PPP Loan Increase for Self Employed, Independent Contractors and Sole Proprietors

SBA announced a PPP loan increase for self-employed, independent contractors and sole proprietors. Providing a way to get a higher PPP loan amount. The Paycheck Protection Program also had 4 more changes done by the Biden Administration.

Visit our website – https://freedomtaxaccounting.com/

DISCLAIMER This video is intended for educational purposes and should not be taken as legal or tax advice. You should consult with your financial professionals about your unique financial situation before acting on anything discussed in these videos. Freedomtax Accounting and Multiservices Inc. are providing educational content to help small business owners become more aware of certain issues and topics, but we cannot give blanket advice to a broad audience. Freedomtax Accounting and Multiservices Inc. or its members cannot be held liable for any use or misuse of this content.

President Joe Biden on Monday announced a series of changes to the Paycheck Protection Program designed to make the program more accessible to underserved borrowers, including a two-week period during which only businesses with fewer than 20 employees can apply for loans.

The effort builds on several recent changes and comes after criticisms that the program’s $659 billion first round last year benefited larger, more affluent and connected businesses at the expense of the disadvantaged businesses for which it was designed.

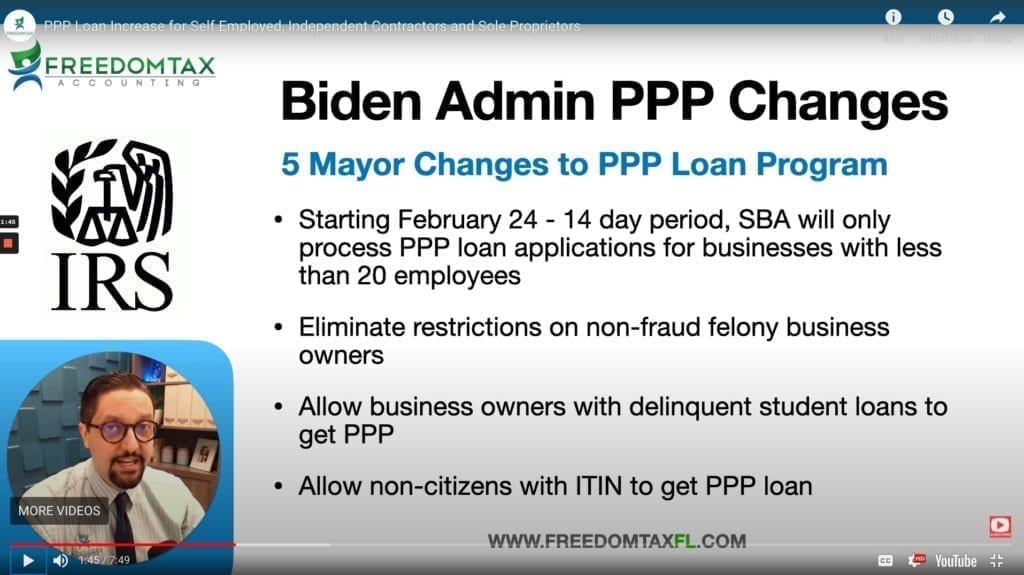

The five changes announced Monday, February 22, 2021:

- Starting Wednesday, only businesses with fewer than 20 employees can apply for loans for a two-week period.

- The way loans are calculated will be revised so businesses without employees get more relief. The previous calculation — based on payroll — made the program ineffective for sole proprietors and independent contractors, including many businesses of color. The Biden administration also will set aside $1 billion in PPP loan funds for businesses without employees in low- and moderate-income areas.

- The elimination of an exclusion that prevents business owners with non-fraud felony convictions from accessing the program.

- The elimination of an exclusion that prevents business owners who are delinquent on federal students loans from accessing the program.

- Non-citizen small-business owners who are lawful U.S. residents will be able to apply for loans using individual taxpayer identification numbers.

Video Transcript

Hello from FreedomTax Accounting, we’re an accounting firm where we have been providing quality tax and accounting services now for over 20 years. Good news for self-employed independent contractors’ sole proprietors that got PPP or will get PPP. Apparently, you’re going to get a higher PPP loan amount and we are recording this video on February 23 and we always emphasize the date on the recording on any video relating to the PPP loan program, because this program is constantly changing. So that means that there may be things in this video, that may change as soon as tomorrow. So that’s the importance of subscribing to our channel. So that way, you’re always up to date with the most current and correct information regarding these SBA loans. Now, yesterday, the Biden administration announced that they’re making five major changes to the PPP loan program.

The first one is that starting Wednesday, February 24, the SBA is going to have a 14-day period where they will only process PPP loan applications for businesses that have less than 20 employees, meaning that smaller businesses are going to get in front of the line.

So basically, the administration is trying to secure PPP funding for smaller businesses, they’re also going to eliminate restrictions on non-fraud felony business owners that they will now be able to apply for loans. Also, business owners that have delinquent student loans will also be able to apply for PPP loans and non-citizens with a tax ID number and ITN number will also be able to apply for the PPP loan. But the biggest news, especially for self-employed individuals, is that the way the SBA determines your PPP loan amount is going to change and that change is going to result in that you will get a higher PPP loan amount.

So, let’s go now to Schedule C to discuss the change. Now, if you know the PPP loan formula rules for Schedule C, you know, this is your schedule C, you know yet you had to go to line 31, which is your net profit, and whatever. So, on line 31, you needed to divide by 12 and multiply by 2.5. I remember that line 31 into your net profit, meaning that you have your gross sales, then you have all your expenses and whatever’s left is line 31 example, you have $100,000 in sales, you have $80,000 in expenses, you get $20,000 in net profit, right? So let’s do the math. Let’s say that here, we have $20,000. net profit, which means that with the old formula, you would have received a PPP loan of 4136 66. All right, but once again, let’s go back to the top and let’s say that you had $100,000 gross sales.

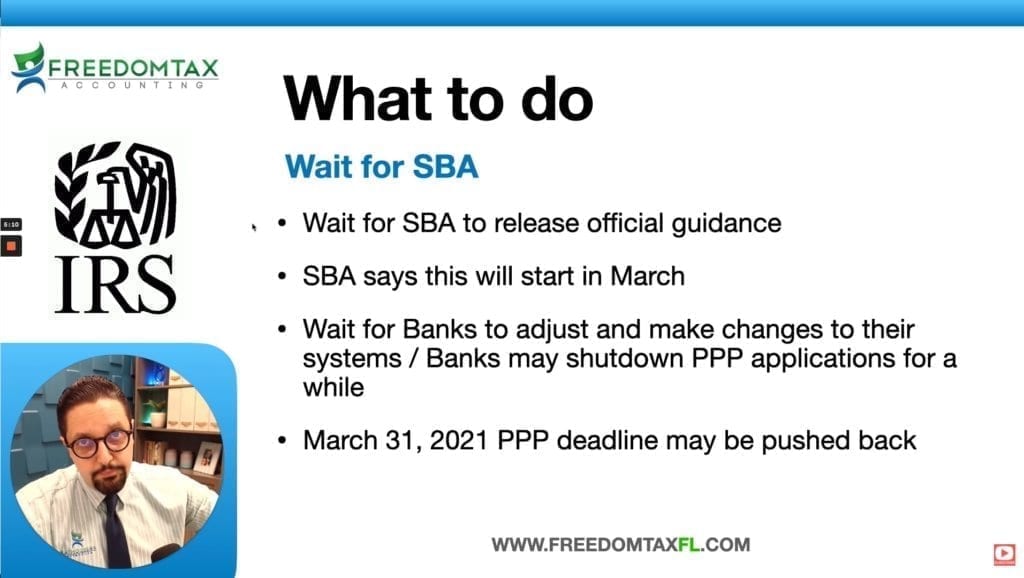

And also, maybe here in line seven, okay? because realistically, we still don’t know if they’re going to use line one or line seven to do the calculation, we feel they’re going to use line seven, right? And you’re only able to use $100,000 for this calculation, meaning that if your line seven says $130,000 online one says $130,000 for the formula, you can only use $100,000. But now let’s say that it says 130. So now the new PPP loan amount will be $100,000 divided by 12 multiplied by 2.5. That’s 20,008 33. That’s a big change. Because in the old method using line 31, we only got around $4,000. Now we’re getting 20,008 33. That is a huge increase. Right. So that’s the change that’s coming for this schedule see business owner that is going to apply or has already applied for the PPP loan. Now what do we need to do now basically, we have to wait for the official release of this guidance. There’s a lot of details we need to know, for example, are we going to use line one? Are we going to use line seven? Is are people who already apply for PPP? How are they going to apply to get the difference? Are they able to use 2019 and 2020? schedule? See, we need to wait for those details. The SBA has said that this change will start in March. But once they release this guidance will still, I think that we’re going to have to wait for the banks to adjust and make changes to their systems. Because remember, that PPP loan application is through the bank.

So, we may see that basically, the banks may say, we’re going to shut down the PPP portal in order for us to make the changes in the system and open it up further down the line. So, this may be mid-March. This is just us speculating. But basically, we feel that this basically obligates the SBA to push back the march 31st, PPP, that line that is currently determined in this round of PPP. According to the SBA, the PPP loan program will end March 31. But with these changes, we really feel that they’re going to have to push this deadline back. So, for now, the only thing we can do is wait, we need to wait for further guidance. There’s no way to apply. There’s right now there’s no way to apply for the increase. We need to wait for the SBA to bring the final official rules, and then maybe we’re going to have to wait for the banks to adjust their system.

Thank you for watching this video. Remember, it is tax season, and we are a full-service accounting firm. We are authorized by the federal government to prepare personal tax returns and business tax returns for individuals and businesses that are located in any of the 50 US states.

So this is our contact information:

- Address: 1016 E Osceola Parkway, Kissimmee, 34744, Florida, United States

- Telephone: 407-502-2400

- E-mail: [email protected]

And remember that we are part of Freedom Group, we are a group of four companies where we do tax accounting.

So we can help you in many ways.

Thank you for watching this video. Remember to subscribe to this channel and if you have received value out of this information like this video and share it with someone that can take advantage of this information.

Thank you for watching. God bless you. Bye-bye.

#pppselfemployed #pppincrease #ppp #pppupdate #pppchanges

Subscribe to my channel

Subscribe to my channel