Covid-19 Payroll Tax Credit- Sick Leave & Family Leave Tax Credit

Employers have access to more financial help with new Covid-19 payroll tax credits. The Sick Leave Tax Credit and the Family Leave Tax Credit are two payroll tax credits that are available for employers to claim in 2020 and 2021.

Visit our website – https://freedomtaxaccounting.com/

DISCLAIMER

This video is intended for educational purposes and should not be taken as legal or tax advice. You should consult with your financial professionals about your unique financial situation before acting on anything discussed in these videos. Freedomtax Accounting and Multiservices Inc. are providing educational content to help small business owners become more aware of certain issues and topics, but we cannot give blanket advice to a broad audience. Freedomtax Accounting and Multiservices Inc. or its members cannot be held liable for any use or misuse of this content.

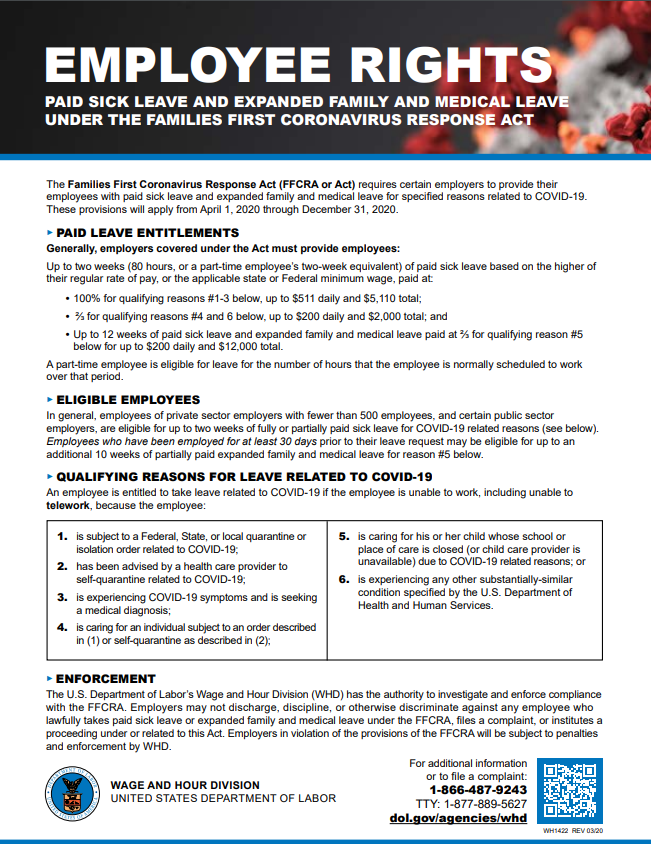

The FFCRA provides businesses with tax credits to cover certain costs of providing employees with paid sick leave and expanded family and medical leave for reasons related to COVID-19, for periods of leave from April 1, 2020, through March 31, 2021.

Note: The COVID-related Tax Relief Act of 2020 extends the tax credits available to Eligible Employers for paid sick and family leave provided under the EPSLA or Expanded FMLA through March 31, 2021. Therefore, any references to these credits expiring on December 31, 2020, have been updated to March 31, 2021.

Eligible Employers may claim tax credits for qualified leave wages paid to employees on leave due to paid sick leave or expanded family and medical leave for reasons related to COVID-19 taken for periods of leave beginning on April 1, 2020, and ending on March 31, 2021.

Eligible Employers may claim the credits on their federal employment tax returns (e.g., Form 941, Employer’s Quarterly Federal Tax Return PDF), but they can benefit more quickly from the credits by reducing their federal employment tax deposits. If there are insufficient federal employment taxes to cover the amount of the credits, an Eligible Employer may request an advance payment of the credits from the IRS by submitting a Form 7200, Advance Payment of Employer Credits Due to COVID-19.

Video Transcript

Covid-19 Tax Credits Payr-VideoIndirelim.com

Are you still missing out on the payroll tax credit that gives you back 100% of certain wages paid? Well stick around. That’s what we’re talking about in this video.

Hi, everyone, this is Carmen Huertas. Once again, from freedom tax accounting, we are a full-service accounting firm that has been serving the community for over 20 years and we want to reach out to you today to discuss some information on the paid sick leave and family leave credits that are not new. They’ve been out. They all came out with the families first coronavirus Relief Act back in March of last year. However, like we all know, there are changes that are continually coming out and this one was one of the ones that also got changed in the Appropriations Act that came out in December and a lot of people, because the focus has been on the PPP loans or the SBA idle loans. These are certain credits that people have overlooked, and they have failed to take because there hasn’t been enough clear information whether the you could take all of these credits at the same time and there’s just been a lot of confusion, a lot of information, but it hasn’t been quite clear.

Okay, so we’re talking today about the paid sick leave and the family leave under the families first coronavirus Relief Act, okay. Now, this credit is really great, because as employers, small employers, we’re talking about employers with under 500 employees, you’re required to pay sick leave and family leave to your workers, if they have been diagnosed with COVID and they’ve had to stay home, they can’t work, they can’t telework, and they’re at home. Many people don’t realize that they’re required to pay their employees, their sick leave, okay, and they’re not sure how much to pay. So, this is what we’re going to go over. The good thing about it is that these sick leave wages, I mean, everybody’s trying to save the money and that’s why a lot of people perhaps haven’t been paying the employees, but the credit surrounding this gets you 100% back of the wages paid to those eligible employees, okay and I say eligible, but basically anybody working for you is eligible to receive the credit, if they are on payroll. Again, these are payroll credits, this does not count for your subcontractors. Okay, if you are having people on payroll, the wages that you pay to those employees are what we are discussing here.

Now, self-employed individuals also have a chance to do this, and we’re gonna discuss this in a separate video. But this is very important, because I’m sure a lot of self-employed people are out there, seeing what type of relief they can get and just stay tuned for that, that, you know, upcoming video. So I’m just gonna read down the lines is the end of a pretty busy tax day, of course, we’re in tax season. Today is February 11 and I just want to recap some things because I’ve had a lot of questions on the prior video on the employee retention credit. So, I just want to come on here, I don’t necessarily have time to produce a fancy outline or anything. So I’m just going to read off of the FAQ that the IRS provides regarding COVID-19 related tax credits, if you Google, you know, sick leave COVID IRS, you’ll see the link to take you to the IRS page and you can take a look, you know at it for yourself, but I’m going to kind of digest the information and give it to you, which is what a lot of people are looking for, because it’s a lot of stuff to read.

Okay, so what is the tax credit provided? It provides businesses with tax credits to cover certain costs of providing employees with paid sick leave, and expanded family leave. Okay, for reasons related to COVID. This is specifically for COVID because sick leave has always existed, and the FMLA laws and extended family leave that’s always existed, but this is particularly you know, regarding COVID cases, and this covers the period starting April 1 of 2020 through now, March 31 of 2021. It used to end December 31st. But now it got extended. So when can employer start claiming the credits, like I said, back data to April 1 2020 and all the way through March 31. When are you eligible to start receiving the credits? Well, as soon as you submit, if it’s retroactive, the amended 941 or if it’s moving forward, the form 7200 to get, you know, this credit paid to you in advance. Okay, so what documentation do you need? Okay, so let’s start with the basics. You have your staff, somebody got diagnosed with COVID. The employer themselves got diagnosed with COVID. So, they’ve had to, obviously quarantine stay home. Under doctor’s orders. I mean that those are the guidelines that we’ve heard over and over again. So if that employer has to stay home and cannot tell Work, you’re definitely, you know, under requirement to pay them, how much how much is the maximum, so you have to pay that employees’ wages up to $511 per day.

So if they make $800 a day, you’re only required to pay them up to $511 per day, for two weeks, two work weeks, so 80 hours, okay? That is if the employee themselves is sick, if it’s not them, and if they had to stay home, because their kids, you know, they didn’t have school any longer, like my kids, my, I had to stay home for a lot of weeks, you know, the end of last school year and the whole summer, because my children did not have school, so I had to stay home with them. So in that case, I’m not the one that has COVID, I’m taking care of a family member that has COVID, or their school was close, you know, close down and, and I had to stay with them, because they’re, they’re under age. So in that case, instead of $511 being the maximum, the maximum is $200 per day, or two thirds of their pay. Okay, so that’s how that works. This, the paid sick leave gets you two full weeks. So $511 a day for two full weeks, 80 hours, and then the family leave actually gets you 10 weeks, it gives you another two weeks, but the expanded family leave is a total of 10 weeks that you can be out.

Okay. So really, if we’re looking at the maximum that you can get per employee, it’s $5,110 for the sick leave part if the employee themselves is sick, or a maximum of $10,000, back on the extended family leave. Okay, that’s $200 max per day for the whole 10 weeks. What employers may claim the credits, well, all employers that have fewer than 500 employees are eligible to take this, if you’re larger than that, unfortunately, you cannot take this credit. Okay, it you have to be 500. Under 500, I’m sorry and obviously, you’re paying the wages, the sick leave wages and the family leave wages to in order to get the credit. Of course, the same rule that has governed all these other credits apply that federal government governments of any state or political subdivision or any agencies, or instrumentalities of these governments are not eligible for this credit.

Okay. So, what is the amount of the refundable tax credits available to eligible employers, I got ahead of myself, and I already told you that. So, it’s 100%, up to two weeks, which is 80 hours of the qualified sick leave wages and up to 10 weeks of the qualified family leave wages and I already mentioned that. So, we’ll go ahead and they give you an example here, because not only is it 100% of the of the wages, it also gives you the credit equal to the employer share of the Medicare tax, which is 1.45%. So, they give you an example on the IRS website that, say you paid $10,000 in qualified sick leave. So, the credit that you’re gonna get is 10,145. Because it’s the 10,100% of the wages up to 10,000 plus the employer share of the Medicare, which is 145, on $10,000. Okay, so keep that in mind and let’s see if that payment, which in most, I guess in a lot of cases, the payment that you are due back is larger than any, you know, federal tax deposit that you have to make. It’s refundable, it’s gonna cover your whole, you know, next payroll tax payment that you have to make and whatever is an addition or an excess, then they will refund that to you and you get that money back in advance by filing the same form 7200 that you would use, if you were doing the employee retention credit, that’s gonna get you the money in advance. If time passes and you just haven’t gotten around to doing that, then you can file it on the 941.

Either way, whether you file form 7200 or not, it has to go reconciled on the 941 when you file it, okay, so keep that in mind, do the qualified leave wages include wages paid to an employee who must care for a child, because the summer camp is closed? Yes. Anywhere your kids are supposed to be that’s going to take care of them while you’re at work. That counts. If it’s no longer available due to COVID, which none of these places that provide childcare have been open, then that counts that that absolutely counts. That would be me taking care of a family member. So again, my max wages would be $200 per day, or two thirds of my pay, whichever is lower. Okay. So this also includes the wages that you’re looking at also includes the qualified health plan benefits that we’ve discussed with the employee retention credit, any health benefits that the employer pays pretax are also Going to be added into those wages. Okay, so that gives you even more money that you’re going to get back.

Let’s see, are any small businesses exempt? Because Okay, so if you have less than 500, you qualify. But is anybody exempt from having to do this, some people actually prefer not to do it, or maybe they don’t have the money to do it, even though you’re getting 100% of it back. It takes a while between you paying it and you’re getting it back. So yes, the families first coronavirus Relief Act actually permits the Department of Labor to provide certain rules to make businesses with fewer than 50 employees, that they can say that they’re exempt, or they can qualify for an exemption, if paying the wages is going to it says here, if providing the qualified the wages would jeopardize the viability of their business as a going no concern. So if that’s the case, then if you have less than 50 employees, you can apply for the exemption and not have to do it. So, nobody can, you know, file a complaint against you for not providing the sick leave. Obviously, if you’re not paying the sick leave, then you can’t get any credit for that. Okay, so you’ll just get, you may qualify for the employee retention credit on the wages that you are paying. Again, it just asked how you claim the credits while you’re going to claim them on 941.

Again, this started back in April of 2020. So if you want to go back and you realize you did pay them, but you never asked for the credit, then you can go back and amend whatever quarter you did pay those qualified wages, the sick leave in the family leave, and go ahead and amend that 941 and ask for it there and they’ll send you that that refund back. If it’s moving forward, again, form 72, we’re already in February. So, January payroll has passed, some people pay weekly, that’s already for pay periods. Some people want to do it on a monthly basis, whatever it is, you don’t have to wait till April, which is when you file the first quarters 941 to get the money back, you can file form 7200 to claim and advance and you would do that. If you as well are doing employee retention credit, you do both of those all three credits, the employee retention credit, the sick leave, and the family leave all go on that same form.

Okay. Now what you have to keep in mind, you can use them all simultaneously, which is a question that is here, may an eligible employer receive both tax credits for qualified leave wages and the employee retention credit? Yes, you can do them simultaneously and the next question says, can you do it if you have PPP? Yes, you can do all of it at the same time. So that rule got eliminated that you if you had PPP, you couldn’t do anything else, you can do all of them, the thing you have to make note of is that you’re not using the same wages, you know, the same 10,000 that in the example that you pay the employee for extended family leave, you cannot use those 10,000 wages for the forgiveness of the PPP and you can’t use it for the employee retention credit. So you have to keep track of three things.

Okay and nothing about this year has been easy. It’s not easy. It’s not difficult. It’s just tricky and there’s so much stuff going on that it’s just an extra thing for you to think about. But try to be organized, you have to separate those wages, whatever you’re using for PPV forgiveness, make sure you’re not double-dipping that into these payroll tax credits. Okay, so let’s see here are similar tax credits available to self-employed yes, like I said at the beginning of the video, make sure to stick around because we are going to release another video regarding self-employment, paid sick leave, and family leave because it does apply to you too and that’s great news and I think that’s it for now, I just wanted for you guys to be informed of these credits, do not overlook them and not only because it’s a money back for you, but you may not be in compliance if you have more than 50 employees less than 500 that you know they got sick and you ended up not paying so make sure you are aware of the laws, make sure you’re aware of the benefits that are out there for you.

Yes, there are requirements but thankfully the government is providing you back the funds to replenish the requirements that they’re having you do which is to pay those people that are not working, and I know it hurts but at least we have relief and there’s a lot of relief coming from a lot of different places. So, I am glad that you stayed watching the video to through the end. If you haven’t already, please hit the like button. Hit the subscribe button so you are notified of new videos we try to put out frequent material, especially when we post a video, we see a lot of the questions that come up and we try to touch base on those items as well. So, I thank you so much for sticking with us again through the end of this video, and stay tuned for the next one.

So this is our contact information:

- Address: 1016 E Osceola Parkway, Kissimmee, 34744, Florida, United States

- Telephone: 407-502-2400

- E-mail: [email protected]

And remember that we are part of Freedom Group, we are a group of four companies where we do tax accounting.

So we can help you in many ways.

Thank you for watching this video. Remember to subscribe to this channel and if you have received value out of this information like this video and share it with someone that can take advantage of this information.

Have a great day. Great evening. whatever time you watching this and again, we thank you and we appreciate you guys. Bye.

#covid19taxcredits #sickleavetaxcredit #familysickleavetaxcredit #payrolltaxcredits

Subscribe to my channel

Subscribe to my channel