Top 10 End Of Year Tax Planning Strategies For Small Business Owners

It's that time of the year again - the time when you need to start thinking about your taxes and how to make sure you're taking the right steps to keep your business running smoothly. In this video, we're sharing the Top 10 end of year tax planning strategies for small business owners (plus a bonus tip!).

For more information visit https://freedomtaxaccounting.com/ or call 407-344-1012.

This video is intended for educational purposes and should not be taken as legal, financial or tax advice. You should consult with a professional about your unique situation before acting on anything discussed in these videos. Freedomtax Accounting and Multiservices Inc., Freedom Insurance Financial Inc., Freedom Realty Source Inc., and Freedom Immigration International Inc. provide educational content to help small business owners and individuals become more aware of certain issues and topics, but it cannot give blanket advice to a broad audience. Neither Freedomtax Accounting and Multiservices Inc., Freedom Insurance Financial Inc., Freedom Realty Source Inc., and Freedom Immigration International Inc. nor its members can be held liable for any use or misuse of this content.

#taxplanning #taxstrategies #taxtips #businesstaxtips #cpa

Hello from FreedomTax Accounting. We’re an accounting firm where we have been providing quality tax and accounting services now for over 20 years. In this video, we are going to discuss the top 10 year end tax planning strategies that every small business owner should implement before the year ends so they can save on taxes next year. Here we go. Let’s go right into the content. As mentioned, we’re going to go through the top 10 and at the end, I’m going to give you a bonus tip, year end tax planning strategy for small businesses so you can save on taxes. Stay till the end so you get the bonus tip.

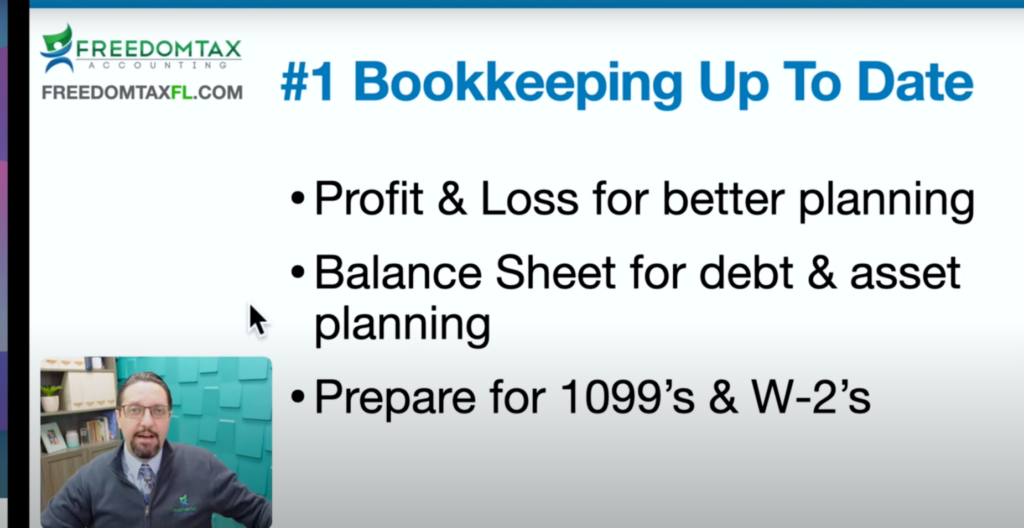

Tip Number one:

You have to get your bookkeeping up to date. If you don’t have your bookkeeping up to date, it’s going to be hard to plan. Why? Because realistically, in order to tax plan effectively, we need to have a profit and loss year-to-date of your accounting so we can know exactly the numbers, the gross income, the expenses, and the net profit you have until now. That way we can do projections and especially with the profit and loss, we can do better tax planning for next year.

Also, we need to have a balance sheet. Why? Because on the balance sheet, we’re going to see your debts and your business assets, and these assets may open the door to implement certain tax strategies for your business. Now, having the accounting up to date also prepares you for getting your 1099 and your W-2s done. Remember that in January, your business has to file the W-2s and the 1099s. Doing the bookkeeping now at the end of the year or having your bookkeeping up to date, you will know exactly how many people you have to give 1099s, how many people you need to do W-2s. If you have missing information from any of your contractors, then get that information now so you’re able to do the 1099s in January. Tip number one for tax planning at the end of the year, have your bookkeeping up to date. If you don’t, we can help you put your bookkeeping up to date and contact us so we can help you have your accounting up to date this year.

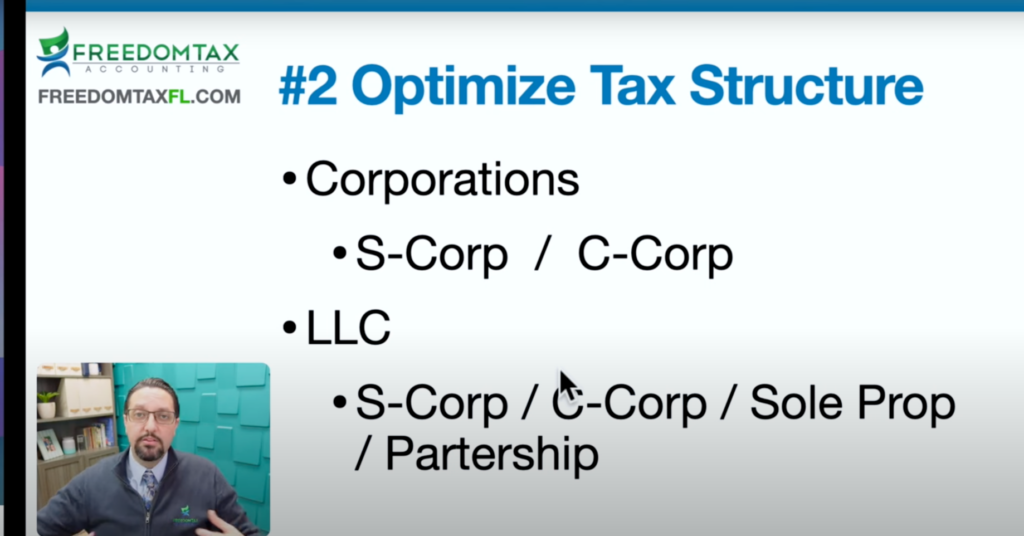

Tip number two:

You have to optimize your tax structure. Remember, if you have a corporation, a corporation can file taxes as an S-corp or a C-corp.

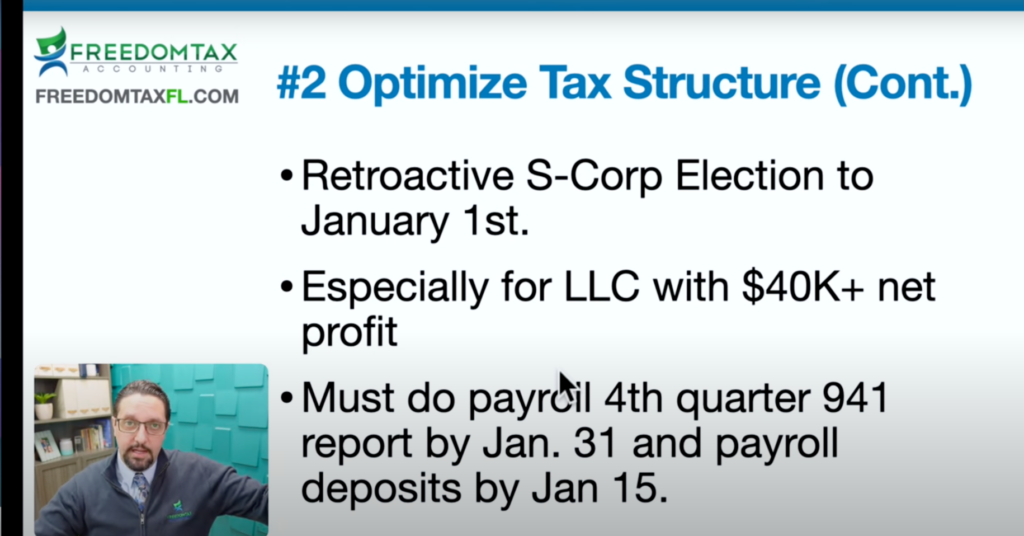

If you have an LLC, the LLC can file taxes as an S-corp, as a C-corp, as a sole proprietor, as a partnership. You have different options on how your business can file taxes. Depending on what your business is doing, then you may want to elect that your business be taxed under these structures so you get the most tax benefits. This is something that you need to do is optimize your tax structure. If you don’t know which tax structure you have, please contact us or contact your tax professional and let them know what you’re doing. Are you doing active income? Are you doing real estate? Because all these factors will determine what’s the best tax structure for your business. Now, talking about optimizing your tax structure, one of the best end-of-the-year tax strategies is to do a retroactive S corporation election to January first. If you have a corporation or an LLC and you’re doing active income, you’re not doing real estate rentals. If you’re doing real estate rentals, you don’t want to have those rentals under an S corp. But if you’re doing active income, you’re selling stuff online, you’re a plumber, you’re an attorney, you have a store, you’re providing services, you’re a consultant, any ordinary active income, usually the S corporation should be the best tax structure.

Now, you may have opened an LLC this year, and some people think that you only have 75 days after you open a business to have the S corporation? No. Even though we’re at the end of the year, we can still change your business tax structure to an S-corp effective January first of this year. You take advantage of the S-corp tax advantages. Now, if you do this, especially for LLCs that have more than $40,000 in net profit, you should change to an S-corp. Now, remember, this is only for active income. If you’re doing passive income like rental properties, you don’t change it to an S-corp. But if you’re doing active income, then if you have an LC that’s going to grow, that’s going to net profit of $40,000 or more, you should change to an S-corp before the year ends. You save a lot in self-employment taxes.

Now, if you change your business to an S-corp, s-corp effective this year, remember that you must have the payroll fourth quarter reports by January 31st, and you must have the payroll deposits by January 15th of next year. Here. Because once you are elected or approved to be an S-corp, remember, as the owner of an S-corp, you have to have reasonable compensation via payroll.

You have the tax advantages, but you also have to meet the S-corp demands of the owners paying themselves through payroll, and you can at least run payroll in the fourth quarter.

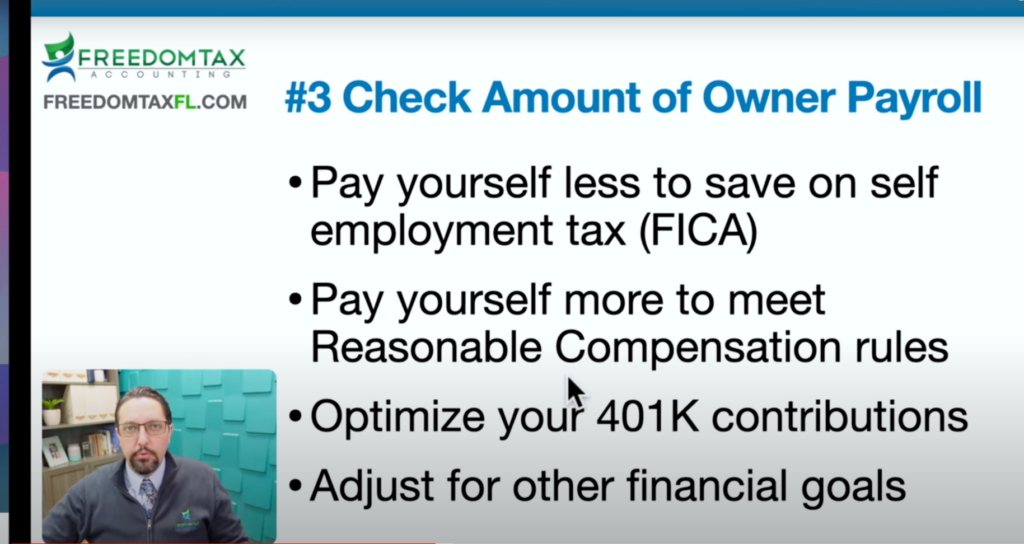

Tax strategy number three:

For the end of the year for all business owners is check the amount that the owner has been paying themselves in payroll this year. You, as the business owner, should be getting compensated via payroll. Now, depending on your gross income and your net profit, you should pay yourself a reasonable amount of payroll. Now, if you pay yourself less, you may be paying yourself too much based on your company’s net profit. So maybe you should pay yourself less in payroll. Why? Because if you pay yourself less, especially on an S-corp, you save on self-employment taxes or FICA. Now, maybe you’re paying yourself too little and you need to pay yourself more till the end of the year because you need to meet the reasonable compensation rules for business owners. Now, you also can optimize your contributions to the 401(k), right? Because the 401(k) depends on how much you pay yourself. We may want to check how much you’re paying yourself in payroll if you want to make more contributions towards your 401(k).

Also, you may want to adjust your payroll depending on other goals you may have. For example, we have many small business owners that they want to buy a real estate property next year. But in order for them to get that home mortgage approved, they need to report a certain income level. This is the time to adjust your payroll to also meet any future goals you may have.

Tip number four:

Buy a vehicle or equipment that you need before the year ends. Now, why should you buy a vehicle or equipment before the year ends? Because you can deduct the accelerated depreciation using Section 179 and bonus depreciation. That is going to give you a higher expense, it’s going to lower your net profit, and you’re going to pay less taxes. Now, do this only if you really need a vehicle or equipment for your business. We would never recommend a business owner to buy a new car or to buy a vehicle for the business or to buy equipment for the business just to get a tax write-off. Just if you’re planning on buying a business vehicle soon or if you’re planning on buying equipment for the business soon, buy it now before the year ends so you get the tax write-off.

Tax strategy number five:

for business owner’s year-end tax planning, do a cost segregation study. Now, what is a cost segregation study? Usually, people think of cost segregation studies only for commercial real estate. But you can also implement the cost segregation tax strategy if you have residential real estate as well. Basically, what you’re doing, you hire an engineering firm to do a study on your property. What that report allows your accountant to do is to take accelerated depreciation. If you do it correctly, you can offset those losses against your ordinary income. Now, in order to achieve this, please talk to your tax professional because it has to be done a specific way in order for that accelerated depreciation to offset your ordinary income. But the cost of irrigation is a very good strategy for small business owners that have a high net profit at the end of the year, buy a commercial real estate or residential real estate before the year ends, do a cost segregation study so you can take advantage of that accelerated depreciation, get those losses, and have them offset your ordinary income.

Tip number six:

On our list of the top 10 year-endtax strategies for small business owners is have your board of advisors meeting.

Now, every business should have a board of advisors or a board of directors. We always suggest that you have your wife and your adult children and family members or other people that you trust on your board of advisors. Why? Because you should have a board of advisors meeting before the year ends and you can take advantage of travel and dining expenses. For example, you can take if your wife and children are in your board of advisors of your business, you can go to a location. You can go to Mexico, you can go to Jamaica, you can go to Puerto Rico, you can go to Florida, you can go to Hawaii. Part of those travel expenses may be a business expense because you’re going to have your board meeting in that location. You can take advantage of those dining and travel expenses. Now, you should always have a board of advisors meeting anyway, so you can protect the corporate veil of your business. You need to fortify your asset protection. In case of an audit, the IRS will always ask for, Let me see your meetings. Let me see what you have discussed with your board of advisors.

If you’re in a lawsuit, the other lawyers and attorneys, are going to ask for the board of advisor meeting minutes on the lawsuit. You should always have the board of advisor meetings not only for the travel and dining expenses but to help legally protect your business.

Tip number seven:

Tax tip, year-end tax tip for small businesses is paying your kids. Now, you have to pay your kids for actual labor. You just don’t pay your kids for paying your kids to get their write-off. No. You have to pay them fair market value wages for actual work they are doing for your business. You need to keep track of everything they’ve done and why you’re paying them. Basically, what you’re doing with this strategy is you’re shifting income to a lower tax bracket. How does that work? Remember that you’re going to have to pay for your kid’s stuff anyway. Why should you pay yourself to pay your kids? Now, if you pay your kids directly for work they are doing for the business, now that money gets deposited into their bank account and they can pay for their stuff. You can pay yourself less. They’re going to pay taxes on whatever you pay them, but they’re at a much lower tax bracket than yourself.

This is one of the best end-of-the-year tax strategies for small business owners. Now, if you have kids that are 18 years or older, you pay them via a W2 or a 1099. If you have children under 18, you pay them via a family management company. Now, you can look online that strategy, how to pay my kids from my business that are under 18 through a family management company. The reason you want to do that is because basically it’s tax-free money for your kids. They won’t have to pay FICA. That can save you a lot of money in taxes as well.

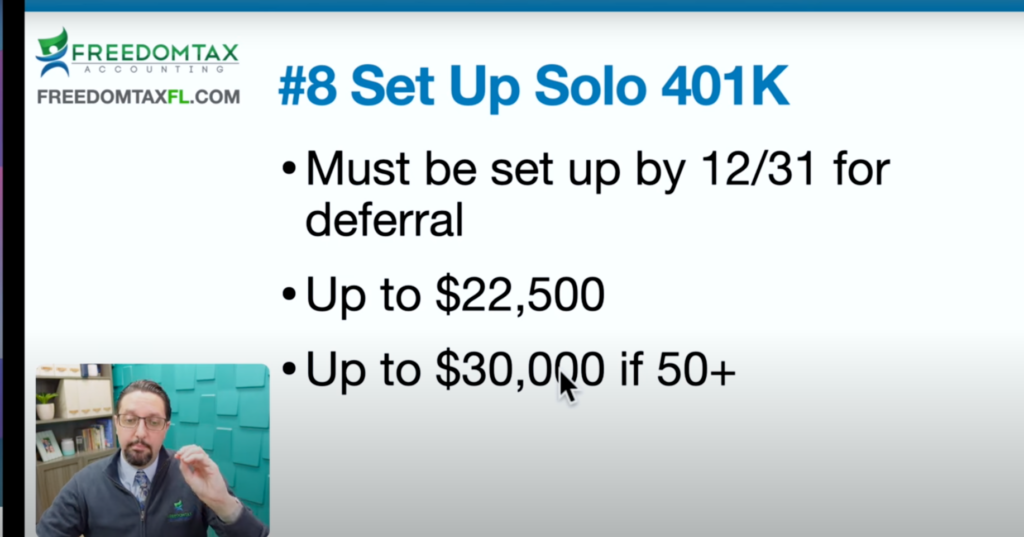

Tip number eight:

The tax planning strategy for the end of the year for business owners is to set up a solo 401(k). For solopreneurs, the solo 401(k) is my favorite retirement account strategy because you can get a lot a bigger write-off. If you’re going to set up a solo 401(k), it must be set up by 12:31 to get the deferral. Now, remember that you can defer at least this year at the time of this recording. Maybe this has change in the future, but at the time of this recording, you can defer up to $22,500.

If you’re 50 or more, you can defer up to $30,000. This is a big tax deduction you can get just by setting up your solo 401(k).

Tax strategy number nine:

Contribute to charitable contributions. Basically, you can donate to your church or other qualified nonprofits. This is not a dollar-for-dollar tax saving, but it helps you lower your taxable income via a tax deduction. Why would you want to do that? Because you may be in a position that this may help you get into a lower tax bracket. If you’re right on the edge of a tax bracket from another, maybe you want to do contribute to charity, and that’s going to bring your taxable income down. Then the rest of your income gets to be in a lower tax bracket. This is one good end-of-the-year tax strategy for small business owners.

Tax strategy number ten:

End of the year tax strategy for small business owners is to delay payments until next year. Why should you do that? If you tell a client, Don’t pay me now, pay me in January, if you can do that, then that amount of income will not count for the current year.

That’s going to help you, it’s going to give you more time for tax plan. I always remember a case like three years ago. We had a client. The client called us the second week of December telling us, I’m going to get a $4 million commission. What can I do to pay less taxes on this income I’m getting? We told them, Well, wow, but it’s almost the end of the year, so there’s very little time of things we can do to offset that income. We told them, Can you tell your client to pay you that commission in January? They said yes. That gave us an entire year to tax plan for this client. This may be one of the best tax planning strategies for you if it’s the end of the year and you can delay and postpone income till next year.

Bonus:

The bonus end-of-the-year tax strategy for small business owners is something called the oil and gas intangible drilling cost deduction. This is something most people don’t know, but if we see a client that has a very high net profit, they’re high-income earners, this is a strategy we implement.

This is one of the few strategies where you can get an 80%, and in some cases, almost 100% tax deduction on the total amount of your investment. Now, the good thing about this strategy is that it offsets ordinary income or capital gains. Now, in most cases, you have to be an accredited investor to invest in one of these companies. If you look online in tangible drilling cost deduction companies, you’re going to find a lot of different companies that you may be able to invest in. This is an investment, there’s always risk. Do your due diligence and study these companies that you’re planning to invest in before you put money in. But it’s a very powerful tax planning strategy, especially for high income earners. That is it. Those are the top 10 and bonus year end tax planning strategies for small business owners. This is our contact information. Call us if you need help with any tax needs you may have. We can help you with your bookkeeping. We can do your personal taxes. We can do your corporate taxes. We do tax planning as well. Call us if you have any tax needs here at Freedom Tax Accounting.

I hope you have received valuable information in this video. If you have, like it and share it with another business owner that can take advantage of this information. Thank you for watching. God bless. Bye-bye.

You can contact us by phone, email, or by visiting our offices:

- Address: 1016 E Osceola Parkway, Kissimmee, 34744, Florida, United States

- Phone: 407-502-2400

- E-mail: [email protected]

Remember that we are part of Freedom Group, a conglomerate of companies dedicated to providing quality services in accounting, taxes, financial consulting, insurance, real estate, and business incorporation, among others.

As for your finances, we can help you with everything you need.