- We are Certified Acceptance Agents (CAA) with the IRS

- Keep Your Original Documents

- Get Your ITIN Number Fast

- Don’t Have To Send Your Documents By Mail to IRS

- Don’t Risk Losing Your Documents In the Mail

- We Fill Out All the Application Forms for You

- We Handle All Communications with the IRS for You

- Apply for ITIN Number and File Your Income Tax Return All In One Place

- Get Your Tax Id Number and Incorporate Your Business All In One Place

Call Us at 407-502-2400 And Start Enjoying The Benefits Of Having Your Tax Identification Number (ITIN) or Email us at [email protected]

Who Needs An Individual Taxpayer Identification Number (ITIN)?

It is intended for individuals who must have a U.S. taxpayer identification number for federal tax purposes but don‘t have, and are not eligible to obtain, a SSN. An ITIN is only issued to individuals who are required to have a U.S. taxpayer identification number but who don’t have and are not eligible to obtain an SSN. This is usually the case for nonresident and resident aliens, their spouses, and their dependents who must file U.S. tax returns.

- Anyone who earns money in the United States and must pay taxes, but does not have a Social Security Number or does not qualify for one.

- Dependents of the person filing a tax return with an ITIN Number in order to be able to claim the dependents on their income tax return and be eligible for tax credits.

- Get ITIN number for H4

- Get ITIN number for L2

- If you do not live in the U.S. but want to own a business in the U. S.

- If you do not live in the U.S but want to own real estate property in the U.S.

Why Do You Need An Itin Number?

- It serves as your identification number for filing your federal taxes.

- It allows you to get a refund from your income withheld by the IRS, if you qualify.

- It allows you to file your taxes and claim dependents and benefit from child tax credits.

What Do You Need To Apply For An ITIN?

We fill IRS Form W-7 and a file an income tax return for you to apply for an ITIN. At Freedomtax Accounting we process your ITIN application while preparing your taxes at the same time.

Call Us at 407-502-2400 And Start Enjoying The Benefits Of Having Your Individual Tax Identification Number (ITIN) or Email us at [email protected]