FINCEN BOI Report (Step by Step Instructions Guide)

Welcome to our comprehensive guide on the FINCEN Beneficial Ownership Information (BOI) Report. As an accounting firm with over two decades of experience, Freedom Tax Accounting is committed to guiding you through the complexities of this new reporting requirement. Starting January 1st, 2024, many companies in the United States will face a new obligation: filing the FINCEN BOI Report. This guide is designed to provide you with a step-by-step approach to navigating this process, ensuring your business remains compliant and avoids potential penalties.

Understanding FINCEN and the BOI Report

FINCEN, the Financial Crimes Enforcement Network, is a division of the U.S. Treasury, distinct from the IRS, tasked with combating financial crimes like money laundering and fraud. The BOI Report, standing for Beneficial Ownership Information, is a new requirement aimed at enhancing transparency in business ownership and control.

Who Needs to File?

The requirement to file the BOI Report depends on when your company was registered:

- Companies Registered Before January 1st, 2024: These companies have until January 1st, 2025, to file their BOI Report.

- Companies Registered On or After January 1st, 2024: These entities must file their report within 90 days of registration.

- Future Registrations (Post-January 1st, 2025): Companies opening in 2025 or later will have 30 days post-registration to file.

It’s crucial to note that these rules are as of January 2024 and are subject to change. Therefore, staying updated with the latest information is advisable.

Exemptions from Filing

Not all companies are required to file the BOI Report. There are 23 exceptions, primarily large corporations such as banks, credit unions, financial institutions, and large insurance companies. Additionally, businesses with IRS tax-exempt status (501(c)) and large operating companies (with more than 20 full-time employees and over $5 million in annual sales) are exempt.

The Penalties for Non-Compliance

Ignoring the BOI Report can lead to severe consequences. The penalties include:

- Civil Penalties: Up to $500 per day for non-compliance.

- Criminal Penalties: Up to 2 years in prison and fines up to $10,000.

These penalties underline the importance of timely and accurate filing of the BOI Report.

Step-by-Step Guide to Filing the FINCEN BOI Report

Filing the BOI Report requires a methodical approach. Here’s how you can start:

Accessing the FINCEN Website

Begin by visiting the fincen.gov website. Look for the section titled ‘Beneficial Ownership Information’ and select the option to ‘File a report using the BOE filing system.’ The website layout may change over time, so it’s important to navigate based on the current design.

Creating a FINCEN ID Number

While filing the BOI Report, you’ll also see an option to create a FINCEN ID number. This ID is recommended for every company and owner, as it’s likely to become as crucial as your business EIN number. The FINCEN ID number is free and is issued instantly upon completing the report.

Filing the Report

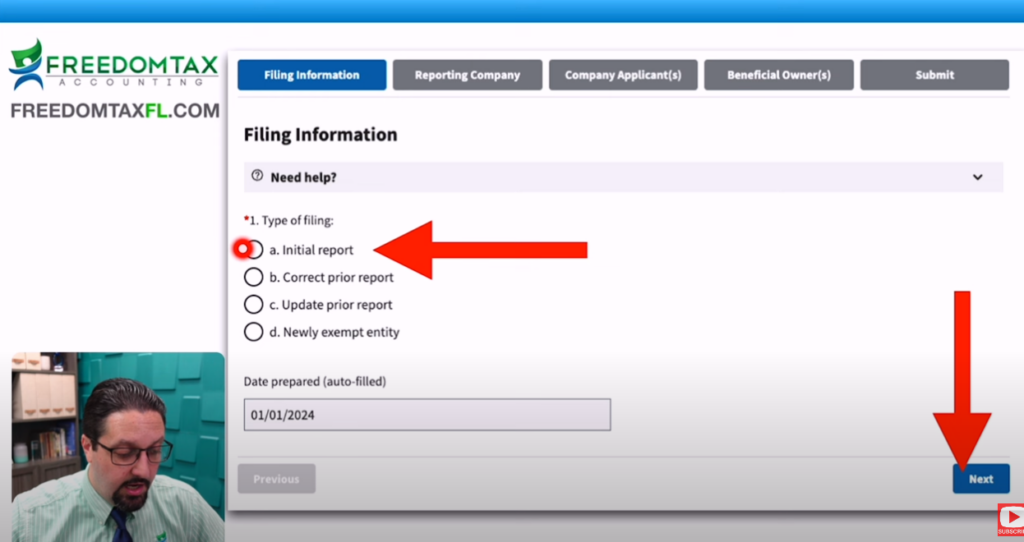

You have the option to file the report either via PDF or online. For online filing, click on ‘Get Started’ under the ‘Beneficial Ownership Information’ section. You’ll be directed to a page where you can begin the filing process.

Completing the Online Filing Process

When filing online, you’ll be presented with two options: filing as an initial report or making corrections/updates to an existing one. For first-time filers, select ‘Initial Report’ and proceed to the next steps.

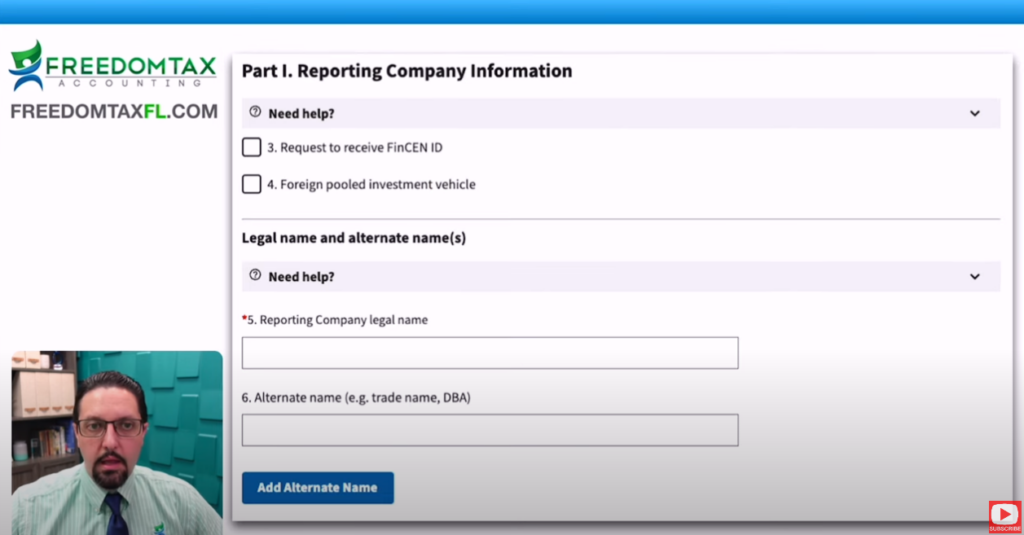

Providing Company Information

The form will prompt you to enter your business’s legal name and any other trade names or DBAs (Doing Business As) under which your business operates. If your business has multiple DBAs, you can add them all. You’ll also be asked to provide your business’s tax ID number, which could be an EIN, social security number, or ITIN, depending on your business structure and registration.

Specifying Business Operation Details

You need to specify where your business is operating (usually the United States of America) and the state in which it is registered. Additionally, you’ll be required to input your business’s current address in the U.S.

Identifying the Type of Business Entity

The form will ask if your business is an existing company (created before January 1st, 2024). If so, you won’t need to report the applicant’s information. This distinction is crucial as it determines the level of detail required in the report.

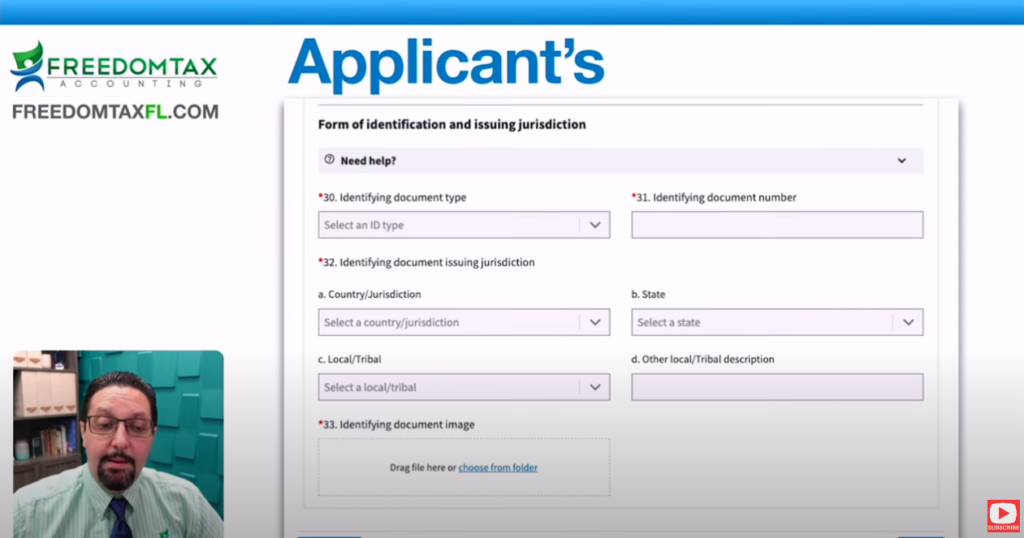

Reporting Applicant Information

For businesses established in 2024 or later, you must provide detailed information about the applicants – the individuals who opened the company. This includes their FINCEN ID number, name, current address, and a valid form of identification (driver’s license, passport, or state-issued ID). An image of the ID must be uploaded to the system.

Detailing Beneficial Owner Information

This section is critical as it requires information about each beneficial owner of the company. FINCEN defines a beneficial owner as anyone with at least a 25% interest in the company or substantial control over it. This could include CFOs or other executives who may not be owners but have significant control. For each beneficial owner, you’ll need to provide their FINCEN ID number, name, date of birth, residential address, and a government-issued photo ID.

Finalizing the Report

After entering all the required information, you’ll need to confirm your email address and provide the name and last name of the person completing the report. Before submission, ensure that all information is accurate and complete to avoid any issues.

Submission and Confirmation

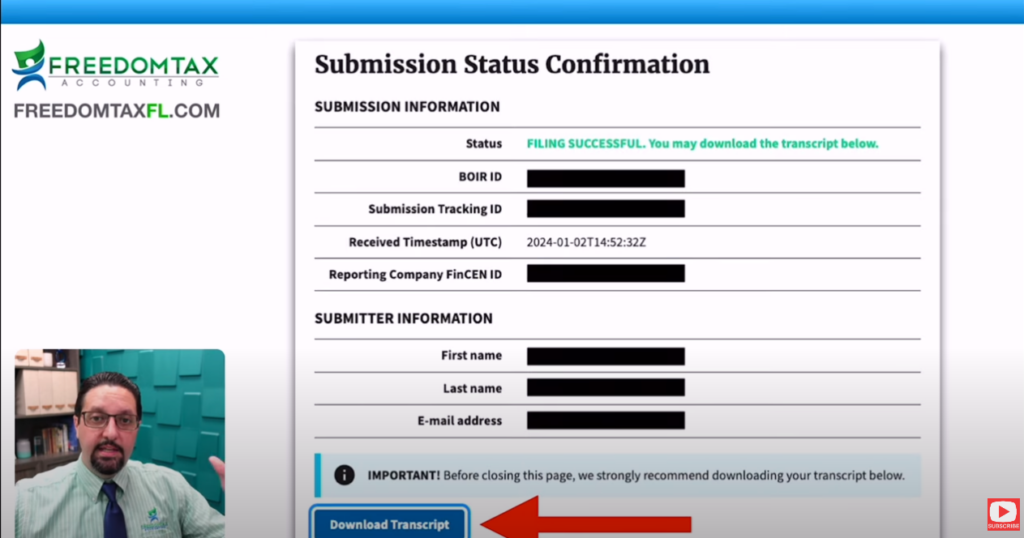

Once submitted, you’ll receive a confirmation with a tracking number and a FINCEN ID number for your business. It’s advisable to download a PDF transcript of the report for your records.

Updating the BOI Report

If there are any changes in your business details, ownership, or beneficial owners’ information, you have 30 days from the occurrence of the change to update the BOI report. This ensures that FINCEN has the most current information about your business.

Conclusion and Further Assistance

Filing the FINCEN BOI report is a mandatory process that requires attention to detail and accuracy. The steps outlined in this guide are designed to help you navigate the process smoothly. Remember, this report is a one-time requirement, but updates are necessary if there are significant changes in your business.

At Freedom Tax Accounting, we understand that dealing with such reports can be daunting. That’s why we offer BOI report filing as a service, along with personal and corporate taxes, bookkeeping, payroll, and tax planning services. If you need assistance or have any questions, feel free to reach out to us. Our team is ready to help you ensure that your business complies with all regulatory requirements.

We hope this guide has been informative and helpful. If you found value in this information, please like and share it with other business owners who might benefit from it. Thank you for reading, and we wish you the best in your business endeavors.

Transcription:

Hello from FreedomTax Accounting. We’re an accounting firm where we have been providing quality tax and accounting services now for over 20 years. In this video, we’re going to show you a step-by-step guide on how to do the new FINCEN BOI report. This report many companies need to do it starting January 1st, 2024. So once again, we’re going to give you a step-by-step guide on how to do the new FINCEN BOI report. FINCEN stands for the Financial Crimes Enforcement Network, this is a division of the US Treasury, kind of like the IRS, but they are not the IRS. And BOI stands for Beneficial Ownership Information. So this is the new report that many companies need to start doing now starting January 2024.

So before we go into the step-by-step guide, let’s review who needs to file. If your company was registered before January 1st, 2024, you have until January 1st, 2025, to file your FINCEN BOI report. If your company was registered on or after January 1st, 2024, then you have 90 days to file your BOI report. It’s 90 days after the company is registered in the state. Okay, now if your company is going to be open in January 1st, 2025, or after, then you’re going to have 30 days to file your BOI report after the company is registered in the state.

Now these rules are the ones up to now; we are recording this video in January of 2024, so these rules may change, but these are the rules up to January 2024. Okay, now there are 23 exceptions of companies that do not need to file their BOI report. Now, I am not going to give you the 23 exceptions; you may look them up on the FINCEN website, but for many small business owners, what do you need to know? Basically, big corporations are exempt from doing the BOI report. If you’re a bank, a credit union, an exchange, a financial institution, or a big insurance company, these big corporations don’t have to file the BOI report. If your business has the IRS tax-exempt status, basically the 501(c) status, you don’t have to file the BOI report. And if you’re a large operating company, that’s how they call it, basically any business that has more than 20 full-time employees and they have more than $5 million in annual sales, if you meet those two

criterias then you do not have to file the FINCEN BOI report. Okay, now there are penalties for not filing, so this is a report that you must file. What is the penalty? A civil penalty of up to $500 per day that you don’t comply with the report, and there’s a criminal penalty of up to 2 years in prison and up to $10,000 fine. So if your company needs to do this report, make sure it is done on time.

Okay, so let’s get started on the step-by-step instructions on how to do the FINCEN BOI report. How do you start? You start by going to the fincen.gov website. Once you’re in the website, basically you click over here, here. Alright, and once again the website may change, you just have to look where it says beneficial ownership information. In this case, you click in this icon that says BOI. When you click on there, it’s going to take you to this page, and in this page, you basically click here which says file a report using the BOE filing system.

Okay, now you also see that it says create a FINCEN ID number, that is something we’re going to talk about in another video. Okay, but every company and every owner of the company should have a FINCEN ID number as well, but you do your BOI report first. So you click here where it says file a report using the BOE filing system. Once you click there, it’s going to take you to this page, and then you click here where it says get started. Make sure you click where it says beneficial ownership information. You have another option here that’s not the option, it says here where it says BII report, so you click get started.

And it’s going to give you two options, you can either file via PDF or you can file online. We’re going to file online, so you basically click over here. So it’s going to give you a warning that you are providing information to a US Government website, you click accept or you click agree. Okay, now if it’s most of you are going to do this report for the first time, if that’s the case, then you check off this circle here that says initial report. If you do your initial report and you need to make corrections or updated, then you would check off these circles. But if this is the first time you’re filing your BOI FINCEN report, you basically check off initial report and you click next.

Then you’re going to give information about the company. Okay, now in this stage, it says it’s going to give you the option if you want to request a FINCEN ID number for your business, and we highly recommend that you do so. Check this box, we are recommending that every company that does the BOI report to get the FINCEN ID number. It’s free, and you get it instantly once you finish the report. We feel this FINCEN ID number is going to be as important as your business EIN number, so make sure to check this box.

Okay, if you’re a foreign pool investment, that’s another topic, but most of you, you just have to check request FINCEN ID number, you don’t have to check this one. Then it’s going to ask for your business legal name, okay, and any other trade name or DBA that your business has. If you have more than one DBA, then you basically add, you click here where it says add alternate name, and you basically list all the DBAs or fictitious names that your business is operating under.

Okay, you scroll down, and it’s going to ask you what tax ID number are you going to provide for your business. Okay, so here it’s going to give you the option of either using your business EIN, you may have your business registered under your social, you may have your business registered under your ITIN number if you have a foreign business doing business in the US, you click here. But most of you that have businesses in the US, your business has an EIN number from the IRS, so you click EIN, and then you basically add your EIN number in this box here.

Once you do that, you continue scrolling down, and it’s going to tell you where is your business operating. Most of you are going to put United States of America, okay, because this is where your business is registered. Okay, um, is going to ask you in which state is your business registered, okay, or is your business also registered in any type of tribal or local community. Okay, but here most of you are only going to check the state.

Here it’s going to ask for the business current address, is the business address in the US, okay, so here you put your business US address, their current address, and you click next. Once you click next, it’s going to take you to this page where it’s going to say is this an existing company. Basically, an existing company is a company that has been created before January 1st of 2024. Why is this important? When you check this box that you have an existing company, you do not have to report the applicant’s information. Applicants are the

people who open the company, okay, not the owners, but if your business was open before January 1st, 2024, you do not have to report the applicant’s information. But if you’re opening up a new business now in 2024, you have to report the applicant’s information. Now, it’s going to tell you that when you have an existing business, basically all the fields to put the company applicants are going to be blocked. Okay, so important to know there are two types of applicants: one is the direct filer or someone who controls the creation of the company. These are the two types of applicants. The direct filer is the person who physically opens the business, that registers the business with the state. The other applicant may be the owner of the business or the person who gave the order to open the business. For example, if you are the owner of your own business and you register your own business in the state, then you are the direct filer. But if you are a business owner and you hire Freedom Tax to open up your business, you would be the control applicant, and we would be the direct filer.

Okay, so once again, this only applies if your business is open in 2024 or onward. If your business was open in 2023 or before, you do not have to put the applicant’s information in the BOI report. Okay, so for the applicant, it’s going to ask you if they have a FINCEN ID number, the individual’s name, they’re going to ask for their current address, and what type of ID. Okay, you can, for the applicants, you can use a driver’s license, passport, or state-issued ID. Okay, you put the ID number, and you need to upload an image of the ID here, then you click next.

So now we go to part three, which is the beneficial owner information. This is the information from the owners that you need to tell FINCEN. Now, beneficial owner has two definitions. Okay, a beneficial owner for FINCEN is a person that has at least 25% interest in a company or any person that has substantial control over a company. For example, you may have a CFO that he’s not an owner, but he does have significant control of the company. So that CFO, even though he’s not an owner, his information needs to be on the FINCEN report. Okay, so beneficial owners are persons who have at least 25% interest in a company or anyone in the business that has substantial control. If that person is a minor, okay, under 18, then the parent or guardian of that beneficial owner must put their information.

Okay, so for each beneficial owner, if they have a FINCEN ID number, you put that number there. This is good, why? Because, for example, myself, I applied for the FINCEN ID number, and I am an owner of several businesses. Okay, so I need to file several BOI reports for all my businesses. So when I do my BOI report for one of my businesses, I don’t need to put all my information all over again. I don’t need to put my address and my date of birth and upload my passport. I just put my FINCEN ID number, and FINCEN already knows who I am. Okay, so that’s why we recommend every business and every owner of the business to get a FINCEN ID number, and that’s something I’m going to do another video on how to apply for that.

Okay, so for the owners, it’s going to ask you the owner names, the last name, the first name, the middle name, the date of birth, the residential address. This is not the business address; it’s where the owners live. Okay, if you live in a foreign country, they’re going to ask you for your foreign address where you live. For each beneficial owner, it’s their residential address. Okay, and for each beneficial owner, you have to put an ID. Once again, you can have a driver’s license, a passport, or a government-issued photo ID. Here you put the identification number, your driver’s license number, or your passport number, and it’s going to ask you to upload an image of your ID, and you click next.

Okay, and you need to do this for each beneficial owner. After that, you’re going to put your email address, confirm your email address, the name and the last name of the person who is doing the report, and here you check agree. Basically, you agree that you are certified to do the BOI report for this business. Then this is good because once you click next, if something is missing, it’s going to let you know. This is what happened to me; I was missing something in some area, and it told me I needed to go back and do this. But if everything is complete, you will not see this popup.

Okay, so once again, in the bottom of the page, you do a CAPTCHA verification, you put submit BOI R. Once you do that, you’re done. It gives you this confirmation; it says the status of the report was successful. It’s going to give you a tracking number, it’s going to give you a timestamp, and here is the reporting Company FINCEN ID number. Okay, so this is the FINCEN identification number for your business, so you keep this number.

Okay, and you can also click here to download a transcript. Basically, all the information that you put in the BOI report, you get a PDF of all the information, so you should download it for your company records. Okay, and you’re done. Now, if you file the report and you have updates or corrections, you have 30 days to update or correct the submitted BOI report. For example, if your business changes address, you have 30 days to update the BOI report. If one of the owner’s address changes, you need to update the BOI report. If there’s a change in ownership, you need to update the BOI report. So once those changes happen, you have 30 days to update or correct the FINCEN BI report for your business.

Okay, and that is it. Okay, now this is our contact information. We are doing BOI reports as a service. Also, we remember that we do personal taxes, corporate taxes, bookkeeping, payroll, tax planning. If you need to open up a business, this is our contact information, and we will gladly help you out. So if you have received valuable information in this video, like it and share it with another business owner that can take advantage of this information. Thank you for watching, and God bless you. Bye-bye.