3 Easy Steps to Open a Florida LLC for Foreigners or Immigrants Without a Social Security Number

Did you know that you can open a new Florida LLC if you are a foreigner or an immigrant without a Social Security Number, nor an ITIN Number? In this video, we show you 3 easy steps that teach you how to register a Florida LLC even if you are an immigrant or foreigner without an SSN or an ITIN tax id number.

Visit our Website – https://freedomtaxaccounting.com/

DISCLAIMER This video is intended for educational purposes and should not be taken as legal or tax advice. You should consult with your financial professionals about your unique financial situation before acting on anything discussed in these videos. Freedomtax Accounting and Multiservices Inc. is providing educational content to help small business owners become more aware of certain issues and topics, but we cannot give blanket advice to a broad audience. Freedomtax Accounting and Multiservices Inc. or its members cannot be held liable for any use or misuse of this content.

Transcript:

Did you know that you do not need a social security number nor an ITIN number to open up an LLC in Florida, and that you can open up your LLC in three simple steps? That’s what we’re going to talk about in this video. Hello From Freedom Tax accounting or an accounting firm where we have been providing quality tax and accounting services now for over 20 years. If you are new to this channel, we provide strategies for small business owners so they can achieve their financial goals. So, if that’s something you like then subscribe to our channel so you always are up to date with the most current strategies, tax strategies, financial planning strategies for small business owners to save on taxes and build wealth for the future.

So, one of the most common questions we get here in our office is, “Can I open up an LLC without having a social security number nor an ITIN number?” And the answer is yes, okay you can open up an LLC basically in any state without a social and without an ITIN number now the steps that we are going to show you really apply to any state not just Florida. But in this video, we’re going to show you step by step the three simple steps that you need to do to open up an LLC in Florida without a social security number and without an ITIN number all right.

So, let’s get to it.

So, basically before we go into the steps these are the things that you are going to need in order to do the LLC in Florida:

We always suggest that you have on hand a list of three desired names for your LLC because if the name you want is not available then you have two other options that you can use okay. So, make a list of three desired names for your LLC. You are also going to need a Florida physical address; it cannot be a PO box; so, you do need a Florida physical address. Now if you do not have a Florida physical address that you can use then you are going to have to maybe buy a virtual office service or a Florida registered agent service so that they can allow you to use a physical Florida address okay. Now you will also need $125 because that’s the fee that you will need to pay to Florida in order for them to process your new LLC registration application. So, this 125 you pay directly to Florida.

Okay now once again you will not need your social security number nor an ITIN number to open up the LLC. You may need it in the future to file your business taxes and you may need a social or an ITIN number to open up a business bank account because right now there are some banks that tell you that in order for them to open up your LLC bank account you do need an ITIN number. So, call the bank that you want to open up the business account with and find out if they require an ITIN to open up the business bank account. Not all the banks are asking for the ITIN. But most of them are okay but to open up the LLC you do not need the social and you do not need the ITIN number okay.

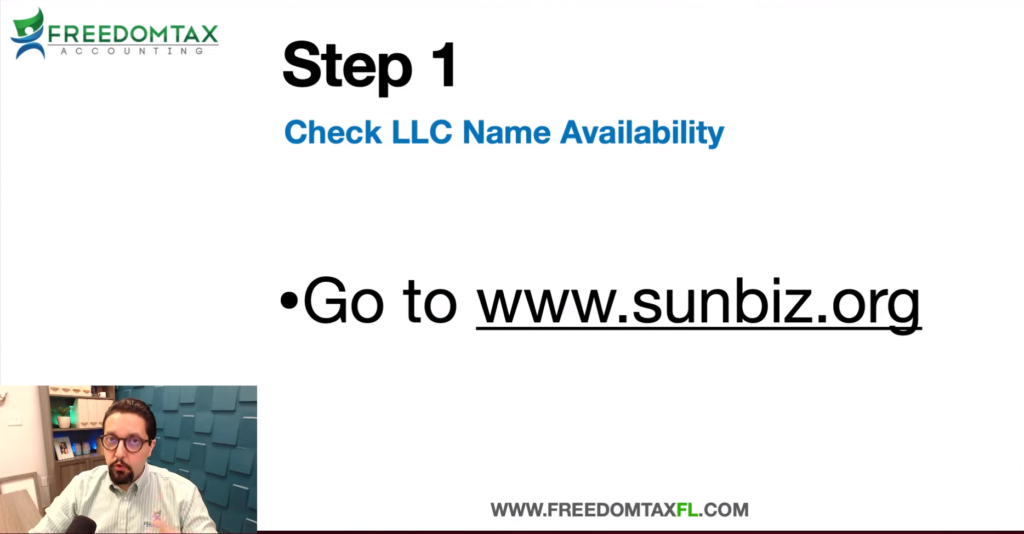

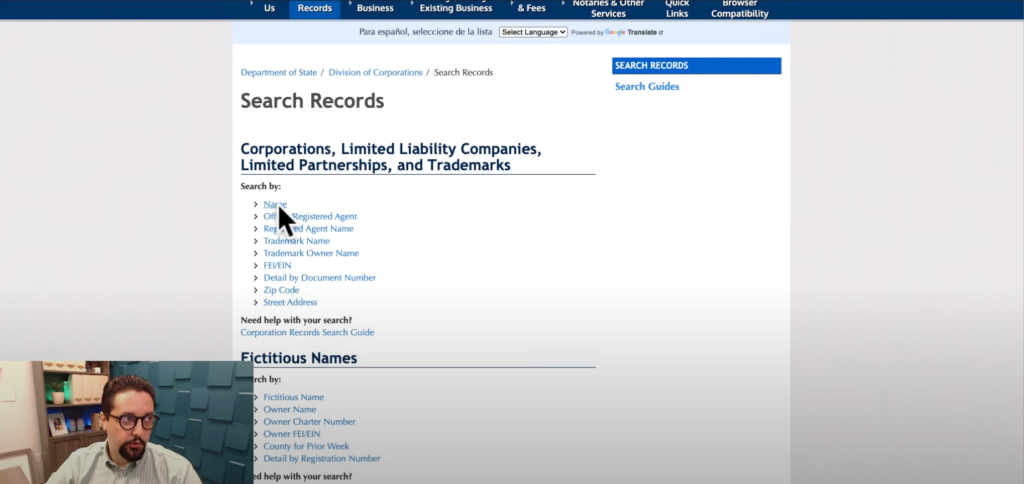

So, let’s go to step one. What is step one? It is to check if the name for the LLC that you want is available and where do you check it you need to go to this website www.sunbiz.org that’s the page for the Florida department of corporations okay so go to this website which is this one okay this is sunbiz.org and click here where it says “search records”. When you click search records okay see here where it says search by name so you click name.

Okay where it says entity name here just put the name of the LLC you want to use for example if you want to call your business Super Services LLC and you click search now okay now this is the list of all the names that are registered in Florida with Super Services. Now as you can see here Super Services LLC appears inactive. If it says inactive, you need to go in that file and check where it says the event date filed and if this date is at least two years old, then you can use that name okay. But here’s the other thing there’s another company called Super Services Corp okay now since there is another uh company says that says Super Services Corp or Super Services INC the state will not allow you to register Super Services LLC because there is another company with a similar name is just that it has Corp or INC okay. So, you have to find a name that is available okay. So, basically, that’s how you check if the name you want is available.

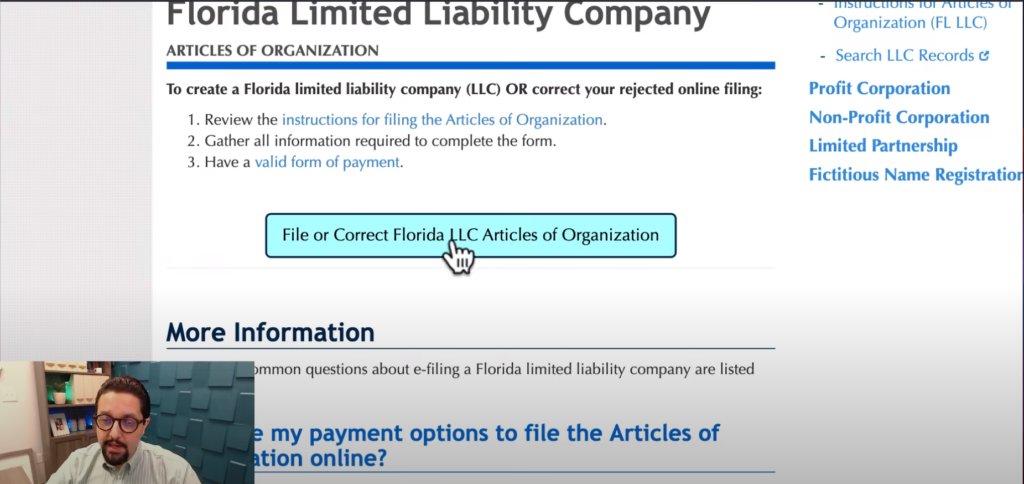

Now once you find a business legal name that is available, the next step would be to register your LLC with the state of Florida and once again you need to go to sunbiz.org okay. So, you go back to sunbiz.org the home page and now you go to start a business. Okay you go to this drop-down and you click limited liability company. When you click there it takes you to this page okay. So, once you are on this page you click file Florida LLC articles of organization. Once you go to that page unfortunately this page is not working right now, but once you click this link this dark blue button, basically it takes you to a page where there is a form where you’re going to put the business name that you want, your name, the business address, the owner’s name. Basically, the general information about your business and at the end, they’re going to ask you to pay the $125 to Florida you pay online with a credit card or a debit card. So, that’s the second step.

Now once you uh fill out the form from the Sunbiz page okay you’re going to get an email from the state of Florida and that can take a couple of days. Depending on how busy the state of Florida is that can take for 48 hours it can take two weeks, it depends. You’re going to get an email from the state of Florida confirming that your LLC was formed. Now you still have to wait for an email to check if your LLC is already appearing on the Sunbiz website.

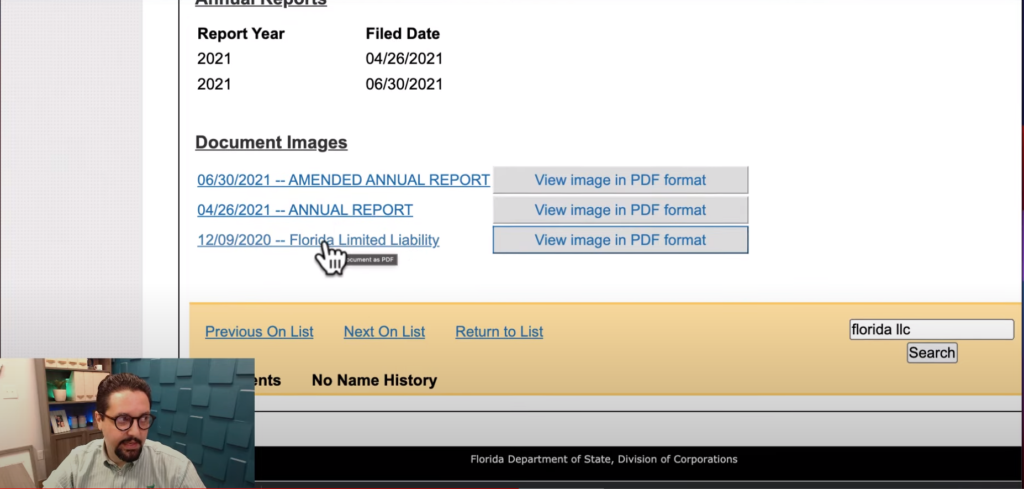

Why? Because you need to have the articles of organization in order to go to step five okay. For example, once you get the email from the state of Florida that your LLC was formed, then periodically once again you check search records and go to name and in entity name here where it says, entity name you put the name of your LLC. Let’s say that is Florida LLC or the name of the LLC that you registered, you click search now and you look for your LLC okay. Here Florida LLC. So, you look for your LLC here at the Sunbiz page and you scroll down all the way down where it says Florida limited liability you can click here or you can click view image in pdf.

And when you click there, it takes you to your LLC’s articles of organization. This is a legal document from the state of Florida where basically uh your business name, the business address, the business owners, but you are going to need this document in order to go to step number three okay. So, once again once you have the articles of organization that’s where you go to step three which is applying for your IRS EIN number.

What’s the EIN number? It’s a tax identification number for a business from the IRS the same way that we as individuals have a social security number or an ITIN number, the government gives companies uh an identification number called the EIN number. EIN stands for “Employer Identification Number” okay and this is the most important thing and the most important step that you need to do because without this EIN number you cannot open up the bank account and you cannot start operating your business okay.

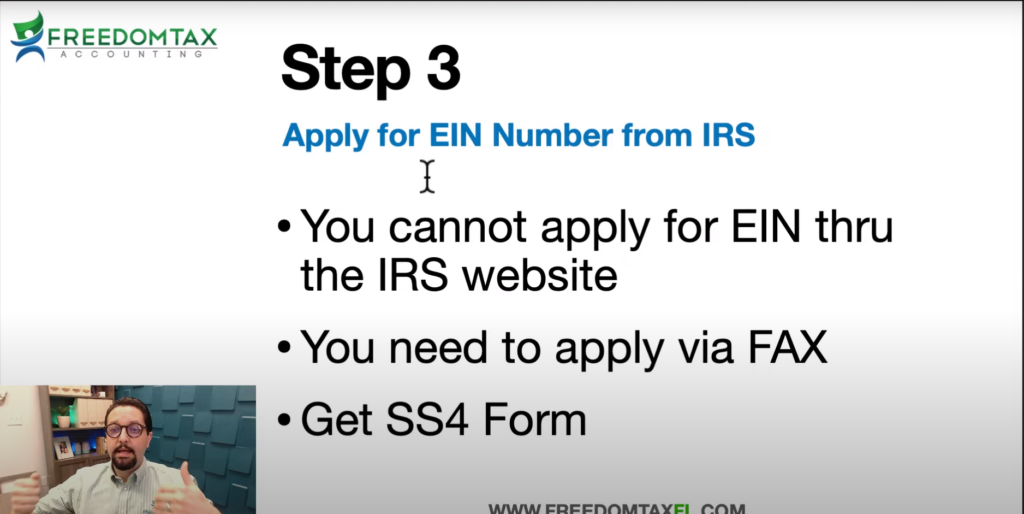

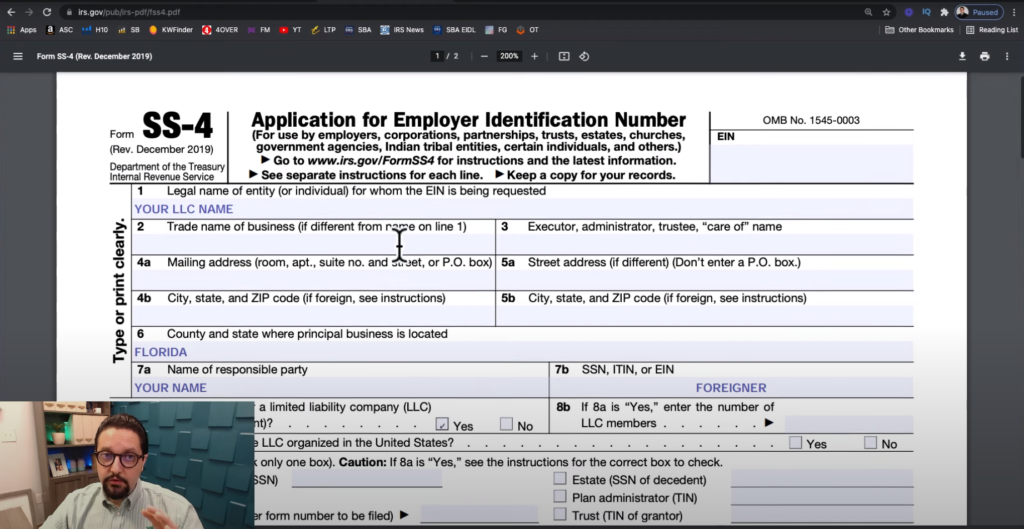

Now step three unfortunately you cannot apply for the EIN through the IRS website, you could if you have a social security number. But since this is about opening an LLC without a social security number nor an item, you cannot apply for the EIN through the IRS website. Believe it or not you have to apply for the EIN via fax okay. We are in the 21st century, the IRS is still using facts so we’re going to show you how to fax and the number you need to fax it. But the first step is to download the SS4 form from the IRS because that is the EIN number application form okay. So, once again you go to google, you go to google and you type in SS4 form and this is the form that comes up okay. So, this is the SS4 which is the application for the employer identification number with the IRS okay. Now this form once you get it you put this is basic information about your business, you put your LLC name, you put your address here you put the country or state, you put Florida name of responsible party, you put your name. In 7b where it says social security ITIN or EIN you have to put a foreigner okay because you do not have a social, you do not have an ITIN and you do not have an EIN okay. Is this application for an LLC? You put yes now. From 8b forward okay depending on many factors that’s how you complete this form okay. So, depending on the number of owners depending on how you want your LLC to pay taxes depending on the industry that your LLC is going to work either real estate construction, services, so depending on your specific case that will depend how you fill out the rest of this form and there are so many variables that realistically we will need to do a video that is maybe three hours long to discuss every little case.

So, the good thing is that if you go to google and you search for instructions for the SS4 this document will help you okay fill out the rest of that form because how you fill out the rest of the form will determine how your business pays taxes and other uh requirements that you will have with the IRS. So, if you do not know how to fill out the rest of this SS4 we highly suggest that you hire a professional to do it because it will impact the way your LLC files taxes with the IRS and other filing requirements. And once again, it’s not that we don’t want to show you how to fill it out because but there are so many different variables and so many different ways that you can fill this out depending on the industry, how many owners other variables that we would need to spend at least three hours on a video on how to fill out this form okay. But once again you could look for the instructions online, they are available, read them and that way you know how to fill out the rest of the ss4 okay.

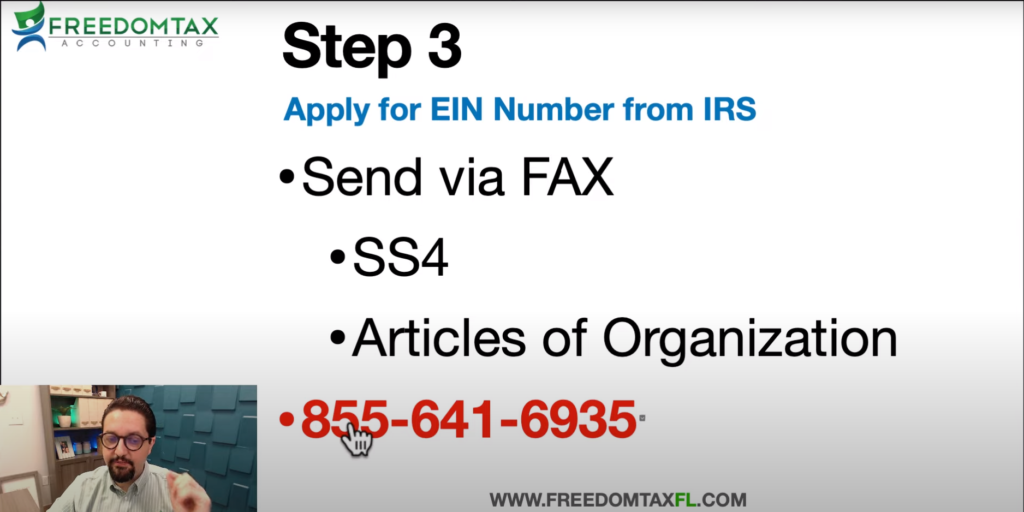

Now once you have the ss4 completed you print it out okay and you send it via fax you need to send the ss4 with your articles of the organization both documents you send by fax to the IRS, and this is the fax number it’s 855-641-6935. So, once again once you complete the ss4 and once you have the articles of organization you need to fax both documents to the IRS at 855-641-6935.

Now once you send it to the IRS via fax, in a couple of weeks this may take three weeks. We’ve had cases where it takes four months. So, it all depends on how fast the IRS processes your EIN number application, but regularly two-three weeks you should get an IRS letter in the mail on the business address that you put on the ss4, you will get a letter the official EIN number letter from the IRS with your assigned EIN number for your LLC. Now if a lot of time goes by and you do not get the EIN number letter in the mail then you can call the IRS at this number to follow up with the IRS to see where the process of the EIN application is okay. Now once you get the EIN number letter from the IRS that’s when you take the articles of organization and you take your EIN number to any bank and you can open up a business bank account. But once again check with the bank first because there are some banks that will tell you that in order for them to open up a business bank account for your LLC, you may have to apply for a personal ITIN number.

So, basically, those are the three steps if you need any help with this process, we do provide this as a service. This is our contact information. We are a full-service tax accounting firm. We can help you open up an LLC in any of the 50 U.S. states. We can help you with personal taxes and corporate taxes. If you have tax problems with the IRS, we can apply for your ITIN number. We can help you in many ways. Also, we are part of the Freedom Group. We are a group of four companies where not only do we provide tax and accounting services, we have a company for immigration services, we have real estate here in Florida and we also have financial planning and an insurance company so we can help you in many ways.

Thanks for watching this video. Remember to subscribe to our channel and share it with your relatives and friends if this informative video was of benefit to you.

You can contact us by phone, email, or by visiting our offices:

- Address: 1016 E Osceola Parkway, Kissimmee, 34744, Florida, United States

- Phone: 407-502-2400

- E-mail: [email protected]

Remember that we are part of Freedom Group, a conglomerate of companies dedicated to providing quality services in accounting, taxes, financial consulting, insurance, real estate, business incorporation, among others.

As for your finances, we can help you with everything you need.

#floridallc #openanllc #opennewllc #llcforforeigners

Subscribe to my channel

Subscribe to my channel