Top 5 Questions On The NEW FINCEN BOI Report

In this video we answer the top 5 questions that small business owners have concerning the new FINCEN BOI Report. This new Beneficial Owner Information Repo...

Introduction

- Brief introduction about the importance of understanding new financial regulations.

- Overview of the NEW FINCEN BOI report and its relevance to small businesses.

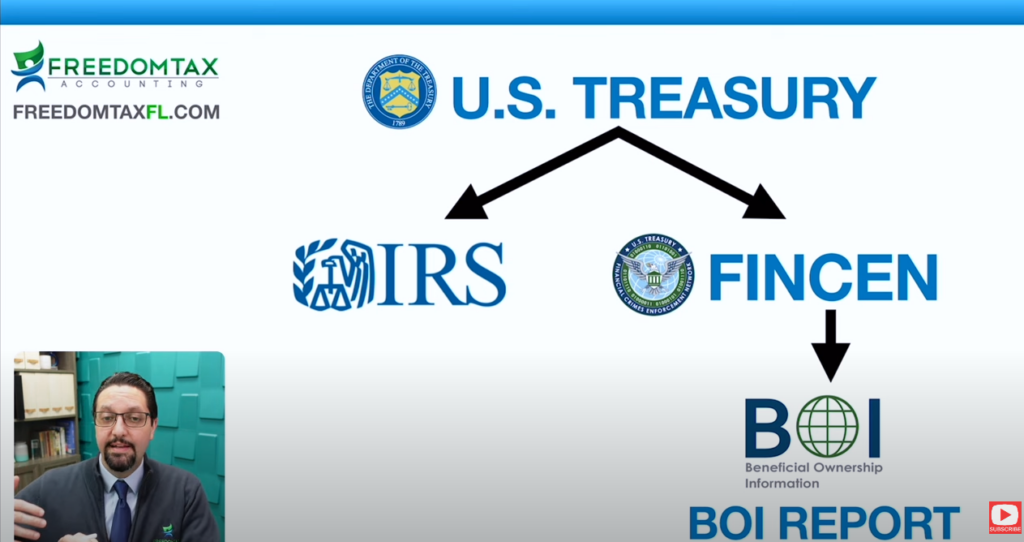

Section 1: Understanding the NEW FINCEN BOI Report

- Explanation of the FINCEN BOI report in the context of the Corporate Transparency Act.

- The purpose behind the legislation: combating fraud, scams, and money laundering.

- The role of FINCEN (Financial Crimes Enforcement Network) and its distinction from the IRS.

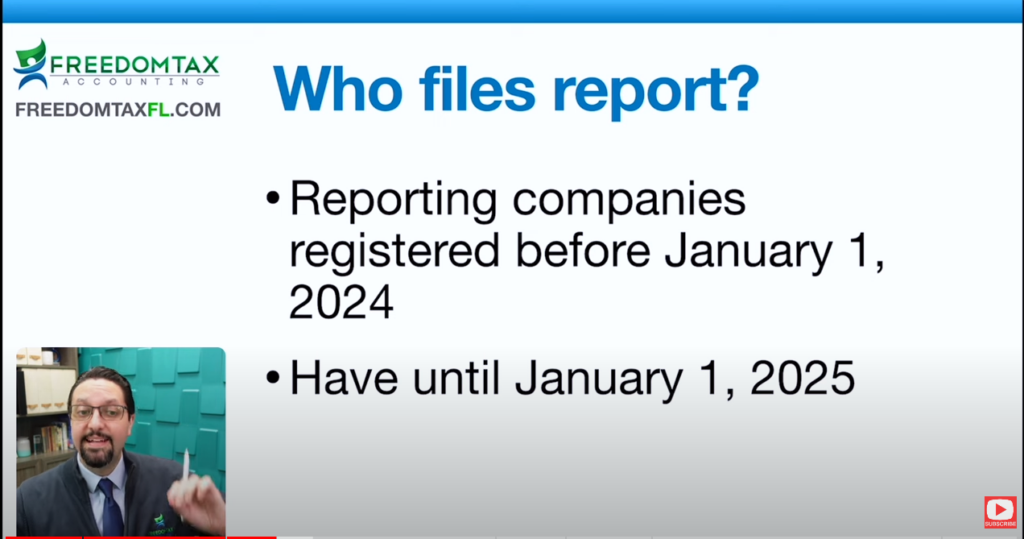

Section 2: Who Needs to File the BOI Report?

- Detailed criteria for businesses that need to comply with the BOI report filing.

- Explanation of the deadlines based on the date of business registration.

- Discussion of the 23 exceptions for businesses that are exempt from filing.

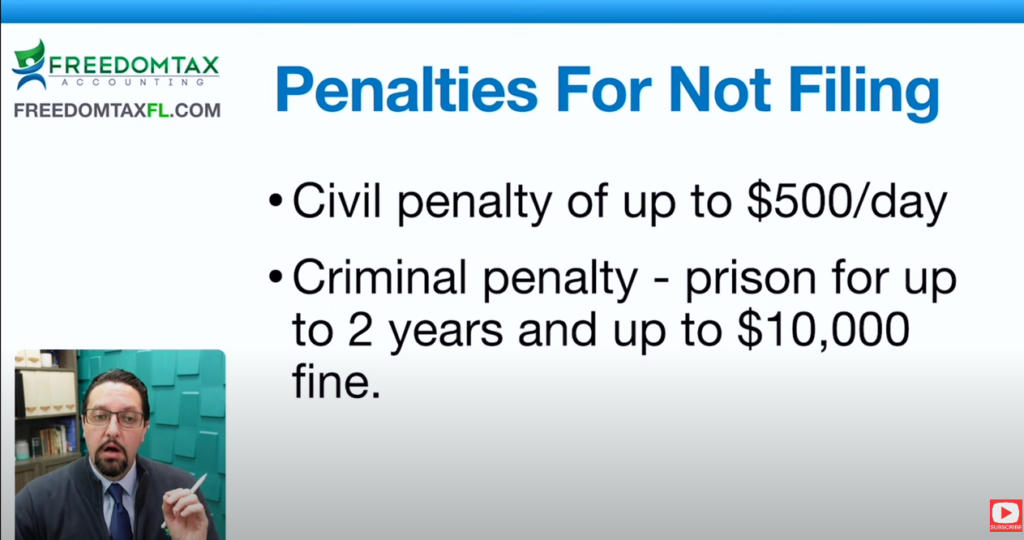

Section 3: The Consequences of Non-Compliance

- Outline of the civil and criminal penalties for failing to file the new FINCEN BOI report.

- Real-world implications for small business owners.

- Importance of timely compliance to avoid hefty fines and legal issues.

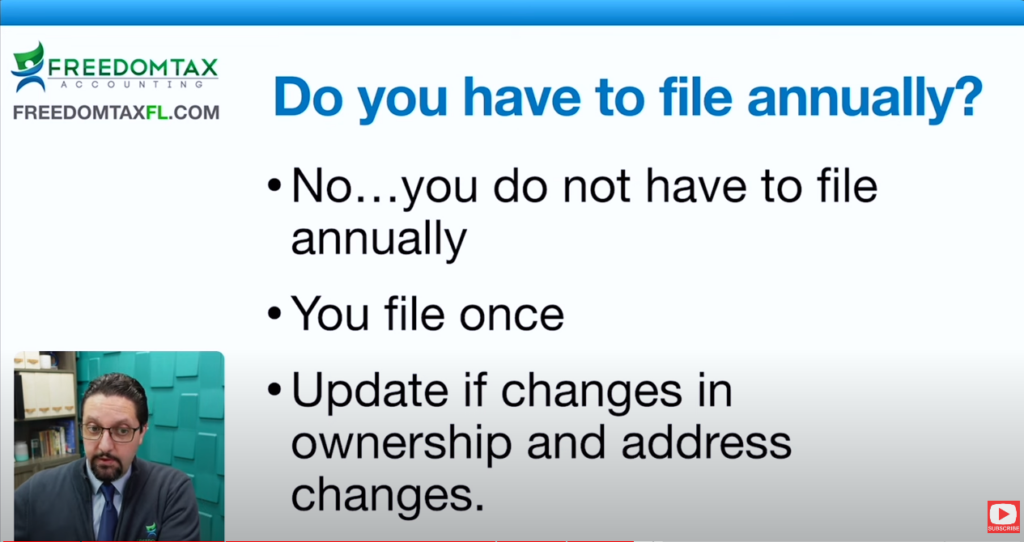

Section 4: Frequency of Filing the BOI Report

- Clarification on the frequency of filing the new FINCEN BOI report.

- Conditions under which updates to the report are required.

- Tips for maintaining compliance over time.

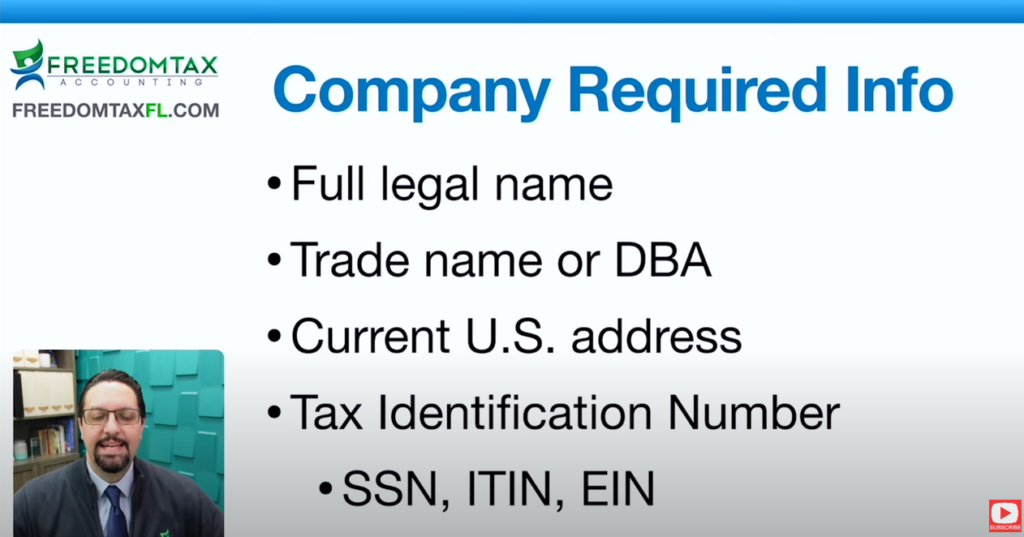

Section 5: Required Information for the new FINCEN BOI Report

- Breakdown of the information needed about the business and its owners.

- Definition and significance of ‘Beneficial Owner’ in the context of the BOI report.

- Required documentation and how to prepare it.

Section 6: Filing the BOI Report

- Step-by-step guide on filing the BOI report online.

- Discussion of available resources and services to assist with filing.

- Contact information for further assistance.

Conclusion

- Recap of the key points covered in the blog post.

- Encouragement to take action and comply with the new regulations.

- Final thoughts on the importance of staying informed about financial and legal obligations for businesses.

Transcript

Hello from FreedomTax Accounting. We’re an accounting firm where we have been providing quality tax and accounting services now for over 20 years. In this video, we are going to discuss the top five questions that we are getting in our office about the new FINCEN BOI report. If you don’t know what this new FINCEN BOI report is, it’s a new federal report that many small businesses need to file starting now January of the Year 2024.

Question 1: What is the FINCEN BOI report? Basically, Congress passed a new law called the Corporate Transparency Act. This new Act was designed to avoid fraud, scams, and money laundering. The way the system is set up now, people who want to do scams can set up several companies and shell companies and hide their names from the government. That’s why they need this new report where they’re asking more information about the owners of the US business entities that are being formed now or in the past. The report goes to a government agency called FINCEN, which is the Financial Crimes Enforcement Network, a department of the US Treasury like the IRS. FINCEN is not the IRS. Many people think that the BOI report has to be sent to the IRS, but it’s a separate Federal agency under the US Treasury called FINCEN. So, you send the BOI report to FINCEN.

Question 2: Who needs to file the BOI report? Any reporting company that has been registered before January 1st of 2024. If your business was registered before January 1st, 2024, you have until January 1st of 2025 to file this BOI report. If your business is registered on or after January 1st, 2024, you have 90 days to send the BOI report to FINCEN from the day it is registered in the state. If your business is registered on January 1st, 2025, or forward, you’re going to have 30 days to file the BOI report. There are 23 exceptions of types of businesses that don’t need to file the BOI report.

Question 3: What happens if I don’t file the BOI report? There are penalties, and they are pretty steep. There is a civil penalty of up to $500 per day that you are not compliant with the report and a criminal penalty of prison of up to two years and up to a $10,000 fine. So, make sure you do this report on time for your small business.

Question 4: Does the BOI report need to be done annually? The answer is no, you do not have to file every year. You file the report one time, but you do need to update it if there’s a change in ownership or a change in address, not only a changing address of the business or if any owner changes their residential address. You need to update the report as well. But if there’s no change, you file the report one time, and that’s it.

Question 5: What information does the BOI report ask for? The BOI report needs information about the business and about the owner. For the business, you need to put the business’s full legal name, the business trade name or DBA, the current US address for the business, and the tax identification number of the business. For the owners, under the eyes of FINCEN, they have something called the Beneficial Owner. A beneficial owner is anyone that owns at least 25% of the company or anyone that has substantial control over the company. For these individuals, you need to provide their full legal name, date of birth, current residential address, and an image, like a picture of your US passport or a state driver’s license or an ID issued by the state or local government, or a foreign passport. You have to upload one of these documents.

The last question is where do I file the BOI report? It’s basically done online on the fincen.gov website. You can go online and fill it out, or we are providing the BOI report as a service. We can fill it out for you. This is our contact information if you want us to help you file the BOI report for your business.

Thank you for watching this video. I hope you have received valuable information. If you have, like it and share it with another business owner that can take advantage of this information. Thank you for watching. God bless you. Bye-bye.