5 NEW Tax Credits in New Stimulus Package Signed by President Biden

President Biden signed the new stimulus package that includes many new tax credits and tax provisions that help individuals and businesses get more financial tax help during this Covid-19 pandemic.

Link to Employee Retention Tax Credit Playlist

Link to Sick Leave and Family Leave Tax Credits

DISCLAIMER

This video is intended for educational purposes and should not be taken as legal or tax advice. You should consult with your financial professionals about your unique financial situation before acting on anything discussed in these videos. Freedomtax Accounting and Multiservices Inc. is providing educational content to help small business owners become more aware of certain issues and topics, but we cannot give blanket advice to a broad audience. Freedomtax Accounting and Multiservices Inc. or its members cannot be held liable for any use or misuse of this content.

President Biden signed the new stimulus bill that includes several tax provisions.

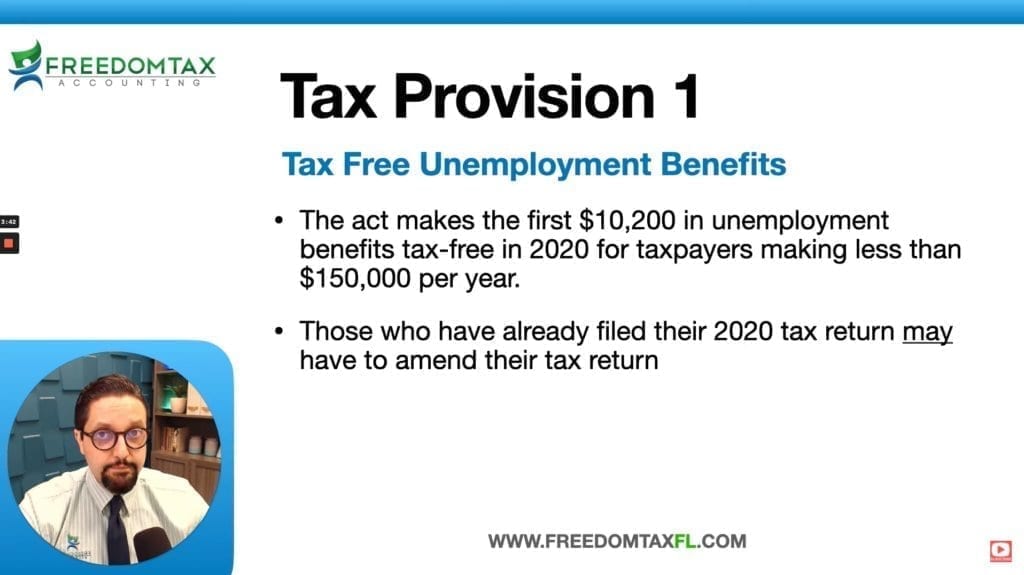

2020 tax-free unemployment benefits

Initially, the bill didn’t include retroactive tax provisions, but during the Senate’s voting session, a compromise was made on unemployment benefits that will affect 2020 tax returns. The bill provides a $300 weekly federal unemployment benefit through Sept. 6 and also makes the first $10,200 of unemployment payments nontaxable ($20,400 in the case of a joint return, but only $10,200 per spouse) in 2020 for households earning less than $150,000.

NATP understands the burden this puts on you during your busiest time of year. We reached out to our contacts at the IRS to find out if the IRS will process refunds for returns already filed, or if taxpayers will need to amend. The IRS responded, “We do not have any information or guidance to share regarding unemployment and the American Rescue Plan.” When the IRS provides guidance, we’ll immediately pass it along.

An individual can receive an advanced premium tax credit (APTC) to lower their monthly health insurance payment (premium). If at the end of the year they have received more APTC than the credit allowed based on final household income, the taxpayer does not have to pay back the excess when filing their 2020 federal tax return. For those who have already filed their 2020 return, we are waiting for guidance as to how to get the refund.

Recovery rebates to individuals

Single taxpayers with AGI under $75,000 will receive a $1,400 refundable tax credit, while joint filers with AGI under $150,000 will receive $2,800. In addition, taxpayers will receive $1,400 for each qualifying dependent (including adult dependents). The credit will completely phase out at an income threshold of $80,000 for single filers and $160,000 for joint.

The Treasury is directed to issue this credit as an advance payment based on the information on 2019 or 2020 tax returns. This credit will be reconciled on the 2021 tax return. Taxpayers who are married to undocumented residents will be able to receive the stimulus payments. If your client has changed to income, dependencies, or filing status, it may be advantageous to file before/after these payments are issued.

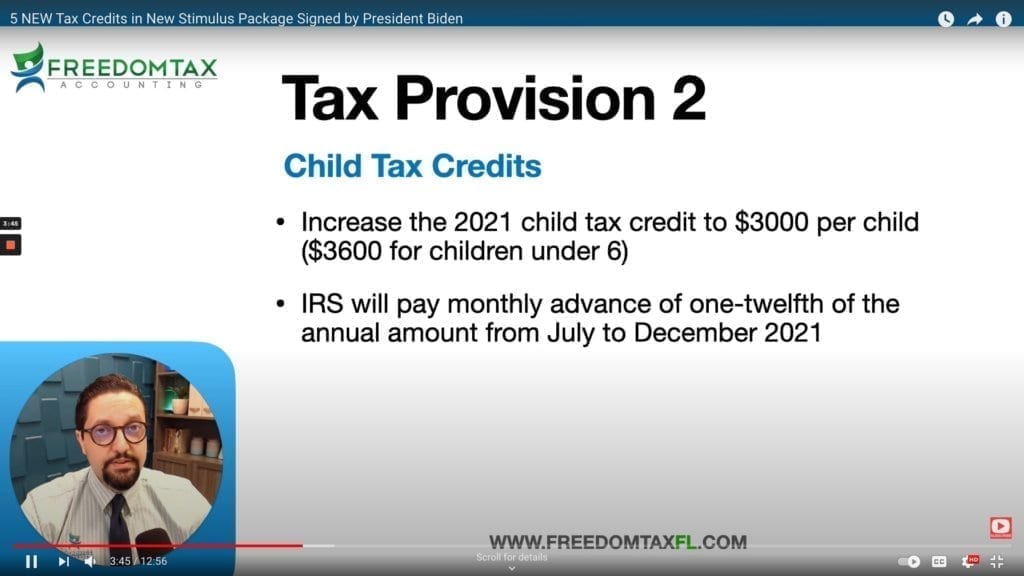

Child tax credit

Special rules for 2021 include an expansion of the credit from $2,000 to $3,000 per eligible child under age 18 ($3,600 per child under age 6). The fully refundable credit, with 50% of the credit issued as advance periodic payments starting in July, will be reconciled on the 2021 tax return. For 2021, the increased credit amount (additional $1,000 or $1,600 per-child in excess of the present-law $2,000 per-child) begins to be phased-out at $75,000 ($150,000 for MFJ and surviving spouse and $112,500 for head of household). Once the increased credit amount is reduced, the credit plateaus at $2,000, and the phaseout begins at $200,000 ($400,000 for MFJ).

Starting in July, the Treasury will issue advance payments of the child tax credit based on 2019 or 2020 tax return information. The Treasury is tasked with establishing an online portal to allow taxpayers to opt-out of receiving advanced payments and provide information regarding changes in income, marital status and the number of qualifying children for purposes of determining each taxpayer’s maximum eligible credit.

Earned income credit

For 2021 only, the bill expands the eligibility and the amount of the earned income credit (EIC) for taxpayers with no qualifying children. The maximum credit amount for childless people will increase from $543 to $1,502. For 2021, taxpayers can use their 2019 income if it was higher than 2021.

Video Transcript

President Biden just signed the new stimulus package and with it, there are many new tax credits and tax provisions; that’s what we’re going to talk about in this video.

Hello, from Freedom Tax Accounting, we’re an accounting firm, where we have been providing quality tax and accounting services now for over 20 years. If you’re new to this channel, we provide strategies for small business owners so they can achieve their financial goals. Today is March 11th, and we’re going to bring you some good information coming out of the new stimulus bill that was just signed a couple of minutes ago by President Biden, and how it will affect and help in your taxes okay.

Now I said, the new stimulus package has just been signed by president Biden. The name of the stimulus package is called, “The American Rescue Plan Act”. With it he is approving $1400 per eligible individual and dependents. According to the new stimulus bill, people should start seeing this stimulus payments as soon as this weekend; so that’s pretty fast. Also, he has extended the unemployment benefit of $300 per week through September 6 of 2021.

Now among a lot of things that are included in this new stimulus bill, it does have several tax items. So, we are going to discuss five of the new tax provisions that are included in the new stimulus bill; three of them are for individuals and two of them are for small business owners and even for self-employed. And stick around to the last one, because we feel that the last one that we’re going to discuss, has the biggest impact on small businesses to get additional funding, and get them through this coronavirus pandemic okay.

Now the first tax provision that we are going to discuss is tax-free unemployment benefits. Basically, the act makes, the first $10,200 of unemployment benefits tax-free for the tax for the unemployment benefits that you received in 2020; that’s for taxpayers making less than $150,000 per year. So, why did they have to do this? Because in 2020 a lot of individuals got unemployment benefits, but a lot of them did not know that they had to pay taxes on those unemployment benefits income. So, now when they filed their 2020 tax return, they got a surprise tax bill. So, now they’re going to make the first $10,200 of unemployment benefits that you received in 2020 tax free. So, that means that if you have already filed your 2020 tax return and you received unemployment benefits in 2020, you may have to amend your tax return. We still have to wait for guidance from the IRS to see how they’re going to handle this item. But I’m pretty sure the IRS will not automatically make the change for you. We’re pretty sure that the IRS is going to say that, you are going to have to amend your file 2020 return to get the extra tax credits for the unemployment benefits that you received in 2020 okay.

So, the second tax provision that was included in this new stimulus bill was an increased child tax credit okay. The current child tax credit is up to $2000, that is being increased to $3000 per child and $3600 per children under six.

Now important to note that:

This increased child tax credit is for 2021. Okay remember that now we are filing the 2020 personal tax returns, so this child tax credit you cannot get it when you file your 2020 tax return. Okay, now what does this mean? So, this means that for 2021 this is the child tax credit of $3000, so you can claim it when you do your 2021 taxes next year. But what the government is going to do is that they’re going to give you an advance on this tax credit. How? Starting July, from July to December of this year, you’re going to get 1/12th of the credit and the IRS will pay you on a monthly basis. For example, let’s say that your child does qualify for the $3000 tax credit, if you divide 3000 by 12 that’ll means $250. So, starting July the IRS will deposit in your account $250 on a monthly basis from July to December; so that’s six months. So, the IRS is going to give you six months advance on the child tax credit. So, that means if you take $250 in six months that’s $1500 that you got in advance from this child tax credit; so, the remaining $1500 to complete the 3000 you can claim it when you do your 2021 tax return next year okay.

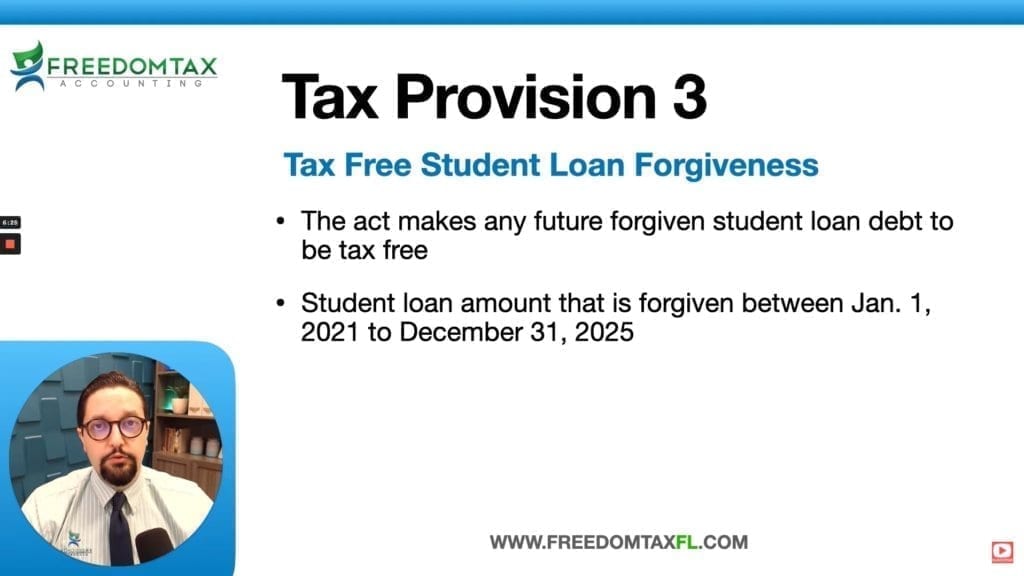

Now the third tax provision that was included in this new stimulus package is, tax-free student loan forgiveness okay. Remember, if you have been following the news this president is under a lot of pressure to forgive student loans. Now we still don’t know if they’re going to forgive $10,000 or $50,000 in student loans. The thing is, the IRS law says, “Any forgiven debt is now considered taxable income”. So, to prevent this from happening, they’re putting this change in effect now, so that any future student loan debt that is forgiven before December 31st of 2025 does not have to pay taxes okay. So, this is a good foundation in order to move forward with future student loan forgiveness okay.

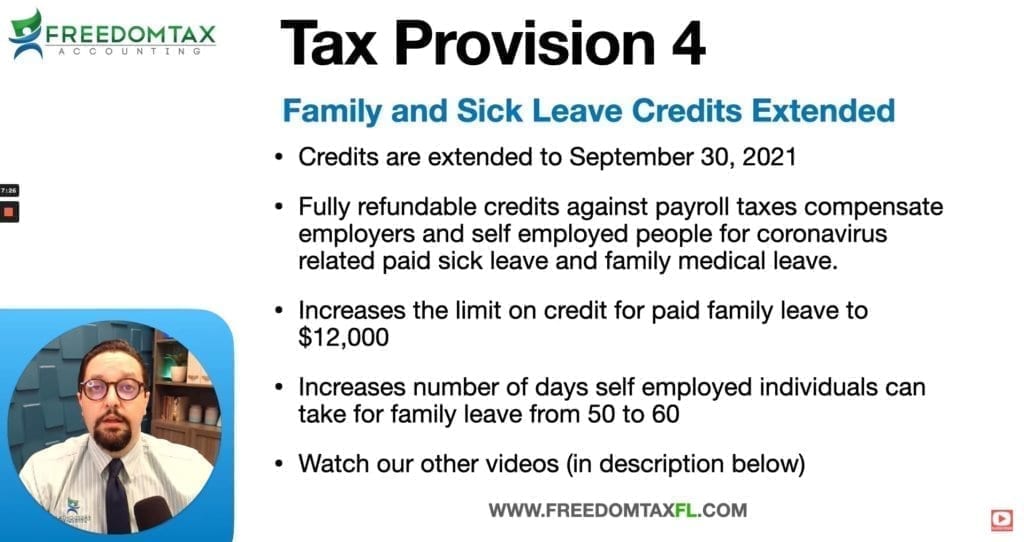

Now we’re going to talk about the last two tax provisions, and these apply for small businesses and self-employed okay. So, the fourth tax provision that once again, can be used by small business owners, employers and self-employed is, the extended family and sick leave credits okay. These were supposed to expire by the end of March, so now they have been extended an additional two quarters to the end of September 2021 okay. Remember that this is a fully refundable payroll tax credit that you can get. For example, if you’re an employer and you have employees that get sick with covid or that they have family members that are sick with covid and they cannot work, you can pay them their sick leave, but then the government is going to give you a refund of on those wages that you paid your employee that had to go to get better for covid or take care of a family member for covid. And this also applies for self-employed okay.

If you don’t know how these sick leave credits work, in the description of this video, we are going to put links to past videos that we did, so you know exactly how to get this sick leave credits okay.

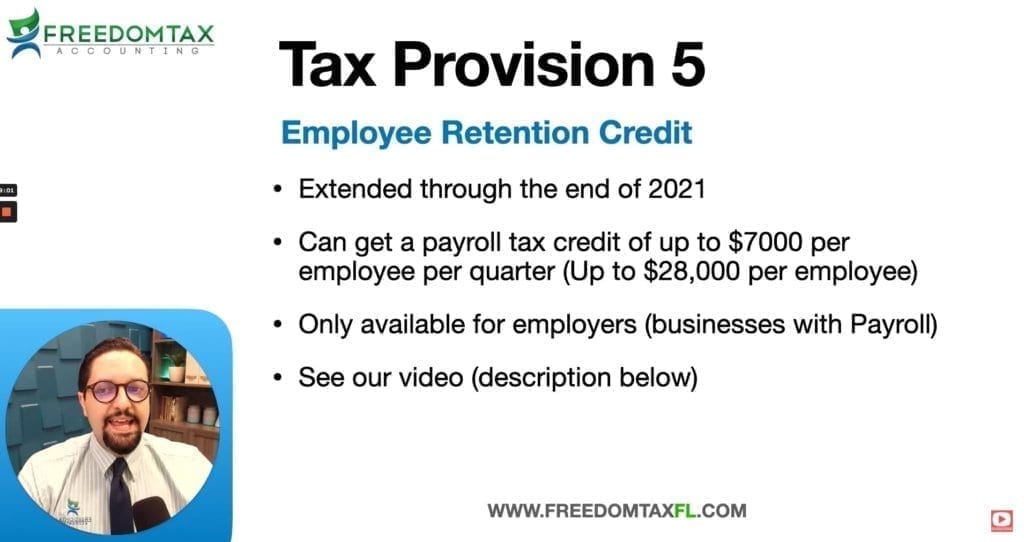

Now the fifth provision which only applies to employers and we feel this is a huge help for employers- employers meaning, businesses that have employees on payroll and they give them a w-2 okay- is that they have extended the employee retention tax credit to the end of 2021. This means thousands and thousands of dollars believe me four small four small businesses that they can get this payroll tax credit now extended till the end of the year okay. Remember this credit already existed in 2020. And if you have seen our videos all the way back from 2020, you know that in April and May of last year, we were saying that this credit for some employers was a better deal than the PPP okay. But since most businesses the PPP was a better deal, the employee retention credit did not get as much publicity because in 2020 you could not have both. You had to choose either to get PPP or get the employee retention credit. But that changed in December where now you can get both. You can get PPP and you can get the employee retention tax credit; you can get it retroactive 2020, and now it has been extended to 2021.

Remember, you can get up to 5,000 credit per employee for 2020, but now for 2021 it’s up to $7000 per employee per quarter. So, that means that your business can get a payroll tax credit of up to $28,000 per employee. So, there’s a lot of help here. We have been helping our clients with this, and we have been able to get them thousands and thousands of dollars. So, if your CPA is not helping you with this, please call us have a consultation because most likely if you have people on payroll you may apply to get this employee retention tax credit okay. And once again, we are going to put links in the description of this video so you know exactly how this credit works okay.

So, other than these tax provisions, there are many other tax provisions; the retroactive advanced premium tax credit; expanded earned income credit; enhanced child and dependent care assistance. So, there’s a lot of tax help. The thing is, that you do not lose out in all these tax credits that are available for you. So, make sure that you take advantage of all the tax credits that you are eligible for. So, make sure that you are working with a tax professional that can help you get as much as possible in these new tax credits, and that’s why we are here. We are helping our clients get the best tax credit that are available right now. This is our contact information. You can visit our website at freedomtaxfl.com. And if you need help with your personal taxes or your corporate taxes. We can do personal and business taxes in all 50 states okay.

Now remember that we are part of Freedom Group, we are a group of four companies where we do tax accounting, immigration, real estate, insurance, financial planning. So, we can help you in many ways.

This is our contact information:

- Address: 1016 E Osceola Parkway, Kissimmee, 34744, Florida, United States

- Telephone: 407-502-2400

- E-mail: [email protected]

And remember that we are part of Freedom Group, we are a group of four companies where we do tax accounting.

So we can help you in many ways.

Thank you for watching this video. Remember to subscribe to this channel and if you have received value out of this information like this video and share it with someone that can take advantage of this information.

#newstimuluspackage #bidenstimuluspackage #stimulusbill #covid19taxcredits

Subscribe to my channel

Subscribe to my channel