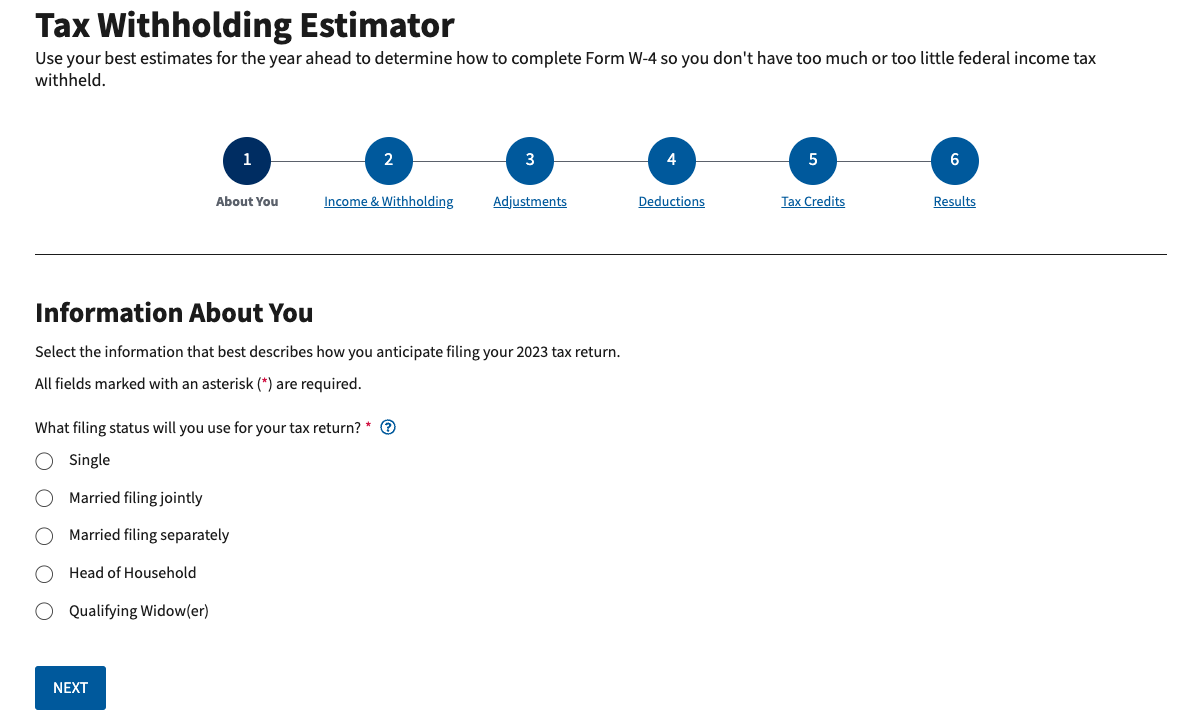

This IRS online tool can help you estimate your 2023 tax withholding.

Reviewing your income tax withholding early in the year can help you set yourself up for success all year long. The Tax Withholding Estimator on IRS.gov makes it easy to figure out how much to withhold.

The Tax Withholding Estimator is an online tool that helps employees withhold the correct amount of tax from their wages. It also helps self-employed people who have wage income estimate their quarterly tax payments.

There are many reasons to use the Tax Withholding Estimator. Some reasons include:

-To estimate how much tax will be withheld from your paycheck

-To see if you need to make any changes to your tax withholding

-To get an idea of how much money you will have left over at the end of the year

Taxpayers can use the results from the Tax Withholding Estimator to decide if they should:

- Complete a new Form W-4, Employee’s Withholding Allowance Certificate and submit it to their employer.

- Alternatively, make an additional estimated tax payment to the IRS.

Use your best estimates for the year ahead to determine how to complete Form W-4, so you don’t have too much or too little federal income tax withheld.

How It Works

Use this tool to:

- Estimate your federal income tax withholding

- See how your refund, take-home pay or tax due are affected by the withholding amount

- Choose an estimated withholding amount that works for you

Results are as accurate as the information you enter.

What You Need

Have this ready:

- Paystubs for all jobs (spouse too)

- Other income info (side jobs, self-employment, investments, etc.)

- Most recent tax return

Your information isn’t saved. Learn more about Security.

Before using the tool, taxpayers may want to gather some documents, including:

- Pay stubs for all jobs. If the taxpayer married filing jointly, they would also need their spouses’ pay stubs.

- Forms W-2 from employers to estimate their annual income.

- Tax forms 1099 from banks, issuing agencies, and other payers, including unemployment compensation, dividends, and distributions from a pension, annuity or retirement plan.

- A 1099-K, 1099-MISC, or W-2 for workers in the gig economy.

- Form 1099-INT for interest received.

- Other income documents and records of virtual currency transactions.

People do not need these documents to use the tool, but having them will help taxpayers estimate their income for 2023. The Tax Withholding Estimator results will only be as accurate as the information the taxpayer enters.

The Tax Withholding Estimator isn’t for taxpayers who

- Only have pension income – They can read more about pension and annuity withholding on IRS.gov

- Taxpayers with more complex tax situations may have to pay more in taxes. This includes people who owe certain taxes, such as the alternative minimum tax and people with long-term capital gains or qualified dividends.

Don’t use this tool if…

- You have a pension but not a job. Estimate your tax withholding with the new Form W-4P.

- You have nonresident alien status. Use Notice 1392, Supplemental Form W-4 Instructions for Nonresident Aliens.

- Your tax situation is complex. This includes alternative minimum tax, long-term capital gains, or qualified dividends. See Publication 505, Tax Withholding and Estimated Tax.

Estimator Frequently Asked Questions

After You Use the Estimator

Use your estimate to change your tax withholding amount on Form W-4. Or keep the same amount.

To change your tax withholding amount…

- Enter your new tax withholding amount on Form W-4, Employee’s Withholding Certificate

- Ask your employer if they use an automated system to submit Form W-4

- Submit or give Form W-4 to your employer

To keep your same tax withholding amount…

- You don’t need to do anything at this time.

- Recheck your withholding when needed and each year with the Estimator. This helps you make sure the amount withheld works for your circumstance.