As the tax season swings into full gear, the flurry of paperwork and calculations can often lead to moments of quiet dread – the missing W-2. The thought of: ‘Can I File Taxes Without a W2?’ starts to echo in the mind, growing louder as the filing deadline draws near. The elusive W-2, a crucial document provided by employers, outlines wages earned and taxes withheld for the year, forming the backbone of any tax return submission.

However, when the W-2 is absent, untraceable or worse, never received, it does not signal the end of the tax filing process. There are well-established provisions in place, specifically Form 4852, which acts as a substitute, allowing taxpayers to proceed with their filings. This form, readily available, requires details of wages and taxes withheld. Past pay stubs or a previous year’s W-2, if consistent with the current year, can prove invaluable in this scenario. Thus, there exists a lifeline for those questioning, “What to do if I haven’t received my W-2?

Missing W-2

Transitioning from the calm before the storm, the reality of a missing W-2 can evoke a sense of panic. Imagine staring at the mounting pile of tax documents, a mountain of paperwork designed to capture a year’s worth of earnings, deductions, and credits. The W-2 form, the linchpin in this dizzying array of tax forms, remains notably absent.

Don’t despair. Take a deep breath. There’s a beacon of hope shining through the fog of income tax preparation. If the employer has been contacted, but the W-2 remains elusive, the path forward is not a dead-end. As an initial step, there’s an option to file taxes without a W-2, by using last pay stub information.

But, what if the employer vanished, or closed the doors unexpectedly? Fear not. The IRS can step in to help find your W-2 or provide a substitute for Form W-2. A call to the IRS or a visit to their website can set the process in motion for receiving a copy of your W-2.

Yet, what if the federal tax deadline looms near? In such cases, IRS Form 4868 can be used to request an extension. But remember, even if you’re missing form W-2, you must still file your federal income taxes.

What Is a W-2?

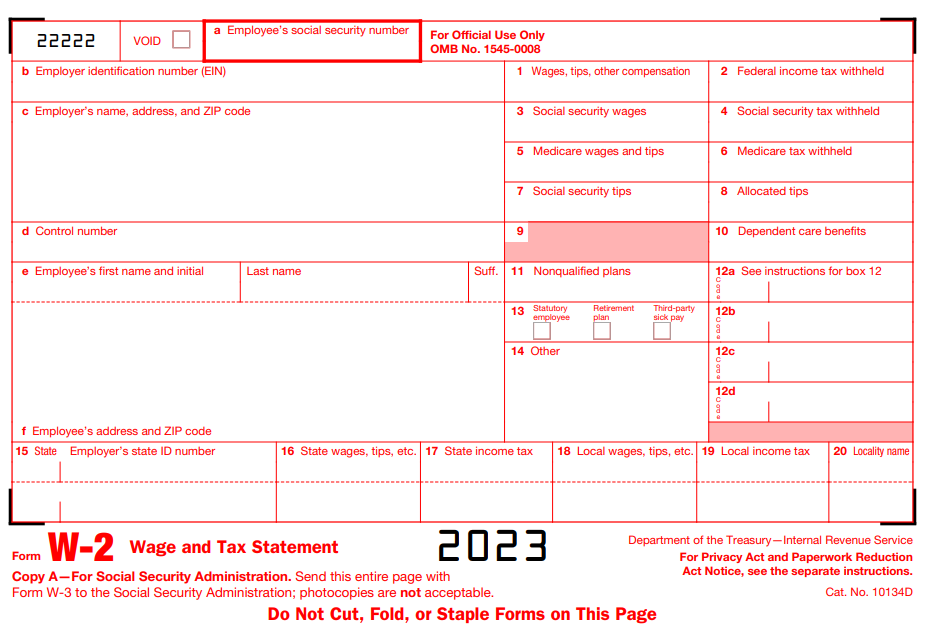

Venturing from the previous section’s topic of a missing W-2, let’s dive into the essence of this crucial document. A form that is a vessel of vital tax information, the W-2, is a wage and tax statement furnished by employers to detail the total wages and withheld taxes for the year. This quintessential document includes additional data such as contributions to a 401(k), health savings account, and even the premiums paid for health coverage by employers.

Picture this: The time to file your taxes is around the corner. Ready to file your return, but can’t seem to get your hands on your W-2? Don’t panic. Start by contacting your employer to get a copy. They might have forgotten or made a mistake. However, if the employer went out of business or refuses to provide it, the IRS can step in to help. Contact the IRS to get your W-2.

Sometimes, you might need to file your taxes without your W-2 document. In such situations, IRS Form 4852, also known as “Substitute for Form W-2,” comes to the rescue. However, it’s crucial to remember that filing without your W-2 may lead to a delay in processing your return or even a penalty. The W-2 also holds significance for independent contractors who receive a 1099 instead.

Importance and Features of W2 Form

Delving deeper into the significance and intricacies of the W2, one quickly realizes its pivotal role in the annual taxing process. A labyrinth of 34 boxes beckons the employer’s attention, each requiring filling only if pertinent. An unfilled box simply implies a lack of corresponding information.

The initiation into a new organization necessitates an individual’s filling out a W-4 form. This form acts as the compass for the employer, guiding the deductions for health insurance, social security, and taxes. These deductions, in harmony with the employee’s name, social security number, and address, paint a vivid image on the W2 canvas.

Even the shortest employment stint warrants a w-2 from your employer. The W2 is a faithful messenger, journeying to the address provided by the employee. A change in location requires the employee to update the employer. The employer might need to resend the W2 if the address on record falls short.

The W2 holds the key to filing income tax return according to the IRS booklet instructions. The form is a mirror reflecting identical information at various spots. The onus of attaching the appropriate W2 section to the tax form falls on the employee when choosing to file the traditional way. Conversely, a tax preparer can handle the W2 intricacies when choosing to file electronically.

Who Receives a W-2?

Transitioning from the significance and elements of a W-2, let’s delve into the topic of who receives this crucial document. Ordinarily, a W-2 is presented to anyone deemed an employee as opposed to an independent contractor. For those who switched jobs within the calendar year or hold more than one employment position, multiple W-2s could be on the horizon.

For the solo ventures of independent contractors, a Form 1099-NEC replaces the W-2, cataloging total income and other perquisites for the year. Unlike the W-2, organizations employing independent contractors typically do not withhold federal income tax or Social Security and Medicare taxes. As an independent contractor, the onus falls on you to estimate and quarter-pay these taxes throughout the year.

What happens when you’re ready to file your taxes and haven’t received your W-2 yet? The first step is to contact your employer. They may have already sent it or could provide you with the necessary tax information. If the employer reported the income, the IRS may have received the information, which you can check on the IRS website. If you still can’t get your W-2, you can use Form 4852 as a substitute to file your tax return.

Step 1: Check Online

Transitioning from the understanding of the W-2 recipients, let’s delve into the intricacies of how to access this crucial document, namely, form W-2. Taking the first stride into this process, let’s explore the digital path. As technology permeates every sphere of life, so it has the realm of taxation. Employers often resort to the digital medium to dispense W-2 forms, making the task of obtaining them much easier and faster.

Picture this scenario: An email arrives, not with the W-2 attached, but with a link leading to an online portal. Here, nestled among employment details and payroll information, lies the coveted W-2, waiting to be downloaded. But beware, the email might have strayed into the spam folder or perhaps landed in an incorrect email address. Therefore, vigilance is required to ensure its receipt.

Should the email or online portal yield no results, despair not! Employers may have another ace up their sleeve. In addition to sending W-2s to employees, they also dispatch them electronically to the IRS. This dual dispatch system ensures the form’s availability even if it’s elusive in the email or the online portal.

Remember, receiving the W-2 is the first step towards filing taxes correctly, and various ways to file your taxes exist.

Step 2: Ask Your Employer

Having exhausted all online avenues, the next course of action involves a direct dialogue with the employer. Those handling payroll or human resources within the company can provide insight into the issuance of the elusive W-2 form. Perhaps it has been sent to an outdated or erroneous address and subsequently returned to the sender. If so, the solution is simple; a request for reissuing the W-2 form may be placed to retain a physical record.

Often, such issues arise due to postal mishaps. In such cases, the popular tax software TurboTax can come to the rescue by pulling out a copy, provided the employer has issued one. The software’s wide reach can effectively import the required document, ensuring no delay in tax filing.

In the event of a continued non-receipt, one might resort to using the final pay stub to file an amended return. However, if the W-2 form remains elusive as the tax deadline approaches, it becomes imperative to still file taxes. This may be achieved by filing form 4852 as a substitute.

Additionally, one could seek advice on taxes from the IRS or state tax authority. They can guide on how to proceed if you haven’t received your W-2 yet. Remember, it is the legal duty of every citizen to file their federal taxes, and any delay could result in penalties.

Step 3: Contact the Irs

Moving beyond the realm of dialogue with an unresponsive employer, the matter now necessitates the involvement of the IRS. In this case, it’s essential to gather and provide crucial details to ensure the IRS can assist effectively. These details comprise not only personal information such as name, address, and the unique identifier known as the Social Security number but also pertinent information regarding the employer and the employment tenure. In addition, an estimate of earned wages and federal income tax is necessary—information often available on the final pay slip of the tax year.

The IRS, with this information, will reach out to the employer first to request the missing form and remind them of their obligations. Should the employer fail to comply, it might seem daunting, but one can still file taxes without a W-2. In such a scenario, the IRS can help you get a substitute form—form 4852.

However, bear in mind, this process might delay your tax refund. Therefore, it’s crucial to file by the tax deadline without the W-2 to avoid potential complications. If one needs more time, one may file form 4868 to extend the deadline, or amend the tax return later on if necessary. While waiting for the IRS to help get a W-2, one could try to get a copy of the W-2 form with the Social Security Administration.

Step 4: File Form 4852 with Your Tax Return

Proceeding to the next step involves engaging with Form 4852. This form is a critical tool when the W-2, a vital document for tax filing, is not received. Form 4852 acts as a substitute, enabling taxpayers to file their taxes legally in the absence of the original W-2.

When utilizing TurboTax, the process is streamlined. The software assists in estimating total wages and withholding based on the information from the final paycheck, facilitating tax filing without the W-2. However, it is important to note that the IRS requires Form 4852 to be filed in paper format, as it is not eligible for electronic filing. This necessitates printing and mailing the form along with other required documents to the IRS.

It should be noted that opting for this method may result in extended processing times due to the IRS’s need to verify the submitted information. Should this delay be a concern, taxpayers have the option to request an extension. However, it is crucial to understand that taxes owed must still be paid by the original deadline. Delays may incur additional interest and potential penalties on the outstanding amounts when the extended return is eventually filed.

Step 5: Request a Wage and Income Transcript

Following the alternative tax filing process, the next step is to obtain a Wage and Income Transcript. This document is instrumental in providing a detailed account of your earnings as reported by your employer to the IRS. It includes information from various forms, such as W-2s and 1099s.

There are two ways to obtain this transcript: either through the IRS’s Get Transcript Online tool or by mailing Form 4506-T. However, acquiring this transcript often requires patience, as it may not be available until mid-summer.

Once in possession of the transcript, it can be used to verify and compare the information against the data submitted via the replacement document. Discrepancies may necessitate an amendment to your tax return. Remember, you are still able to file your taxes without the W-2 and can later submit an amended return if necessary.

Step 6: Amend Your Return (Maybe)

The process may evolve into the potential amendment of your tax return. This step is essential for correcting any inaccuracies that become apparent after receiving your W-2. Discrepancies between the W-2 data and the information previously reported require attention.

In such cases, Form 1040-X is the tool for rectification. It enables taxpayers to correct errors in previously filed returns, ensuring alignment with the accurate tax information provided by employers.

If the W-2 remains elusive, contacting the IRS for guidance is advisable. This approach ensures that all necessary information is obtained for accurately completing your tax obligations.

File with Confidence—with or without a W-2

In situations where a taxpayer has not filed or received their W-2, Freedom Tax Accounting emerges as a valuable resource. This firm provides expert guidance through the complexities of tax filing, ensuring thorough and accurate completion of the process. For those preferring a more hands-on approach, Freedom Tax Accounting offers unlimited advice and assistance from experienced tax professionals.

Regardless of the method chosen, Freedom Tax Accounting guarantees accuracy and strives to secure the maximum refund possible for each client. This assurance allows taxpayers to navigate their tax responsibilities with confidence, regardless of the challenges they face.

Conclusion

You can contact us by phone, email, or by visiting our offices:

- Address: 1016 E Osceola Parkway, Kissimmee, 34744, Florida, United States

- Phone: 407-502-2400

- E-mail: [email protected]

Remember that we are part of Freedom Group, a conglomerate of companies dedicated to providing quality services in accounting, taxes, financial consulting, insurance, real estate, business incorporation, among others.

As for your finances, we can help you with everything you need.

Subscribe to my channel

Subscribe to my channel