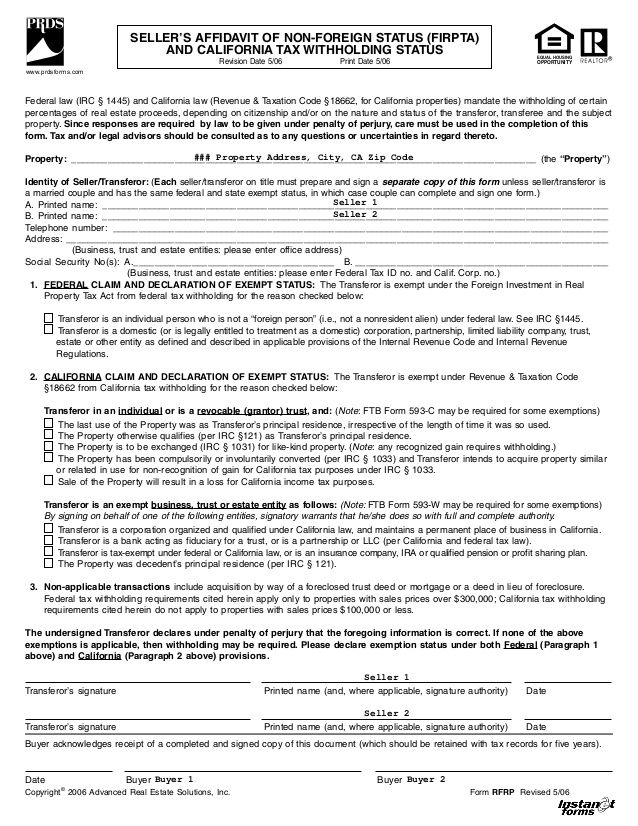

FIRPTA Affidavit

The Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) requires withholding of income tax on dispositions of U.S. real property interests by a foreign person. Dispositions include, but are not limited to, sales, exchanges, liquidations, redemptions, gifts, and transfers. When a foreign person disposes of their U.S. real property interest, the transferee is responsible for withholding 15% (10% for dispositions before February 17, 2016) of the amount realized on the disposition.

A U.S. real property interest is an interest, other than as a creditor, in real property located in the United States or the U.S. Virgin Islands, as well as certain personal property that is associated with the use of real property.

Introduction to Firpta

FIRPTA, the Foreign Investment in Real Property Tax Act, is an important part of the Internal Revenue Code. It affects sellers, buyers, and withholding agents when foreign persons dispose of United States real property interests. The Internal Revenue Service (IRS) requires withholding of taxes on such dispositions unless an exemption applies or a lower withholding rate is certified.

For sellers, the withholding obligation can be satisfied by providing a taxpayer identification number, such as an Individual Taxpayer Identification Number or a Social Security number. Buyers must withhold taxes on the full amount of the purchase price unless a FIRPTA certificate is provided by the seller.

Overview of Firpta

The Foreign Investment in Real Property Tax Act (FIRPTA) is a 1980 law that requires U.S. entities to withhold tax on dispositions by foreign persons of U.S. real property interests. To understand the implications of this law, it is important to have an overview of FIRPTA. This section will provide a brief overview of FIRPTA, who is affected by FIRPTA, and the tax implications of FIRPTA.

FIRPTA applies to any disposition of a U.S. real property interest, whether the seller is a foreign person or not. A U.S. real property interest includes domestic corporations, foreign partnerships, foreign corporations, and states real property holding corporations.

Who Is Affected by Firpta

Transitioning to the next topic, let’s explore who is affected by FIRPTA withholding. FIRPTA applies to buyers of real estate from foreign persons, so anyone purchasing property from a foreign individual, foreign corporation, foreign partnership, or foreign trust would be subject to FIRPTA withholding.

Consequently, sellers of real estate, title companies, and escrow agents must be aware of their FIRPTA withholding obligations. Ultimately, the buyer’s real estate agent may be held liable for actual knowledge that the seller is a foreign person and for failing to complete the 1445 withholding or the 8288 form. If the buyer fails to withhold, they may be subject to penalties of perjury and may be liable for the underlying tax due.

Tax Implications of Firpta

With the introduction of FIRPTA, tax implications for foreign investors, buyers, sellers, and other parties involved in a real estate transaction must be considered. FIRPTA, or the Foreign Investment in Real Property Tax Act, requires foreign investors to pay taxes on any profits they make from the sale of a U.S. property. These taxes may include capital gains tax, as well as a withholding requirement, which may be either at the rate of 10% of the sales price or a lower amount if determined by a qualified CPA or attorney.

The withholding requirement must be reported to the IRS within 20 days of the closing of the transaction, and the full amount must be paid to the IRS, even if it is less than the amount of the actual tax liability.

Firpta Affidavit Features

The Foreign Investment in Real Property Tax Act (FIRPTA) requires a 15% withholding of taxes due on foreign sellers. This withholding applies to local sellers as well, though there are exceptions from FIRPTA withholding. To avoid FIRPTA withholding, the buyer must obtain a withholding certificate, Form 8288, and send it to the IRS along with funds to the IRS equal to the amount of the withholding. The seller can then submit Form 8288-A, which will allow them to receive the funds back from the IRS, usually within 20 days.

15% of Taxes Due on Foreign Sellers

The 15% of taxes due on foreign sellers is a critical area to consider when determining whether FIRPTA withholding is required. When the transferor is a foreign person, the buyer is required to withhold 15% of the sales price of the property sold and remit it to the IRS. The 15% rate applies to U.S. income tax liability on capital gains, i.e. the profits from the sale of the property. This obligation extends to any real estate agents and title companies involved in the transaction, as long as the buyer has actual knowledge that the seller is a foreign person.

Local Seller

The local seller, who is not a foreign person, has a few options in terms of avoiding FIRPTA withholding. First, the seller can provide a certification to the title company, known as a FIRPTA affidavit, which certifies that the seller is not a foreign person and therefore exempt from FIRPTA withholding.

The seller must sign a penalty of perjury oath, attesting that any false statements on the affidavit will result in criminal penalties. This certificate needs to include the seller’s name, home address, and tax identification number, as well as the date of closing and the full amount of the sale.

Exception From Firpta Withholding

Fortunately, there is an exception from FIRPTA withholding that can be beneficial to buyers and sellers alike: when a buyer purchases real property from a non-foreign LLC or partnership, the buyer may qualify for an exemption from the FIRPTA withholding requirement.

To qualify for the exemption, the buyer must certify to the seller that the buyer is a nonresident alien individual or foreign estate, or a domestic corporation that owns at least 50% of the LLC or partnership being sold. Furthermore, buyers who are commonly known as real estate agents in the ordinary course of their trade or business and who acquire the property for the purpose of reselling it to another person may also qualify for the exemption.

Avoiding Firpta Withholding

Availing an exemption from FIRPTA withholding may be possible if the buyer’s real estate agent has the 897 FIRPTA certificate issued by the IRS. If the buyer’s agent obtains the certificate from the seller, the buyer can request the withholding agent to return the withheld funds back to the seller. The FIRPTA affidavit proves the seller’s foreign status and exemption from tax on capital gains.

It must be certified by a CPA or attorney and signed with an oath or affirmation, under penalty of perjury, that all statements made in the affidavit are true. In the case of a single-member LLC, the LLC is treated as a corporation and not an individual, and is therefore subject to U.S. tax liability.

Understanding when a Firpta Affidavit Is Required

Understanding when a FIRPTA affidavit is required is an important part of any real estate transaction involving foreign investors. FIRPTA, the Foreign Investment Real Property Tax Act of 1980, requires foreign sellers of U.S real estate to pay U.S taxes on their capital gains. An overview of FIRPTA affidavits, when a FIRPTA affidavit is necessary, and exemptions to the FIRPTA affidavit requirements can help buyers and sellers alike. When a FIRPTA affidavit is necessary, a seller may be required to fill out a FIRPTA affidavit and a withholding certificate.

Overview of Firpta Affidavits

The FIRPTA Affidavit serves as an important tool for both tax purposes and clarifying the extent of their commission as a withholding agent. To understand when a FIRPTA Affidavit is necessary, it is important to understand the overview of FIRPTA and how it can affect foreign real estate investors.

FIRPTA stands for the Foreign Investment in Real Property Tax Act of 1980, which requires foreign persons selling U.S real property to be treated as a domestic corporation and could apply to a variety of situations. As such, the full amount of the gain must be declared and the withholding agent is required to withhold taxes from the sale for the government, if the buyer does not provide a FIRPTA Affidavit.

When a Firpta Affidavit Is Necessary

Understanding when a FIRPTA affidavit is necessary is essential to avoiding significant financial penalties. FIRPTA, or the Foreign Investment in Real Property Tax Act of 1980, is a federal law that requires foreign persons selling U.S. real estate to the American government to pay tax on any capital gains received from the transaction.

The buyer must withhold the full amount of the taxes due on the sale, then submit the funds to the IRS within 20 days of closing. If the buyer fails to do so, they can be held liable for the unpaid taxes, plus interest and penalties.

Exemptions to the Firpta Affidavit Requirements

Exemptions to the FIRPTA Affidavit Requirements can be found in the Internal Revenue Code (IRC) section 1445, which outlines conditions that define when a FIRPTA affidavit is not necessary. In general, an affidavit is not required if the buyer has actual knowledge that the seller is not a foreign person, or when the buyer is a corporation, REIT, RIC, domestic partnership, or domestic estate.

The buyer is also exempt if they are purchasing a single-member LLC that is commonly known to be domestically owned, or if the seller provides a certificate of nonforeign status. If the buyer is the states real property holding corporation, then the buyer does not need to obtain a FIRPTA Affidavit.

Requirements of the Firpta Affidavit

The FIRPTA Affidavit is a declaration of non-foreign status which is required for dispositions of U.S real property interests by foreign persons. Qualified substitutes for the FIRPTA Affidavit include a full amount, nonrefundable earnest money deposit held by a title company and a CPA or attorney certifying to the transferor’s non-foreign status.

Exceptions to the FIRPTA Affidavit Requirements include dispositions of U.S real property interests by foreign persons that are treated as domestic corporations, domestic partnerships, foreign estates, nonresident alien individuals and foreign trusts.

Standard Declaration of Non-Foreign Status

Having established a clear understanding of when a FIRPTA Affidavit is required, it is important to understand the requirements of the FIRPTA Affidavit, with particular attention to the Standard Declaration of Non-Foreign Status. This declaration is crucial for the buyer of the property in ensuring they are not held liable for any FIRPTA withholding.

In order for the buyer to declare the non-foreign status of the seller, the seller must provide a signed and notarized statement with a penalty of perjury. This statement must include the seller’s full name, home address, and either a social security number or individual taxpayer identification number for tax purposes. This statement should also include the date when the property was sold and the full amount of the sale.

Qualified Substitutes for the Firpta Affidavit

Having understood when a FIRPTA Affidavit is required, it is important to understand the qualified substitutes for the FIRPTA Affidavit. Although the FIRPTA Affidavit is the most common and suggested form of disclosure, there are other substitutes that can be used to fulfill the FIRPTA withholding requirements. These forms include a written declaration of non-foreign status, a FIRPTA Certificate, and a Standard Declaration of Non-Foreign Status.

A FIRPTA Certificate is a form that is typically completed by a foreign seller who is eligible for an exemption from FIRPTA withholding. This document must be completed and signed by a foreign seller in order to claim the exemption.

Exceptions to Firpta Affidavit Requirements

Moving forward, there are certain exceptions to the FIRPTA affidavit requirements that must be taken into consideration. For instance, the FIRPTA withholding tax does not apply when the full amount of the proceeds from the real property sale are paid to a non-foreign seller, such as a domestic corporation, domestic partnership, or a domestic trust. In such cases, the seller is not required to present a FIRPTA affidavit.

Additionally, certain transactions are also exempt from the FIRPTA affidavit. For instance, when a foreign investor, such as a foreign corporation or foreign partnership, owns a single-member U.S.

Impacts of Not Complying with Firpta

Filing and withholding taxes is an integral part of FIRPTA, the Foreign Investment in Real Property Tax Act of 1980. When a foreign person makes a disposition of U.S. real property interest, the buyer is responsible for withholding the full amount of taxes due, and failure to comply can result in hefty penalties.

Interest and late payment fees can also be assessed, in addition to potential criminal penalties. A CPA or attorney should be consulted to ensure that all requirements are met for tax and FIRPTA purposes.

Penalties for Non-Compliance

Failure to comply with FIRPTA requirements can have severe consequences. Penalties for non-compliance include fines, interest and late payment fees, and in some cases, potential criminal penalties. Fines for non-compliance can be up to the full amount of the tax that was required to be withheld. Therefore, it is essential for all parties to make sure they are complying with the FIRPTA requirements to avoid any of these penalties.

Interest and Late Payment Fees

Failure to comply with FIRPTA has serious consequences, including interest and late payment fees. If the full amount of tax required to be withheld is not paid to the Internal Revenue Service (IRS) within 20 days of the closing, the buyer may be assessed interest on the unpaid amount. In addition, the buyer may be liable for a late payment penalty equal to 0.5 percent of the unpaid amount for each month or part of a month the amount remains unpaid.

The late payment penalty can accumulate up to 25 percent of the unpaid amount. Furthermore, the buyer may be liable for an additional penalty of at least 50 percent of the amount of the underlying tax if the IRS finds that the failure to pay was due to fraud or intentional disregard of the FIRPTA regulations.

Potential Criminal Penalties

The consequences of neglecting to follow the FIRPTA regulations may be severe, as potential criminal penalties may be applied. Those found to have wilfully failed to comply with FIRPTA regulations may face criminal sanctions, such as fines and imprisonment.

Furthermore, those convicted of making a false statement on the FIRPTA affidavit, or of omitting material information, may be held liable for the full amount of the tax on capital gains, along with interest and late payment fees. It is therefore essential for foreign investors to understand their FIRPTA obligations and, if necessary, to seek the advice of a certified public accountant or attorney.

How to File a Firpta Affidavit

Filing a FIRPTA Affidavit is a complex process that requires careful preparation. It begins with preparing the FIRPTA Affidavit, which must include the full amount of the FIRPTA withholding and the taxpayer identification number of the foreign person. After completing the Affidavit, it must be submitted to the Internal Revenue Service.

Upon submitting the Affidavit, the withholding agent must also complete the appropriate tax forms, such as Form 8288 and Form 8288-A, to calculate the amount of tax to be withheld.

Preparing the Firpta Affidavit

Having a clear understanding of the process of preparing a FIRPTA Affidavit is essential for any buyer or seller involved in a real estate transaction. Preparing a FIRPTA Affidavit involves several steps, and if not done correctly, can result in costly penalties.

The first step is to obtain a FIRPTA affidavit from the Internal Revenue Service or an attorney or CPA. The affidavit must be filled out accurately and completely, including the full amount of the sale, the seller’s name, and date of closing. If the buyer has actual knowledge that the seller is a foreign person, the buyer must withhold the full amount of the sales price to ensure that the seller pays the appropriate taxes.

Submitting the Affidavit to the Irs

Armed with the knowledge of the potential impacts of failing to comply with FIRPTA, it is essential to understand the process of filing a FIRPTA affidavit. Submitting the affidavit to the IRS is an important step in the process. The affidavit must include the full amount of the FIRPTA withholding that the buyer is responsible for.

The buyer must then send this money to the IRS within 20 days of the closing date. The IRS will then provide a certificate of withholding to the buyer and the remaining funds will be returned to the seller. The affidavit must be filed with the IRS office applicable to the state where the property is located.

Completing the Appropriate Tax Forms

Having gone through the process of preparing and submitting a FIRPTA Affidavit, it is now time to complete the appropriate tax forms. Depending on the nature of the transaction, the taxpayer may need to report the sale to the IRS by filing Form 8288 and 8288-A. The withholding agent must complete Form 8288, which is used to report the sale of U.S. real property interests and withhold the funds.

The Form 8288-A is completed by the seller, to report the sale proceeds and the tax withheld. Both of these forms must be submitted to the IRS within 20 days of the closing date, and any taxes withheld must be remitted to the IRS in full.

Resources for Further Information

To gain a thorough understanding of FIRPTA, the IRS provides comprehensive guidance on the matter. To ensure one is compliant with the act, professional advice should be sought out from CPAs and/or attorneys. They can provide a full amount of information on the withholding rate, filing of 8288 and 8288-A forms, and other potential liabilities.

In addition, they can provide guidance on when a FIRPTA exemption may apply, the tax on capital gains, full name and address of the seller, and the extent of the buyer’s withholding obligation.

Understanding Firpta

Having gone through the steps of filing a FIRPTA affidavit, it is important to understand the fundamentals of what FIRPTA is and how it applies to a real estate transaction. FIRPTA stands for “Foreign Investment in Real Property Tax Act of 1980” and is a federal law which requires a buyer to withhold a certain percentage of the full amount of the purchase price when a foreign person sells U.S real estate.

This withholding amount, which is usually 10 percent of the gross sales price, is then remitted to the IRS within 20 days of the closing. The seller may then receive a refund of the withheld funds if they file an income tax return and prove that their tax liability is less than the amount withheld.

Irs Guidance on Firpta

With a clear understanding of the requirements of FIRPTA and the potential consequences of not filing the FIRPTA affidavit, the next step is to understand IRS guidance on the topic. The IRS provides detailed information about FIRPTA, including the full amount of withholding that must be paid, the form to be used for filing, and the timing requirements.

The IRS also has a specific form, Form 8288, which must be completed by the buyer and filed with the IRS within 20 days of the closing. Form 8288 must include information about the seller, the buyer, the date of the closing, and the amount of the withholding that must be paid.

Professional Resources and Advice

Having a clear understanding of FIRPTA requirements is essential for filing an affidavit and completing the transaction. Professional resources and advice are available for further information and clarification. Certified Public Accountants (CPAs) and attorneys can provide guidance on filing the affidavit and navigating IRS regulations.

They can help determine if U.S. tax is due and assist with the necessary calculations. Additionally, real estate agents may have experience dealing with FIRPTA, and can provide the seller or buyer with useful advice regarding the transaction. Most importantly, they can ensure the full amount of tax is paid and remitted to the IRS, and that the required paperwork is filed in a timely manner.

Summary of Firpta

Having discussed resources for further information, it is time to summarize the Foreign Investment in Real Property Tax Act (FIRPTA). FIRPTA is a law that requires foreign persons disposing of U.S. real property interests to pay tax on any resulting capital gains. It mandates that the buyer withhold 10% of the total sell price, unless the seller provides a FIRPTA affidavit and/or certificate.

The full amount of the withholding must then be sent to the IRS within 20 days of closing. The seller is liable for any shortfall, and the buyer may be held liable in the event of a false statement by the seller. These rules apply to foreign individuals, foreign governments, foreign estates, and foreign corporations.

Key Takeaways

Having explored the intricacies of FIRPTA, we can now take away the key points to remember. First off, the full amount of tax withholding from a foreign person’s disposition of U.S. real property is 15 percent of the gain, unless the property is purchased for use as the foreign person’s primary residence, in which case the amount is reduced to 10 percent.

If the foreign person obtains a FIRPTA affidavit, the withholding will be reduced to 10 percent for all properties. In addition, FIRPTA affiants should be aware of potential liabilities if a false statement is made on the affidavit and of the penalties of perjury if an oath is broken.

Conclusion

The FIRPTA affidavit is an important document that must be completed by sellers and buyers of U.S. real estate. It is required if the seller is a foreign person, and failure to properly file the affidavit can result in substantial penalties. It is imperative for all parties involved to understand when a FIRPTA affidavit is required, the requirements for the affidavit, and the penalties of non-compliance.

Thankfully, filing the FIRPTA affidavit is a relatively straightforward process that can be completed with the help of a CPA or attorney. With the right information and guidance, buyers, sellers, and other parties can comply with FIRPTA and protect themselves from potential penalties.

If you need help with an IRS FIRPTA Withholding Certificate please call us at 407-502-2400, or email us at [email protected].

You can contact us by phone, email, or by visiting our offices:

- Address: 1016 E Osceola Parkway, Kissimmee, 34744, Florida, United States

- Phone: 407-502-2400

- E-mail: [email protected]

Remember that we are part of Freedom Group, a conglomerate of companies dedicated to providing quality services in accounting, taxes, financial consulting, insurance, real estate, business incorporation, among others.

As for your finances, we can help you with everything you need.

Subscribe to my channel

Subscribe to my channel