Tax Deadline Dates For December 2023 (Things To Do To Save On Taxes)

In this video we share 4 important tax deadline dates in the month of December 2023 with things you can do on or before these dates so you can save on taxes....

Introduction

As we approach the end of 2023, it’s crucial for business owners to be aware of key tax deadlines in December. These dates are not just reminders on a calendar; they are opportunities to implement strategies that can significantly reduce your tax liability for the year. From board meetings to healthcare enrollments, let’s explore the essential steps you can take to maximize your tax savings.

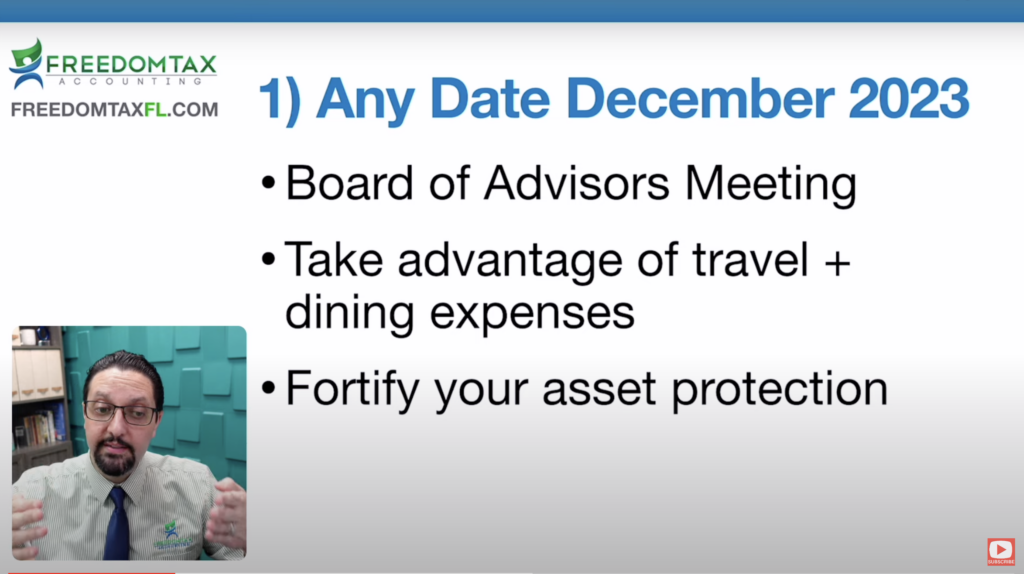

Board of Advisors Meeting: A Smart Tax Strategy

- Why It Matters: Holding a board of advisors meeting before the year ends is a strategic move with dual benefits. It’s an opportunity to discuss business plans and also a way to leverage tax advantages.

- Tax Benefits: By organizing a meeting in a vacation destination, you can legitimately write off certain travel and dining expenses as business expenses. This not only makes for a pleasant business trip but also helps in reducing your taxable income.

- Protecting the Corporate Veil: Such meetings are essential for maintaining the legal protection of your corporate structure, ensuring that your business complies with necessary formalities.

Key Tax Deadlines in December 2023

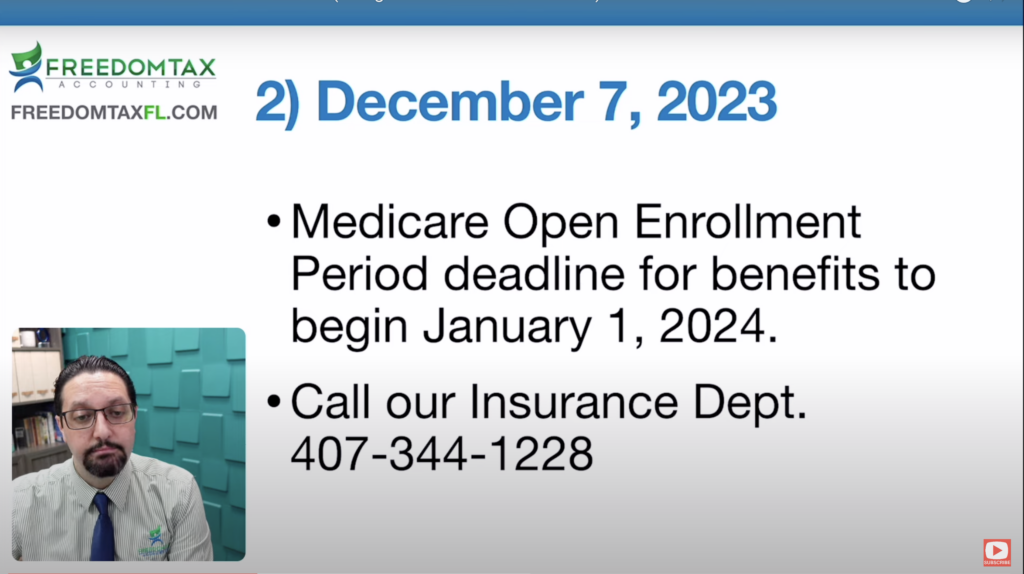

- Medicare Enrollment Deadline: December 7th

Enrolling in Medicare by this date is crucial for integrating healthcare costs into your tax strategy. It’s not just about securing health benefits; it’s about making smart tax choices.

- Obamacare Enrollment Deadline: December 15th

The deadline for Obamacare enrollment is essential for ensuring your health insurance is in place for the new year. A comprehensive tax plan should offer strategies to optimize healthcare costs for tax benefits.

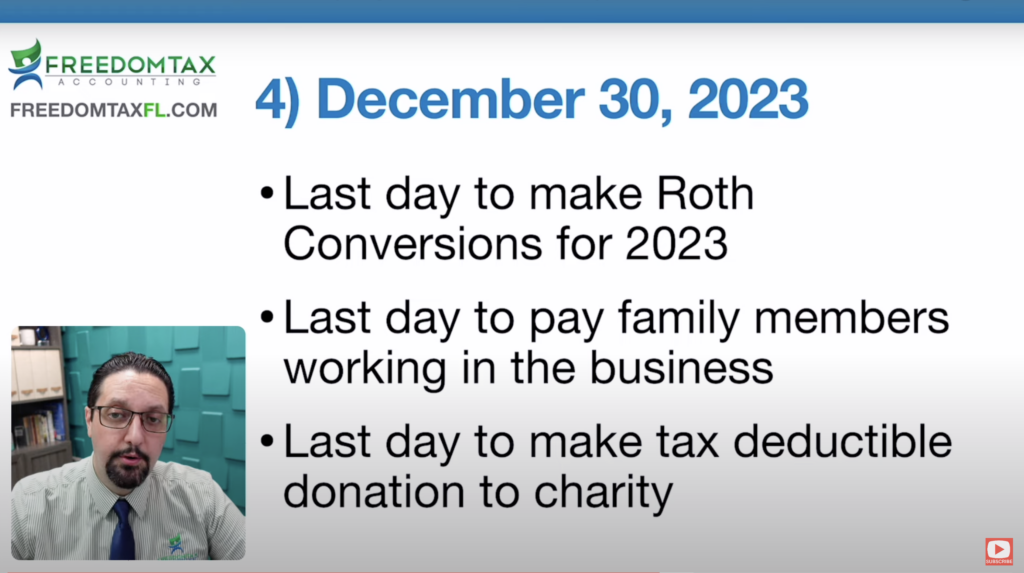

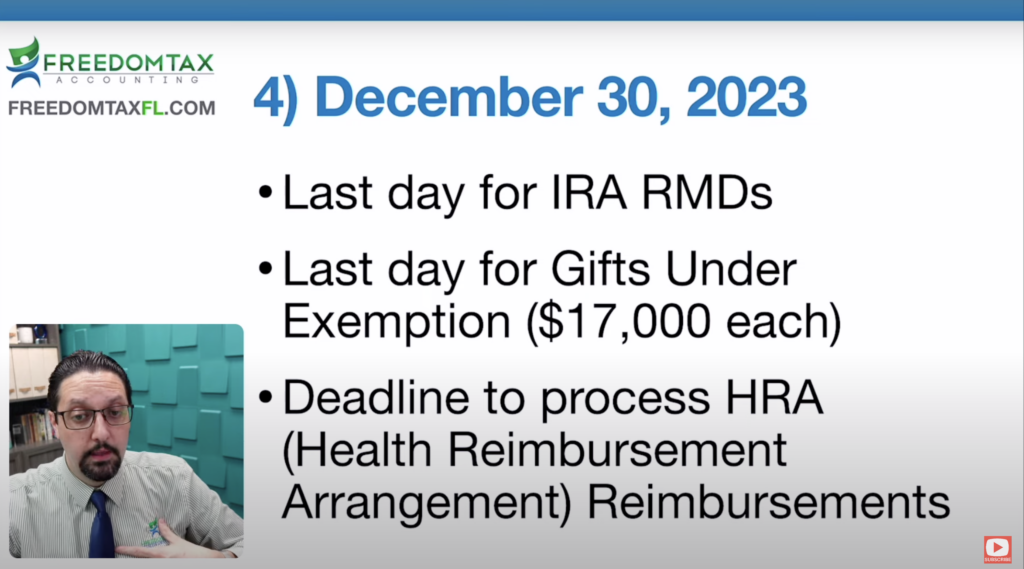

- December 30th: A Day for Multiple Tax Strategies

This date marks the deadline for several tax-saving actions. These include purchasing business vehicles, prepaying supplies, making Roth conversions, paying family members working in the business, and making charitable donations.

Each of these actions can significantly lower your business’s net profit, leading to substantial tax savings.

Conclusion

December is a critical month for tax planning. By taking action before these deadlines, you can significantly reduce your tax liability and enter the new year in a stronger financial position. Remember, effective tax planning is about making the most of every opportunity. For personalized advice and comprehensive tax planning, consider consulting with a professional tax service. As we say goodbye to 2023, let’s do so with smart financial decisions that pave the way for a prosperous new year.

Transcript: Tax Deadline Dates For December 2023 (Things To Do To Save On Taxes)

Hello from Freedom Tax Accounting. It is December 2023, and there are some important dates during the month of December that you should be aware of because there are some things you can do before these dates so you can save on taxes next year. So let’s go right into the content.

First Thing: Board of Advisors Meeting Every business owner should have a board of advisors. Your wife, your children, your family members can be part of your board of advisors. Why is that important? Because then you can go on a trip with your family, have a board of directors meeting over in Puerto Rico, Hawaii, Jamaica, wherever you decide to go on vacation, and you may write off some of those travel expenses and dining expenses from your vacation as business expenses. Not only should you have your board of advisors meeting for tax advantages, but also to protect the corporate veil for legal protection from your business.

December 7th: Medicare Enrollment Deadline The last day to enroll for Medicare to have your benefits ready for January. Any good tax plan should have a strategy involving healthcare costs. If you need to enroll in Medicare, you can call our insurance department for assistance.

December 15th: Obamacare Enrollment Deadline The last day to apply for Obamacare or get your healthcare through the marketplace so you can have your health insurance ready for January. Any good tax planner should provide you with strategies on the best tax strategy involving your healthcare costs.

December 30th: Various Tax Strategies Before December 30th, there are many things you need to do to save on taxes. This includes purchasing a business vehicle, prepaying supplies, making Roth conversions, paying family members working in the business, making charitable donations, and more. These expenses can bring your business net profit down, thus saving you taxes when you prepare your business taxes next year.

Conclusion These are the four important tax dates for December 2023. Remember that we are a full-service accounting firm and can help you with your personal taxes, corporate taxes, payroll, forming a new LLC, tax planning, and more. I hope you have received valuable information in this video. If yes, like it, share it with another business owner that can take advantage of this information. Thank you for watching. God bless you. Bye-bye.

You can contact us by phone, email, or by visiting our offices:

- Address: 1016 E Osceola Parkway, Kissimmee, 34744, Florida, United States

- Phone: 407-502-2400

- E-mail: [email protected]

Remember that we are part of Freedom Group, a conglomerate of companies dedicated to providing quality services in accounting, taxes, financial consulting, insurance, real estate, business incorporation, among others.

As for your finances, we can help you with everything you need.