Got an ITIN number and, are scared you may have to face an audit this year? Do not worry. Audits can be avoided if you follow the rules and make sure there are no errors on your returns. Do not act over smart because the IRS is smarter than you, and they will figure it out. Yes, you have to follow all the rules but you also have to ascertain that you are not crossing any lines. For instance, your charitable donations must not to greater and your business expenses must not be too huge.

So which actions can lead to an audit? Here we present you with the most common situations in which the IRS is bound to catch you and single you out for an audit.

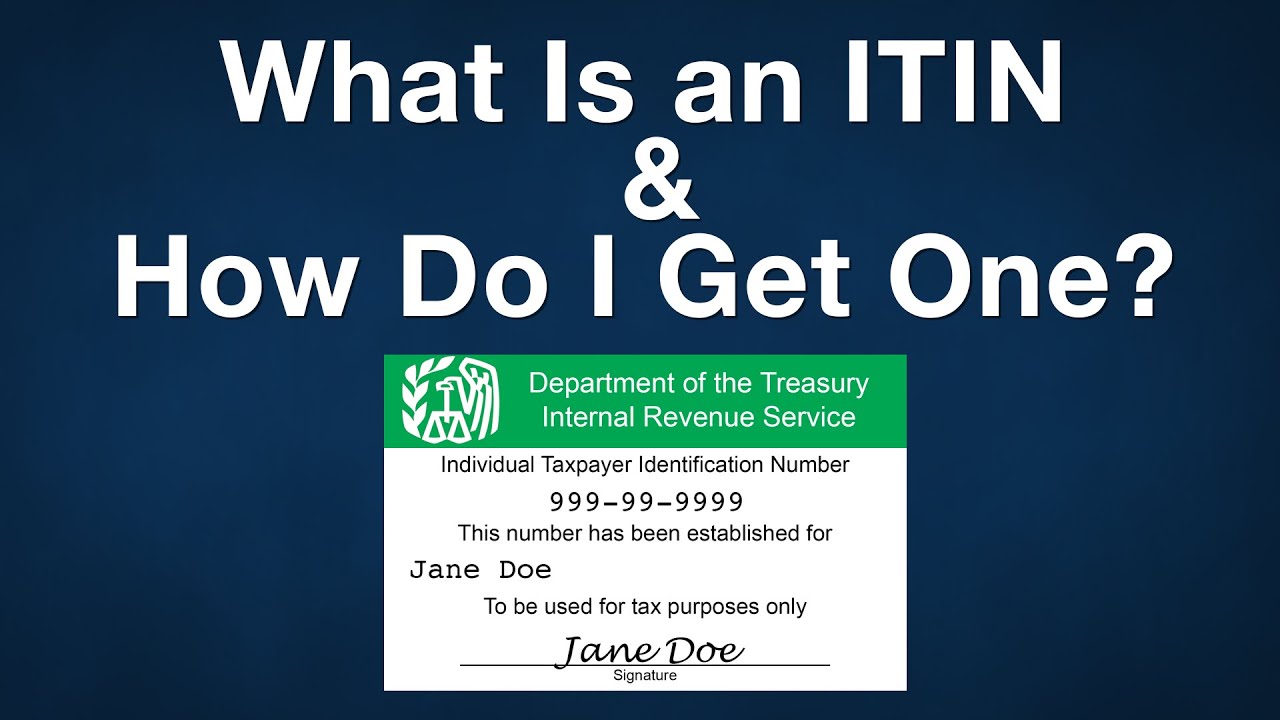

You enter incorrect social security or ITIN Number

The IRS identifies you with your social security number or your ITIN Number, whichever is applicable in your case. Make sure you are entering the correct one. Not doing so will delay your refund and you might even have to go through an audit if the IRS suspects you. And by the way, this is not just for your social security and ITIN Number, it also applies to your dependant’s details.

Your tax preparer is not qualified enough

In some cases, an audit is the mistake of the tax preparer. If he is promising you a huge refund and not even going through your documents, you cannot trust him with your taxes. The mistake may be of your chosen accountant, but you will have to suffer the consequences. And like we said, the IRS is smart and they can figure out all of these things. They handle millions of returns every year and it is not hard for them to realize which deduction is right and which is not.

So before you choose any tax preparer, ask them to show you credentials. Just as you are identified with your social security ITIN Number, they also have a tax preparer ID number.

You make a dumb mistake

This can be accidental but if you make a wrong mistake or perform an incorrect calculation, the IRS will go through your return again. If they become suspicious, they can nail you down especially if your income is in a higher bracket range.

So before you submit your return, check it again and again and make sure you have made no blunders of this sort.

You boast a lot

Yes, you should use deductions, but do not lie about them. Include them only if you have made that expense. And please do not forget to itemize these on Schedule A. So while you should donate, the amount should be something you can easily afford.

You did not file your return

Not filing your return is another mistake that you can make. If you are eligible, you have to file your taxes and pay them, or the IRS will be after you.

If you need more information about our accounting and tax services, please contact us at 407-502-2400. Freedomtax Accounting’s staff has been providing honest accounting services and tax services for 15 years. Our Orlando accounting and tax firm have its main offices in Kissimmee, FL. Our services are provided nationwide, but mainly in the Central Florida market to areas like Orlando, South Orlando, Kissimmee, St. Cloud, Poinciana, Clermont, Davenport, Hunters Creek, Lake Nona, Celebration, Winter Park, Windermere, Dr. Phillips, Maitland, Altamonte Springs, Winter Garden, Ocoee, Apopka, Belle Isle, Edgewood, and Oakland FL. Our tax accountants and IRS enrolled agents (IRS ea) specialize in corporate accounting and bookkeeping, tax services, tax preparation, back taxes help, tax debt relief, tax resolution, tax planning, ITIN number, incorporations, and nonprofit 501c3 tax-exempt.

Post comment

You must be logged in to post a comment.