NO SBA EIDL Loan Payments Until 2022 – SBA Extends Deferment Period for COVID 19.

The U.S. Small Business Administration announced extended deferment periods for all disaster loans, including the COVID-19 Economic Injury Disaster Loan (EIDL) program, until 2022.

DISCLAIMER

This video is intended for educational purposes and should not be taken as legal or tax advice. You should consult with your financial professionals about your unique financial situation before acting on anything discussed in these videos. Freedomtax Accounting and Multiservices Inc. is providing educational content to help small business owners become more aware of certain issues and topics, but we cannot give blanket advice to a broad audience. Freedomtax Accounting and Multiservices Inc. or its members cannot be held liable for any use or misuse of this content.

SBA Extends Deferment Period for all COVID-19 EIDL and Other Disaster Loans until 2022

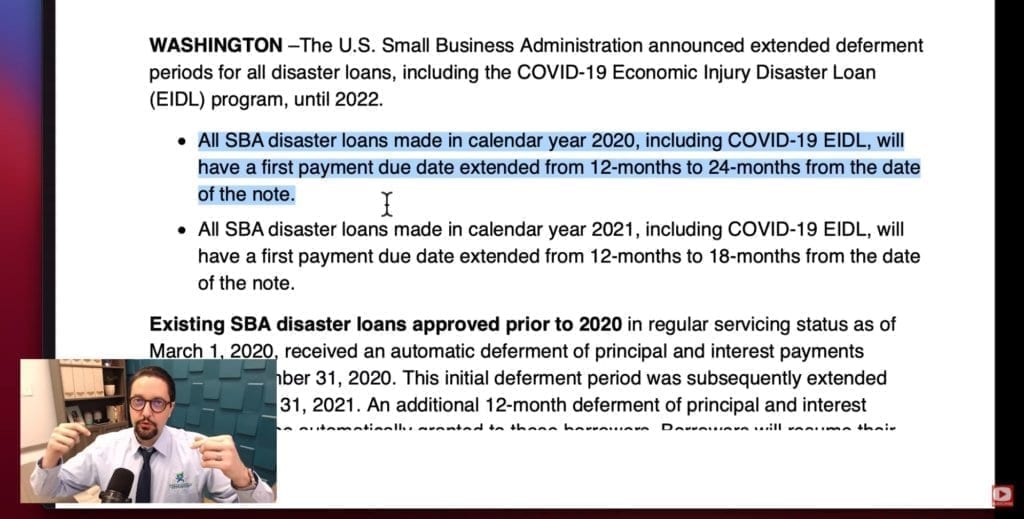

All SBA disaster loans made in the calendar year 2020, including COVID-19 EIDL, will have the first payment due date extended from 12-months to 24-months from the date of the note.

All SBA disaster loans made in the calendar year 2021, including COVID-19 EIDL, will have the first payment due date extended from 12-months to 18-months from the date of the note.

Existing SBA disaster loans approved prior to 2020 in regular servicing status as of March 1, 2020, received an automatic deferment of principal and interest payments through December 31, 2020. This initial deferment period was subsequently extended through March 31, 2021. An additional 12-month deferment of principal and interest payments will be automatically granted to these borrowers. Borrowers will resume their

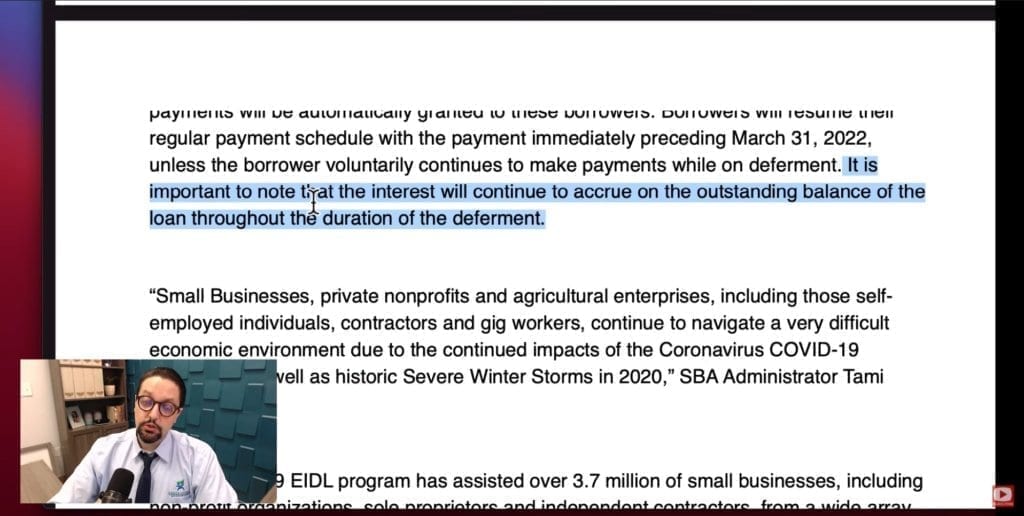

regular payment schedule with the payment immediately preceding March 31, 2022, unless the borrower voluntarily continues to make payments while on deferment. It is important to note that the interest will continue to accrue on the outstanding balance of the loan throughout the duration of the deferment.

“Small Businesses, private nonprofits and agricultural enterprises, including those self-employed individuals, contractors and gig workers, continue to navigate a very difficult economic environment due to the continued impacts of the Coronavirus COVID-19 pandemic, as well as historic Severe Winter Storms in 2020,” SBA Administrator Tami Perrillo said.

“The COVID-19 EIDL program has assisted over 3.7 million of small businesses, including non-profit organizations, sole proprietors, and independent contractors, from a wide array of industries and business sectors, through this challenging time,” continued Perrillo.

SBA continues to strive to make available all previously approved Coronavirus Pandemic stimulus funding and administer the new targeted programs related to provisions in the 2020 Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act (the Economic Aid Act) as quickly as possible.

“The American people and the nation’s Small Business owners need our tireless effort and dedication to get this essential funding to those in great need, and SBA will not rest until we implement President Biden’s “American Rescue Plan” and its’ additional targeted programs and funds allocated for America’s small business and nonprofit communities,” said SBA Senior Advisor Michael Roth.

COVID-19 EIDL loans are offered at very affordable terms, with a 3.75% interest rate for small businesses and 2.75% interest rate for nonprofit organizations, a 30-year maturity. Interest continues to accrue during the deferment period and borrowers may make full or partial payments if they choose.

Video Transcript

Good news coming from the SBA:

If your business got an EIDL loan in 2020 from the SBA, you don’t have to start making payments until 2022. This just came out from the SBA newsroom. Let me share my screen. So, this was just released by the SBA basically saying, “SBA extends deferment period for all covert 19 EIDL and other disaster loans until 2022.”

Remember, the EIDL loan that you got from the SBA in 2020 had a 12-month deferral period. Meaning, that if you got the EIDL loan in May of 2020, you were supposed to start making your monthly payments on that loan in May of 2021. But now, you have until May of 2022 to start making the monthly payments on your EIDL loan okay.

So, let’s read directly from the news release it says, “All SBA disaster loans made in the calendar year 2020 including covid-19 EIDL, will have the first payment due date extended from 12 months to 24 months from the date of the note.” So, once again, you don’t have to start making your payments this year. You have to start making your payments next year in 2022. But remember, the EIDL loan is still available to the end of this year 2021, for all the businesses that did not get it in 2020 or if you have a business that has not received, has not applied for the EIDL loan, you can apply for this loan to the end of 2021.

So, if you get your EIDL loan now in 2021, the SBA is also going to extend the 12-month deferral period. See where it says here, “The SBA disaster loans made in the calendar year 2021 including covid-19 EIDL, will have a first payment due date extended from 12 months to 18 months.” So, it’s not 24 months, but at least it’s six months more than the original 12 months deferral period to start making payments on your SBA EIDL loan.

Now the question everyone is most probably is asking, what about the interest will they still accrue during this deferment? And the answer is yes. Look where it says, “It is important to note that the interest will continue to accrue on the outstanding balance of the loan throughout the duration of the deferment.” So, this is not that good of good news because the interest will keep accruing during this 24-month deferment period. But at least if your business is still struggling, and now in 2021, you don’t have to worry that you don’t have enough funds to start making your monthly EIDL payments to the SBA.

So, once again, I think this is good news and is going to help a lot of small business owners that have still not fully recovered from this pandemic now. They have one more year to get their business going again. But next year, apparently if nothing changes, you are going to have to start making these payments on your SBA loans.

So, once again, thank you for watching this video. Remember to subscribe to our channel, like and share this video with other business owners, so that they can take advantage of this information. Remember that in this channel, we provide strategies for small business owners, so they can achieve their financial goals. Remember, we’re praying for you, your business, and your family. So, let’s stay together, everyone. Let’s get through this coronavirus pandemic together, so that all of our businesses thrive. God bless you and have a great day everyone. Have a great weekend, bye.

#eidldeferment #eidl #eidlloan #eidlgrant #sba #sbaeidl

Subscribe to my channel

Subscribe to my channel