PPP Forgiveness – Do Not Apply Until You Have an Employee Retention Credit Strategy

We are advising our accounting clients not to apply for PPP loan forgiveness so they can maximize the Employee Retention Credit via a good PPP and ERC strategy for 2020 and 2021.

EMPLOYEE RETENTION TAX CREDIT DETAILS VIDEO –

DISCLAIMER This video is intended for educational purposes and should not be taken as legal or tax advice. You should consult with your financial professionals about your unique financial situation before acting on anything discussed in these videos. Freedomtax Accounting and Multiservices Inc. is providing educational content to help small business owners become more aware of certain issues and topics, but we cannot give blanket advice to a broad audience. Freedomtax Accounting and Multiservices Inc. or its members cannot be held liable for any use or misuse of this content.

New legislation from the Consolidated Appropriations Act, 2021 creates a chance for some of your clients to take advantage of both Paycheck Protection Program (PPP) loans and the Employee Retention Credit (ERC).

Several changes specific to the ERC can provide an opportunity for additional relief for your clients. The significant changes that affect small businesses include:

Extension of the ERC through June 30, 2021, Increased credit rate from 50% to 70% of qualified wages Increased the limit on per-employee qualified wages from $10,000 for the year to $10,000 for each quarter Reduced year-over-year gross receipts decline from 50% to 20% and created a safe harbor to allow employers to use prior-quarter gross receipts to determine eligibility The legislation means that employers who receive PPP loans may still qualify for the ERC retroactive to March 13, 2020.

Previously, clients receiving a PPP loan during the first round of relief couldn’t take advantage of the ERC. However, with the new legislation, a business can take the ERC even if they received PPP funding and loan forgiveness as long as the payroll identified for the ERC was not paid out of PPP funds. As noted above, this change is retroactive to March 13, 2020. Your clients may not be aware of this planning opportunity. It’s also a chance for you to bring more value to your clients by helping them take full advantage of relief options. And the time to do so is now — before completing your clients’ year-end payroll filings, especially if your clients haven’t applied for PPP debt forgiveness. Your clients can still claim the ERC if they’ve received forgiveness, but planning will be simpler if your clients haven’t applied yet. While waiting for specific IRS guidance needed to implement these provisions, you can begin discussing the opportunity with your clients.

Specifically, the bill allows eligible entities to claim the prior quarter’s credits from 2020 in the quarter in which the bill was signed: the fourth quarter of 2020.

The ERC is a fully refundable payroll tax credit for employers that, for 2020, is equal to 50% of qualified wages employers paid beginning March 13, 2020. Businesses are eligible if:

They were fully or partially suspended due to an order from a governmental authority limiting travel, business and meetings during the quarter of payroll not paid out of PPP funds, or:

The business had a reduction in gross receipts of 50% or more during a calendar quarter compared to the same calendar quarter in 2019. When the covered period for PPP loans was extended to 24 weeks, many clients’ applications for debt forgiveness qualified for 100% forgiveness on payroll alone without considering the other eligible nonpayroll costs.

However, those other costs now may play a big role in receiving the ERC benefit. In assisting your clients with their forgiveness calculations, analyzing the ratio of payroll and nonpayroll costs is a critical step. If sufficient nonpayroll costs are available, limiting payroll costs to the 60% threshold required for full forgiveness may allow the remaining payroll to be eligible for the ERC-provided relief.

#ppp #erc #ertc #pppforgiveness #employeeretentioncredit

Video Transcript

Hello from FreedomTax Accounting we’re an accounting firm where we have been providing quality tax and accounting services now for over 20 years. If you’re new to this channel, we provide strategies for small business owners so they can achieve their financial goals. If you’re into that, please consider subscribing to our channel.

Today is February 4th, and we always emphasize the date on any video relating to the PPP program because this program is constantly changing. So there may be things we’ll discuss in this video that can change as soon as tomorrow. So that’s the importance of subscribing to our channel. That way you’re always up to date with the most current and correct information regarding these SBA loans.

Today, we wanted to emphasize why we are advising our clients that our employers, should not apply for PPP forgiveness yet. Once again, we have been saying this, if you have been following us in the month of January, we have made a video telling employers not to file for PPP forgiveness because we were waiting on further guidance from the SBA and the IRS on how to use the employee retention tax credit.

So once again, we wanted to dig a little bit deeper on that. Give you more details why we are advising our clients, not to apply for PPP forgiveness yet if they are employers. If you’re self-employed independent contractors and you don’t have employees on payroll, then you can apply for PPP forgiveness, and you should, but for businesses that got PPP with employees on payroll, do not apply for forgiveness yet because you can get bigger financial help combining PPP and the employee retention credit and we’re going to give you a little bit more details on how to do that.

Now, why the change, why the change in strategy? Since for months, we have been telling people to use a hundred percent of their PPP funds for payroll costs because it was the way it was set up in 2020. If you could show that you used a hundred percent of your PPP funds for payroll, you were going to achieve a hundred percent forgiveness and that’s a good strategy.

And the only thing that was holding us back from really doing PPP forgiveness was the ever-changing PPP forgiveness rules and the ever-changing PPP forgiveness forms. They started with one form, then two forms, then three forms. And realistically now there are four because they changed one of them. And everyone was also waiting on the rumor that there was going to be automatic PPP forgiveness for PPP loans under $150,000. Now we do know the automatic forgiveness is out. That’s not happening. What happened is, there’s a simplified PPP forgiveness application for PPP loans that are $150,000 or less.

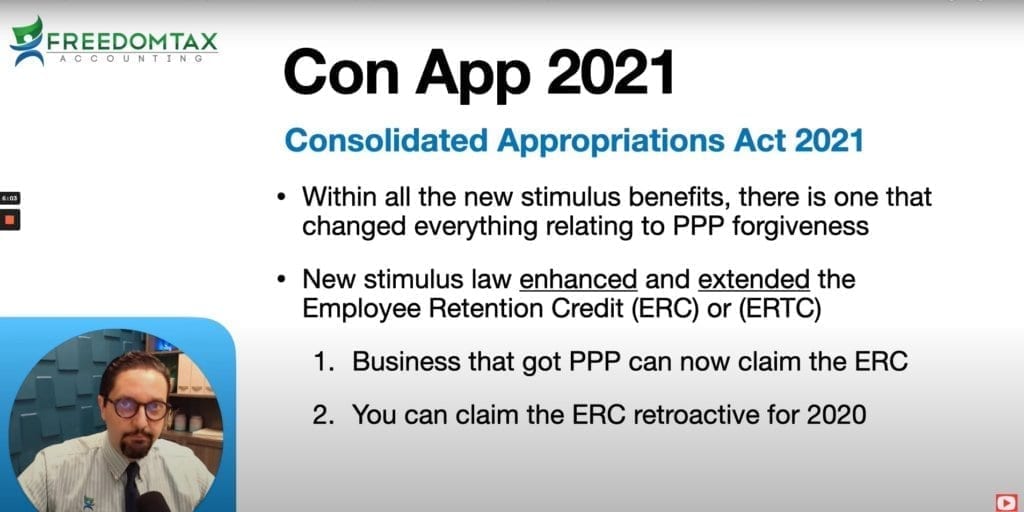

So this strategy to use: All the PPP funds for payroll and achieve a hundred percent forgiveness went out the door on December 27th, 2020. When the consolidated appropriations act of 2021 was approved. This is the new stimulus bill that became law on December 27th, 2020 in short, they call it the Con APP 2021.

What did the consolidated appropriations act 2021 did? This is the bill that approved the new stimulus checks, the new round of PPP, a lot of tax credits, but we then all the news stimulus of benefits; There’s one, that changed everything related to PPP forgiveness, and that’s the new stimulus law and enhance and extended the employee retention credit or the ERC or the ERTC.

This credit is not new this credit existed since March of 2020. Actually, if you see our YouTube video back from April and May, we did videos on the employee retention credited, where we were showing that there were cases that this credit was a better deal than the PPP loan program. But in 2020, you could not take both, you had to choose either take PPP or take the ERC.

And for most businesses, that PPP was a better deal. That’s why a lot of people didn’t even know about the employee retention credit, but what happened with the Con APP 21? The new stimulus law change on December 27th, 2020. Now businesses that got PPP can claim the employee retention credit as well.

So in 2020, you could not have both. Now they’re saying that you can get both and the bigger deal is that now. if you did not claim the employer retention credits in 2020, you can now claim them retroactively for 2020. So all their qualifying wages in 2020 that you can get a big credit for, you can get it now. So that’s a lot of money on the table, and this is a big change.

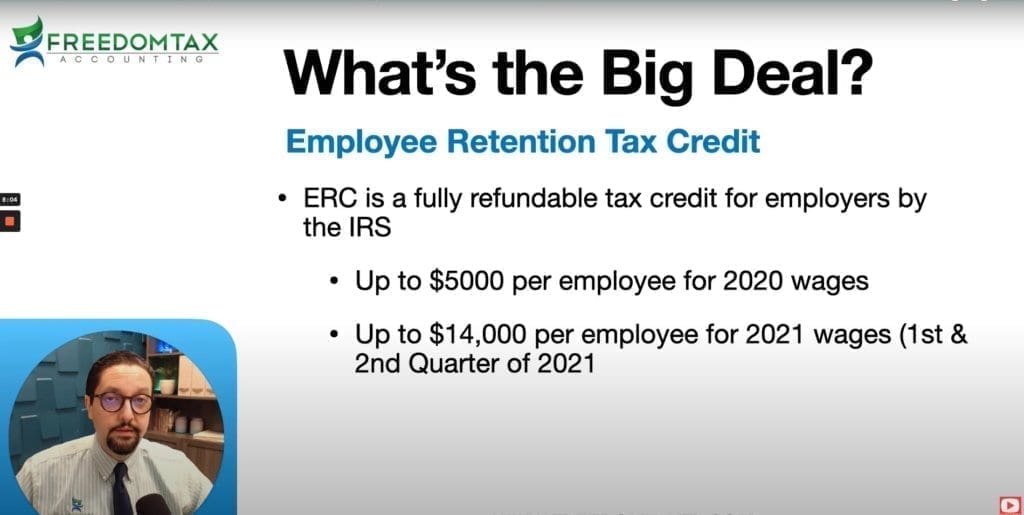

That’s basically the big deal with the employee retention tax credit, but the big deal is there’s a lot of money that your business can get. A lot of financial help. Why? Because the ERC is a fully refundable tax credit for employers by the IRS.

This is very important. It’s not with the SBA. This is a payroll tax credit with the IRS. The thing is when you claim the credit on your payroll taxes, most of the time, the credit is bigger than the liability, meaning that you get a big refund from the IRS towards your business for 2020. So you know how much money we’re talking about for the wages that you can claim the ERC for 2020, you can claim up to $5,000 per employee for the 2020 wages.

For 2021, because the ERC has been extended for the first two quarters of 2021, you can claim up to $14,000 per employee per year in 2021.

To give you an idea of what we’re talking about right now, we have a client that they have 10 employees. And the way they’re structured, they can claim the max credit for all 10 of them. So that means that for 2020, we’re going to get them $50,000 in credits. And for 2021, that’s $140,000 in total, we got our client a $190,000 benefit. So that’s why this is a big deal.

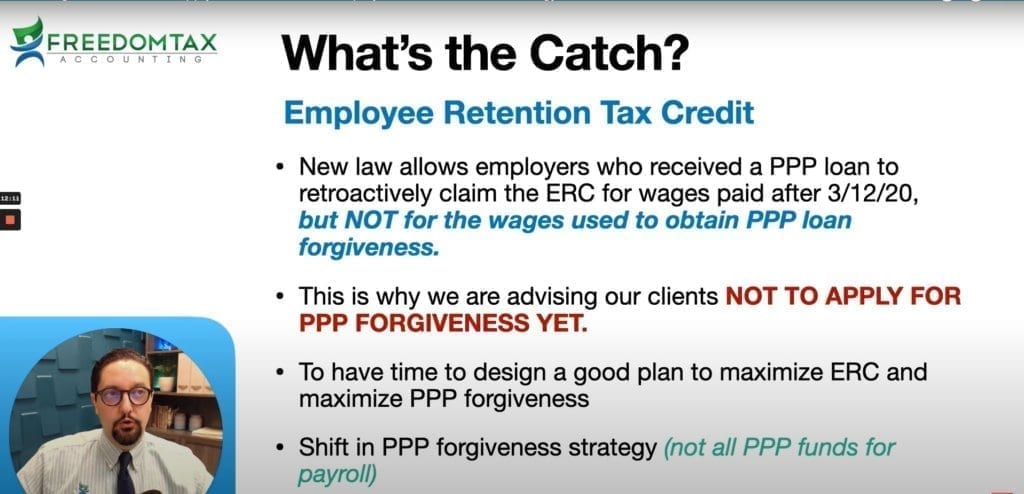

Now, what’s the catch you’re saying this can’t be that easy. And it’s not, it’s not that easy. It requires strategy.

Why? Because the new law allows employers who received a PPP loan to retroactively claim the wages in 2020, but not for the wages used to obtain PPP loan forgiveness. Basically, you cannot double-dip for the wages you claim for PPP forgiveness. You cannot use that same way just to get the employee retention tax credit.

That is why we are advising our clients. That our employers, do not apply for PPP forgiveness yet. Now we saw this more or less coming, that’s why at the beginning of January, we were telling our client’s let’s wait because we feel like the ERC credit is going to be a big deal, but we’re waiting for further guidance.

There are still details that need to be sorted out, but more or less, we can basically start to move forward with this.

So why not apply for PPP now? So you can give a least in our claim. We, in our case, we have time to work with our clients and also have time if you’re working with a CPA who knows this.

So your CPA has time to design a good plan so you can maximize the employee retention credit, and also achieve a hundred percent PPP forgiveness. This is a major shift in the PPP forgiveness strategy. Remember in the past, the strategy for PPP forgiveness was very simple. The government gave you two and a half months or 10 weeks’ worth of payroll. You have 24 weeks to use it. As long as you can show you use all of it for payroll, a hundred percent forgiveness.

Now that we have the ability to use the ERC credit for 2020, its a different strategy. And this is a very technical strategy. And I’m going to try to explain it as simple as I can, but it’s not that simple, but basically, now you need to take all the quarters in 2020, look back and see which quarter you are eligible and applies for the ERC credit. If you find the quarter that is eligible to get the credit, what you need to do is for that quarter, don’t allocate all the payroll wages for PPP forgiveness. Remember to achieve a hundred percent PPP forgiveness you need to at least show that you use the payroll, the PPP funds for at least 60% for payroll.

So that means that now with ERC, what you need to strategize is to take the quarter, take the wages take your costs and try to allocate. Remember it’s 60% for payroll and for PPP forgiveness, you still have 40% that if you can show that you used 40% of those PPP funds for non-payroll related costs that you can use for forgiveness you’re still going to get a hundred percent. I know it’s a little bit tricky.

Now they’re, they’re making it easier because in the past that 40% for PPP forgiveness, you only could use it for:

- mortgage interest

- rent

- utilities

but now they have expanded, you can add:

- accounting

- safety equipment

- some operational costs

- fix up your shop (ex: because it was vandalized)

so that the strategy is to put as much as you can in that 40% PPP for forgiveness and only use the max of 60% for payroll so you have more payroll wages just left in the quarter to claim the ERC credit.

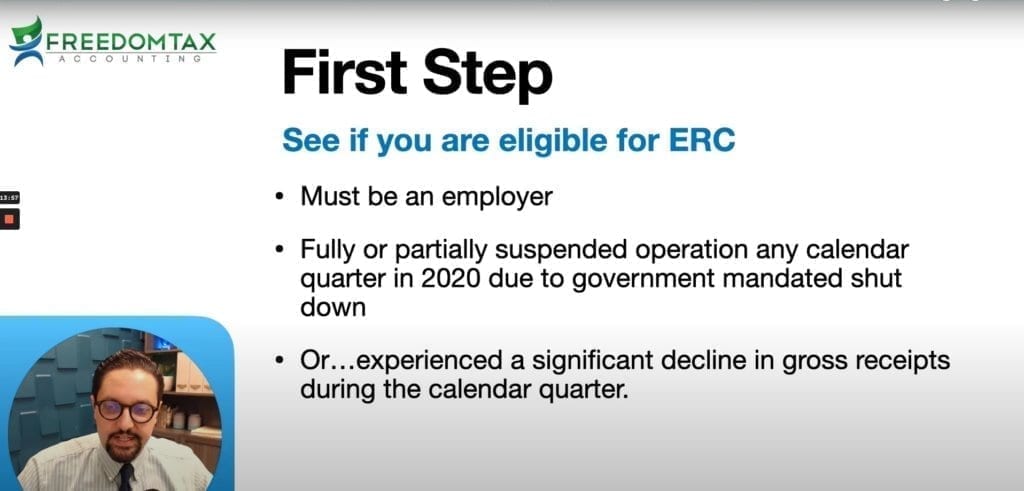

I know it’s a little bit tricky, but I think that’s the simplest way I can explain it. But what’s the first step you need to do now is to see if you’re eligible for the employee retention credit.

First thing is you must be an employer, meaning you must have employees on payroll. 1099. Contractors are not employees.

So if you’re an independent contractor, Sole proprietor, a single-member LLC and you do not have employees on the payroll. You cannot claim the ERC credit. If that’s your case, apply for PPP forgiveness right now.

Your business must have fully or partially suspended operations any calendar quarter in 2020 due to government mandate shut down. Or you must show that your business has experienced a significant decline in gross receipts during the calendar quarter. So we will not discuss the details on how you’re eligible my coworker, Carmen did an excellent video last week, where she goes into detail, how you are eligible for the employee retention tax credit.

It’s a 20-minute long video, but she goes deep into how you can apply or how you’re eligible for the ERC credit. So watch this video. So once again, this is a big deal, everyone that, that if you can strategize.

Correctly on how to use PPP and the employee retention tax credit, that’s a lot of funding you can get for your business. That’s going to help keep your business going during this coronavirus pandemic. Since early January, we have been working with our accounting clients and we have been able to get them a lot of funding and a lot of benefits using this strategy.

So talk to your CPA. There is enough guidance at this date today, February 4th, to move forward and we know enough to see how to get the credit and how to strategize around it. There are still a little bit of details that we are waiting for guidance on the IRS.

But I think those are the minor details we can sort them out, I think a little bit later. You can move forward with a good strategy on how to get PPP forgiveness, a hundred percent forgiveness, and maximize the ERTC credit to the fullest. If you want to talk to us, this is our contact information.

We are in tax season and we are authorized to help individuals and businesses in any tax-related issue and work for individuals and businesses that are located in any of the 50 U.S States. If you want a consultation on any PPP, EIDL loan, employee retention, credit consultation. We are providing consultations as well.

So this is our contact information:

- Address: 1016 E Osceola Parkway, Kissimmee, 34744, Florida, United States

- Telephone: 407-502-2400

- E-mail: [email protected]

And remember that we are part of Freedom Group, we are a group of four companies where we do tax accounting.

So we can help you in many ways.

Thank you for watching this video. Remember to subscribe to this channel and if you have received value out of this information like this video and share it with someone that can take advantage of this information.

Thank you for watching. God bless you. Bye-bye.