Biden Makes 5 Changes to PPP Loan Program

On February 22, 2021 the White House announced that the Biden Administration was going to make 5 key changes to the PPP loan program. These changes will help small business owners get the PPL loan faster and may even get a Paycheck Protection Program Loan increase.

Visit our website – https://freedomtaxaccounting.com/

White House Announcement Link – https://www.whitehouse.gov/briefing-r…

DISCLAIMER

This video is intended for educational purposes and should not be taken as legal or tax advice. You should consult with your financial professionals about your unique financial situation before acting on anything discussed in these videos. Freedomtax Accounting and Multiservices Inc. are providing educational content to help small business owners become more aware of certain issues and topics, but we cannot give blanket advice to a broad audience. Freedomtax Accounting and Multiservices Inc. or its members cannot be held liable for any use or misuse of this content. T

The Biden-Harris administration is announcing several reforms to build on this success by further targeting the PPP to the smallest businesses and those that have been left behind in previous relief efforts.

Institute a 14-day period, starting Wednesday, during which only businesses with fewer than 20 employees can apply for relief through the Program. 98 percent of small businesses have fewer than 20 employees. They are Main Street businesses that anchor our neighborhoods and help families build wealth. And while the Biden-Harris administration has directed significantly more relief to these smallest businesses in this round of PPP than in the prior round, these businesses often struggle more than larger businesses to collect the necessary paperwork and secure relief from a lender. The 14-day exclusive application period will allow lenders to focus on serving these smallest businesses. The Biden-Harris administration will also make a sustained effort to work with lenders and small business owners to ensure small businesses take maximum advantage of this two-week window.

FACT SHEET: Biden-Harris Administration Increases Lending to Small Businesses in Need, Announces Changes to PPP to Further Promote Equitable Access to Relief

Help sole proprietors, independent contractors, and self-employed individuals receive more financial support. These types of businesses, which include home repair contractors, beauticians, and small independent retailers, make up a significant majority of all businesses. Of these businesses, those without employees are 70 percent owned by women and people of color. Yet many are structurally excluded from the PPP or were approved for as little as $1 because of how PPP loans are calculated. To address this problem, the Biden-Harris administration will revise the loan calculation formula for these applicants so that it offers more relief, and establish a $1 billion set aside for businesses in this category without employees located in low- and moderate-income (LMI) areas.

Consistent with a bipartisan bill, eliminate an exclusionary restriction that prevents small business owners with prior non-fraud felony convictions from obtaining relief through the Paycheck Protection Program. Currently, a business is ineligible for PPP if it is at least 20 percent owned by an individual who has either: (1) an arrest or conviction for a felony related to financial assistance fraud within the previous five years; or (2) any other felony within the previous year.

Eliminate an exclusionary restriction that prevents small business owners who are delinquent on their federal student loans from obtaining relief through the Paycheck Protection Program. Currently, the PPP is not available to any business with at least 20 percent ownership by an individual who is currently delinquent or has defaulted within the last seven years on the federal debt, including a student loan.

Ensure access for non-citizen small business owners who are lawful U.S. residents by clarifying that they may use Individual Taxpayer Identification Numbers (ITINs) to apply for relief. The PPP statute is clear that all lawful U.S. residents may access the program, but a lack of guidance from the SBA has created inconsistency in access for ITIN holders like Green Card holders or those here on a visa.

Video Transcript

Hello from freedom tax accounting, we are an accounting firm where we have been providing quality tax and accounting services now for over 20 years. Breaking news coming from the White House today, February 22. The biting administration is making five key changes to the PPP loan program. So that’s what we’re going to talk about in this video. So earlier today, the White House made a press release, announcing that the Biden administration is making changes to the PPP loan program. Now, what are those five changes? This is the official statement coming from the White House. And we are going to provide a link to this official White House statement in the description of this video. So basically, the five changes that the binding administration is going to make to the PPP long program is the following the first, they are going to start a 14-day period starting this Wednesday, this what it says here, see 14-day period starting Wednesday, during which only businesses with fewer than 20 employees can apply to the PPP program. So that will give smaller businesses, they’re going to bring them further up the line to apply for PPP loans.

So, this will help the small business owner. So that’s the first change. The second change, which is super big. The Binding administration is changing the way sole proprietors, independent contractors, and self-employed individuals receive more financial support. Now how are they proposing to do that, they’re going to change the way that PPP loan is calculated. If you are sole proprietor, independent contractor, and self-employed.

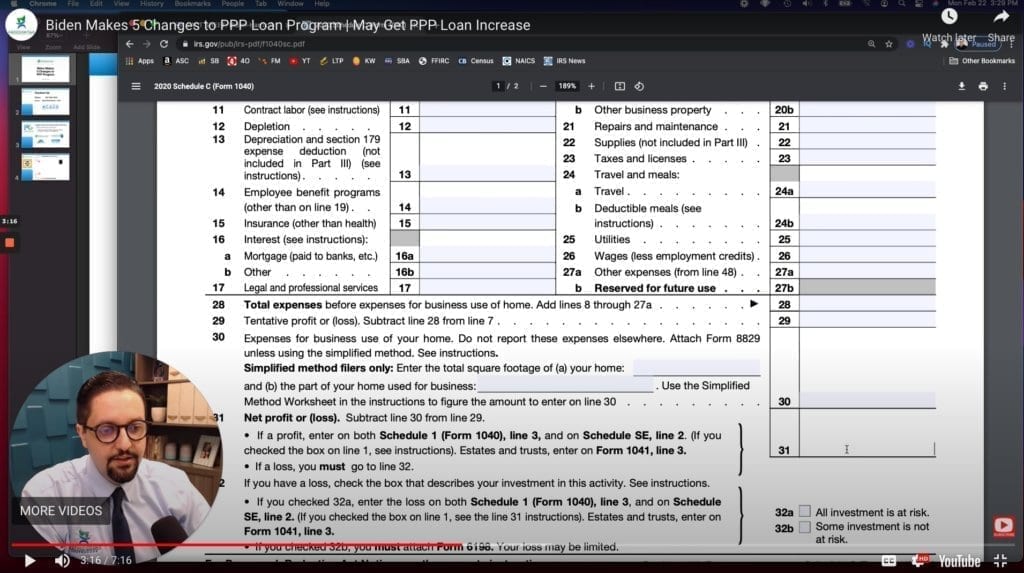

Let’s see what the change is. If you remember, PPP one or PPP do right now, you go to your schedule C and you go down to line 31, which is your net profit, this you divide by 12. And then you multiply by 2.5. And that’s how you know your PPP loan amount. The proposed change is the following that PPP for self-employed independent contractor sole proprietors will not be based on line 31. They will be based online on your gross receipts or sales. That’s a huge change. Now it’s up to $100,000. But This means that anyone who follows a Schedule C and got PPP can now ask for more. For example, let’s say that you had a Schedule C that had $90,000. Inline number one, this was your total sales, then you had all your deductions, and then on line 31, you had $30,000 net profit. So, if you applied for PPP with this, let’s do the numbers, you take $30,000 divided by 12. Multiply that by 2.5, you get a PPP of $6,250. But now you don’t do the formula with line 31. You do the same formula with line number one, meaning you take $90,000 divided by 12 multiplied by 2.5 you get $18,750 which means that you’re going to get $12,500 more in PPP loan.

That’s super huge and a big difference for self-employed individuals. Now we need to wait for further guidance from the SBA. But what the White House is saying is that if you’re a self-employed independent contractor, sole proprietor and you got PPP one, you can now reapply with your bank to get the additional funds with this new formula. So, if this is true, then the SBA will come out with guidance pretty soon and the banks will need to make adjustments. Remember this reapplication process will need to go through your bank that you got PPP so that’s that is a huge help now for self-employed individuals. Okay, now the third change, in the past, if a business owner had a non-fraud felony, they could not apply for PPP, they’re taking that out. If one of the business owners had a non-fraud felony, now they can apply for PPP. Also, in the past, if a business owner had delinquent federal student loans, they could not apply for PPP.

Now they can. And the fifth change is that they’re going to open up the PPP program for non-citizens who have an ITIN number. So, if you are a non-US citizen, but have an Individual Taxpayer Identification Number, and you’ve and you have a small business, you can now apply for PPP as well. These are major changes to the PPP loan program, especially for self-employed individuals who are going to get a huge amount of increase in PPP funds. So now, for now, we just have to wait for SBA guidance and wait for the banks to implement this new system. Okay. But this is coming directly from the White House. So, it shouldn’t take long for the SBA to catch up and for the banks to then change their systems to start this real application process.

thank you for watching this video. Remember, it is tax season, and we are a full-service accounting firm. We are authorized by the federal government to prepare personal tax returns and business tax returns for individuals and businesses that are located in any of the 50 US states.

So this is our contact information:

- Address: 1016 E Osceola Parkway, Kissimmee, 34744, Florida, United States

- Telephone: 407-502-2400

- E-mail: [email protected]

And remember that we are part of Freedom Group, we are a group of four companies where we do tax accounting.

So we can help you in many ways.

Thank you for watching this video. Remember to subscribe to this channel and if you have received value out of this information like this video and share it with someone that can take advantage of this information.

Thank you for watching. God bless you. Bye-bye.

#ppp #bidenpppchanges #bidenppp #ppploan

Subscribe to my channel

Subscribe to my channel