TRUTH About 14 Days of PPP Loan Applications

Clarifying false news about the next 14 days of PPP loan applications for small businesses with less than 20 employees, and the new PPP loan amount increase for self-employed, independent contractors, and sole proprietors that is coming in the month of March 2021.

Visit our website – https://freedomtaxaccounting.com/

DISCLAIMER

This video is intended for educational purposes and should not be taken as legal or tax advice. You should consult with your financial professionals about your unique financial situation before acting on anything discussed in these videos. Freedomtax Accounting and Multiservices Inc. is providing educational content to help small business owners become more aware of certain issues and topics, but we cannot give blanket advice to a broad audience. Freedomtax Accounting and Multiservices Inc. or its members cannot be held liable for any use or misuse of this content.

Smallest Businesses Can Now Go to Front of Line for PPP Loan Applications in the Next 14 Days.

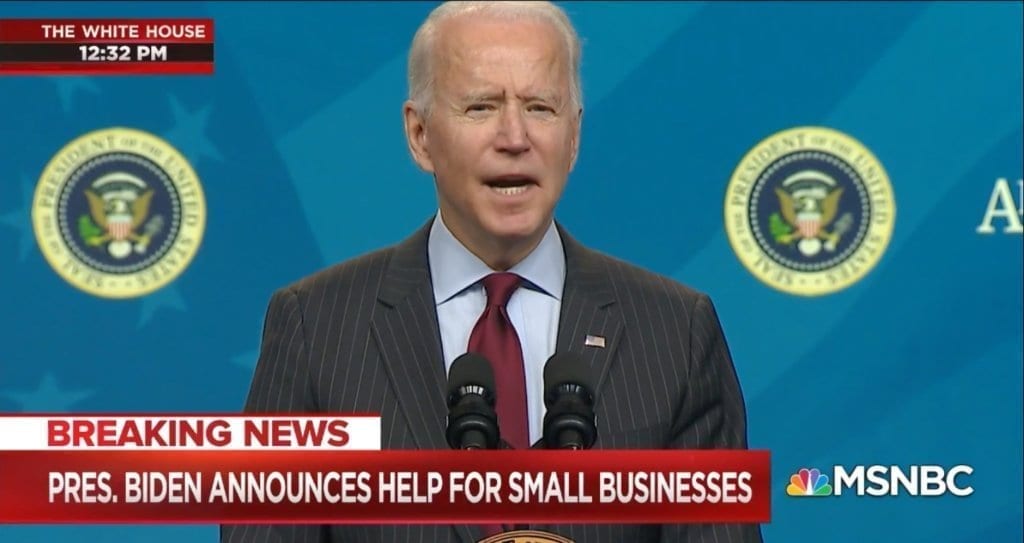

The White House will give the very smallest businesses a chance to cut in line for pandemic relief loans, announcing Monday that for two weeks the Paycheck Protection Program (PPP) will only accept applications from companies with fewer than 20 employees.

The special two-week period, which starts Wednesday, is one of a number of steps meant to make up for past problems with the program, designed for small businesses having financial trouble because of the COVID-19 pandemic. Mom-and-pop businesses “got muscled out of the way by bigger companies” when the PPP was first launched last spring, President Joe Biden said in a speech Monday, and this will give a higher priority to those smallest businesses—many of which are owned by minorities—before the latest round of funding ends on March 31.

President Joe Biden on Monday launched changes to the U.S. coronavirus aid program for small businesses to try to reach smaller and minority-owned firms, sole proprietors and those with past criminal records left behind in previous rounds of aid.

His PPP changes here also aim to allow more single-person businesses — sole proprietors, independent contractors, beauticians and others — to get loans. Many of these were excluded previously because the program was geared towards firms with traditional payrolls, or because their business cost deductions limited them to only nominal loan amounts, administration officials said.

Video Transcript

Hello from FreedomTax Accounting, we’re an accounting firm where we have been providing quality tax and accounting services now for over 20 years. We wanted to do this quick video because there is a lot of bad information coming from other YouTube channels and even other news sources regarding the next 14 days of PPP loan applications and the new PPP loan increase that is available for the self-employed.

So, we wanted to do this quick video because we want you to have the correct information. Okay. Now what happened this week, this week, the Biden administration, they announced several changes to the PPP loan program. If you do not know those changes, just basically watch the video that I’m going to link up here. Okay. Now, one of those changes is that starting today, February 24, the SBA is ordered to only process PPP loan applications for small businesses that have less than 20 employees. Now, that is good news for small businesses, because basically, that puts them in front of the line. And they can get their PPP loans faster, which is good news. Because basically, we hope that the lenders follow the same rule and their lenders, especially the banks, only process PPP loan applications. For businesses that have less than 20 employees, we have seen that in this round of PPP, the banks are taking a long time to process PPP loan applications. We have applications that are waiting now for a month and not for the SBA, we’re waiting on the banks. So the first news is that, for the next 14 days, the SBA will only process B people don’t applications for businesses that have less than 20 employees. The other news is the new PPP loan increase that is available or will be available for the self-employed.

Now, these two news have been mixed. And a lot of other channels are saying the wrong information. So, this is the correct information. Right. Now, for the self-employed, there will be a PPP loan increase starting in March. That’s what the SBA said, the s, if you don’t know what the new increase is, is that the way that PPP loan amount is calculated today, and for the next 14 days, and in the past, is that you needed to take your schedule C, take line 31, which is your net profit. Remember, you have your total sales, you have your expenses, and then whatever’s left is your net profit. The way PPP loan is calculated today is line 31. net profit of your schedule C divided by 12 multiplied by 2.5.

The change is the following. You are now going to be able to calculate your PPP loan amount either with your gross receipts, which is line one or your gross income, which is line seven, we still don’t know which one of the two the SBA is going to use for the PPP loan amount, we think is going to be line seven, which is gross income, but we need to wait because the SBA has announced this new PPP loan amount formula for the self-employed, independent contractor sole proprietor is going to be implemented at some time in the month of March. Now what’s the bad information coming from other YouTube channels is that they are saying that if you’re a sole proprietor, independent contractor, self-employed and you want to apply for this PPP loan increase that you need to apply within the next 14 days. That is not true. That is incorrect. In the next 14 days, the SBA will only process the app the applications they have right now. And the banks the applications they have right now or the applications they get in these 14 days. Using the current PPP loan formula, okay? So, if you want if you’re self-employed independent contractor, sole proprietor and you want the new PPP loan increased, there’s nothing you can do right now and you can’t apply for it in the next 14 days, we need to wait for the SBA to come out with the official guidance. And then we have to wait for the banks to implement it in their system.

So, this is going to be implemented in March. That’s what the SBA said. So, but if you haven’t applied for PPP one or two, don’t wait to March, use these 14 days to at least get your PPP loan approved, even if it’s with the old formula. I’m pretty sure now this is our speculation we can be certain, but there is guidance from the SBA that if you want to apply for an increase, you’re able to do in the old formula, okay, so I’m pretty sure that if you get your PPP loan now with the old formula when the new formula is implemented, you should be able to reapply to get the difference. Now, that’s our speculation. And we think is just that that happens.

Okay. So once again, we just wanted to clarify that if you want the new PPP loan in increase as a self-employed independent contractor, sole proprietor, you can’t do anything right now. And you don’t have to apply for it in within the next 14 days. Okay, so we just wanted to give you guys the correct information regarding the PPP loan.

Thank you for watching this video. Remember, it is tax season, and we are a full-service accounting firm. We are authorized by the federal government to prepare personal tax returns and business tax returns for individuals and businesses that are located in any of the 50 US states.

So this is our contact information:

- Address: 1016 E Osceola Parkway, Kissimmee, 34744, Florida, United States

- Telephone: 407-502-2400

- E-mail: [email protected]

And remember that we are part of Freedom Group, we are a group of four companies where we do tax accounting.

So we can help you in many ways.

Thank you for watching this video. Remember to subscribe to this channel and if you have received value out of this information like this video and share it with someone that can take advantage of this information.

Thank you for watching. God bless you. Bye-bye.

#pppapplication #pppupdate #pppnews #pppselfemployed #ppploan

Subscribe to my channel

Subscribe to my channel