Form 4506-T Instructions for SBA EIDL Loan, Covid-19 EIDL Grant, or SBA EIDL Reconsideration

Step by step instructions on how to fill out IRS Form 4506-T for the SBA EIDL Loan, Grant, or Reconsideration. Learn how to complete Form 4506-T for the SBA EIDL Loan Program.

DISCLAIMER This video is intended for educational purposes and should not be taken as legal or tax advice. You should consult with your financial professionals about your unique financial situation before acting on anything discussed in these videos. Freedomtax Accounting and Multiservices Inc. is providing educational content to help small business owners become more aware of certain issues and topics, but we cannot give blanket advice to a broad audience. Freedomtax Accounting and Multiservices Inc. or its members cannot be held liable for any use or misuse of this content.

Instructions for Completing the IRS Tax Authorization Form 4506-T SBA requires you to complete the IRS Form 4506-T as a part of your disaster loan application submission. The form authorizes the IRS to provide federal income tax information directly to SBA.

Although the form is available online, it cannot be transmitted electronically. The IRS Form 4506-T must be completed and submitted with each SBA disaster loan application, even if you are not required to file a federal income tax return.

A separate IRS Form 4506-T must be returned with the SBA disaster loan application for:

(1) each disaster loan applicant (individuals filing joint returns may use a single IRS Form 4506-T)

(2) each corporation or partnership in which the disaster loan applicant holds a 50% or greater interest

(3) each individual or entity which holds a 20% or greater interest in the disaster loan applicant

(4) each general partner

(5) each affiliate business.

Video Transcript

Hello from FreedomTax Accounting. We’re an accounting firm where we have been providing quality tax and accounting services now for over 20 years. We wanted to do this tutorial video because there are a lot of businesses that have applied either for the EIDL Laon, the EIDL grant, the EIDL Loan rate consideration and the SBA is requesting the form 4506T from these business owners. And we just wanted to show you how to do this form.

So basically what is form 4506T? It is a form from the IRS. It is not a form from the SBA and it’s an IRS form that is used to request tax information or your tax return transcript from the IRS from current or prior years.

The SBA or other financial institutions usually ask for this document because now they can take this form. They can send it to the SBA and the IRS is going to send them your tax transcript because now they want to confirm your income and they want to confirm the information that you put the EIDL Loan application and the SBA is not the only agency that uses this.

For example, when you’re going to buy a new home, usually the title company or the mortgage company, the loan mortgage company request this form because you have provided them with your income and financial information, but now they want the information directly from the IRS, just to make sure that the information that you have provided is accurate.

So the same thing the SBA is doing with business owners that are applying for the EIDL loan, the reconsideration, the EIDL grant, because remember you have filled out an EIDL loan application, and realistically the SBA has not asked for any documentation. So now the SBA says, okay, “you provided this information about your income, your business income”

So now we just want to tell the IRS to send us your IRS transcript so they can confirm that the information you have provided in the application is accurate and the SBA started doing this because they were under a lot of scrutinies from the office of the attorney general, because of all the fraud that has been going around, especially with the EIDL grant.

The first thing you have to do is put “name shown on your tax return”. Now, if you are working on a business, for example, if you’re working on the right corporation or an LLC, here you go. You’re going to put the LLC name per sample, LLC.

But if you’re a self-employed independent contractor and you’re not working on there, a business here, you’re going to put your personal name. Okay. So for example, me Carlos, if I’m self-employed and I’m going to fill this out, I’m going to put my name. On box one a. Now, if I fill out my tax returns joint with a married jointly, then I also need to put the information of my spouse.

You do not have to put your spouse’s name if you’re working on an LLC or a corporation. So here you put your business name or your name. On this line, either you put your social security number. If you’re, if you’re a self-employed or independent contractor, and you’re now working under an LLC or a corporation, you put the social.

If you are working under an LLC or a corporation here, you’ve put your EIN number. Now, you have to put your spouse’s information here. You put your spouse’s social security number here. You’re going to put your current name and address that’s where your business is now or where you are operating as a self-employed individual. Your home, current address if the current address is different from the address that’s on your prior year’s tax return, then the prior year’s address you put on line 4.

Customer file number, you live in the blank. And then on number 6 is the transcript requested. Now, if you’re a self-employed independent contractor, a single member, LLC, basically any business that filed their business return on a schedule C here you need to put the 1040.

Okay, because remember the schedule C is inside your 1040 personal tax return. So that’s what they are requesting. Now, if you are a C corporation, then you put here the 1120 because your corporation that files us a C corporation files their business taxes under the 1120 form. If you are an S corporation then you put here 1120S because that’s the form that you report your business income with.

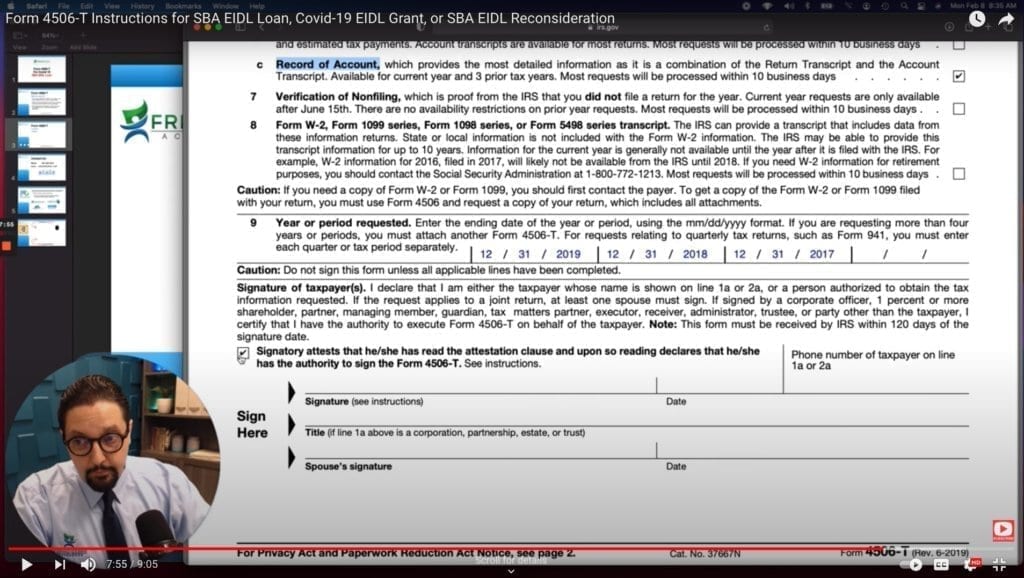

So here you scroll down and basically, you go to see and you check this box, which is C because this is the request that has more information about your case. So you take C you check that because that’s the records that the SBA wants to look at. You continue going down and on 9 it’s the years that you want the IRS to send the SBA. Now the SBA currently is requesting three years of tax transcripts. So basically you have to put here three years of the last day of the tax year. For example, now we put December 31st of 2019, and the second year is December. 31st 2018. And the third year is December 31st of 2017.

Why? Because this is the last day of that tax year. So that’s the way you put the three years that the SBA is requesting. You check this Mark right here. That means that you’re assigning and you’re unauthorized site sign here. You put your signature, the date, your phone number, your title, you can put owner.

And if you are requesting also your spouse’s information, you put your spouse’s signature and the date and that’s basically it. And then you print it out and send it to the SBA agent. Has you can see it’s a pretty simple form. Remember that we are a full-service tax accounting firm.

We are in tax season and we are authorized to help individuals and businesses in any tax-related issue and work for individuals and businesses that are located in any of the 50 U.S States. If you want a consultation on any PPP, EIDL loan, employee retention, credit consultation. We are providing consultations as well.

So this is our contact information:

- Address: 1016 E Osceola Parkway, Kissimmee, 34744, Florida, United States

- Telephone: 407-502-2400

- E-mail: [email protected]

And remember that we are part of Freedom Group, we are a group of four companies where we do tax accounting.

So we can help you in many ways.

Thank you for watching this video. Remember to subscribe to this channel and if you have received value out of this information like this video and share it with someone that can take advantage of this information.

Thank you for watching. God bless you. Bye-bye.