A new portal has been established for companies to submit Forms 1099.

The IRS announced Wednesday that businesses of any size can start filing Form 1099 series information returns for free by utilizing the new Information Returns Intake System (IRIS). The agency believes this system will be particularly helpful for small companies which have previously filed such data on paper. IRIS is open to accepting Forms 1099 for the tax year 2022 and onwards.

Mike Maltby, IRS Small Business/Self-Employed exam case program manager, declared during an online press conference on Wednesday that their system is without cost, safe, precise, and does not need any special programs.

At the news conference, Kyle Kampschroer, the project manager for IRIS and an IRS Small Business/Self-Employed division exam case revenue agent, stated that if taxpayers opt for IRIS instead of filing paper information returns, then it could help reduce future backlogs.

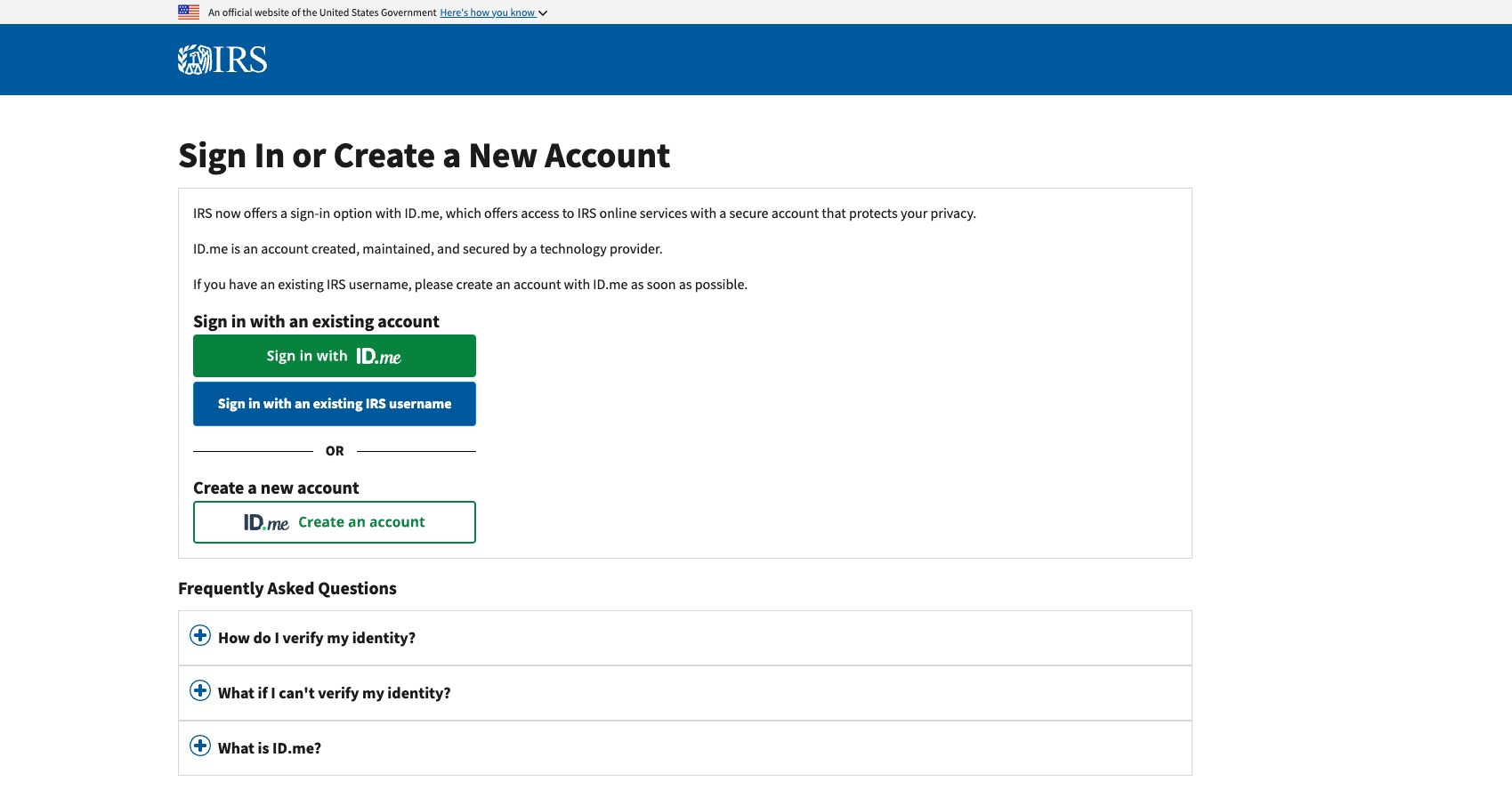

Taxpayers can now utilize the platform to craft, transfer, modify, and check data and receive fulfilled forms of the 1099 series for dispersal and confirmation, according to a statement published by the IRS. Signing up for the IRIS filing platform is available right now.

The Filing Information Returns Electronically (FIRE) system, necessitating specialized software, will stay operational for large-scale filing Form 1099 series and other data returns up to the 2023 filing season at least.

More information about IRIS is available at irs.gov/iris.