Real estate enjoys a powerful position in the economic growth of any country and when it is the real estate market as strong as that of the United States then people from all around the world couldn’t help but be attracted to make an investment. Simply enough, the real estate market of every country is its asset and it can only prosper when clear sets of rules and laws are established. For this reason, the tax laws state,

“Residents, non-residents, and the non-business individuals are subjected to the payment of withholding tax, originating from the exchange or sale of real estate”

According to this taxation code, every single person who is involved in the exchange or sale of real estate property has to pay withholding tax. This withholding tax ensures that the person is paying tax and also ensures everyone who profits from a real estate property is paying income tax. This tax regulation was introduced after tax evasion was increasing largely and the state of California introduces the concept of the Real Estate Withholding Certificate, which is a fixed rate of the amount paid to the IRS upon selling of properties.

However, there are some exceptions and exemptions from the rules whereas others have to go through the application procedure for the withholding certificate. Before starting the procedure, it is important to learn how to fill out a real estate withholding certificate because it requires considerable preparation to do it right.

If you need a FIRPTA tax withholding certificate, please call us at 407-502-2400, or email us at [email protected].

Before we dwell deeper into the topic, here’s a quick guide to some of the important terminologies regarding the subject:

- Beneficiary:

The beneficiary is the person who is legally allowed to benefit from the exchange or selling of a property that originally belongs to someone else.

- Trust:

No one can pay the selling amount to the beneficiary except for the legal body created by a grantor. The Trust is responsible for benefiting the appointed beneficiaries while following the conditions laid down by the law.

- Fiduciary:

Administration and management of a property can be undertaken by a legally assigned person called a fiduciary who has the legal authorization to do so.

- Trustee:

An individual or an organization is responsible for possessing someone else’s property temporarily and managing it on someone’s behalf to benefit them with the earnings received.

- Estate:

An individual’s entire assets and liabilities are known as his estate.

What Is Real Estate Withholding Certificate?

Real Estate withholding is not an additional tax on the sale of a real estate property but rather an advance payment of the income tax that becomes due after selling and gaining profit from a property. The withholding tax rate is fixed and by the end of the year when a person files his tax returns, the difference is paid back to the individual.

The reason behind withholding the real estate income is to reduce tax evasion in California and to ensure that sale gain on property is also paid in full. It also saves the sellers from being penalized when they fail to pay the tax or underpay the real tax amount.

When is the right time for withholding?

As soon as the title of property and possession rights transfer from one person to another, the withholding becomes applicable on the transaction. The withholding is also required in the following cases:

- In the case of Gift: withholding is required when the person going off-title is relieved of liability and/or receiving proceeds and the sum of the debt relief received is more than $100,000.

- The sum of the selling amount proceeds is more than $100,000.

Note that withholdings are not required when the seller owns the property for incidental purposes.

Exceptions to Withholding

Before we move on to learning how to fill out a real estate withholding certificate, we should understand the context and conditions surrounding it. As we discussed before, there are exceptions to the rules and not everyone is liable to pay and fill out the withholding tax certificate. Here are the exceptions:

- When the property is sold for $100,000 or less, the seller is not required to pay the withholding tax. Remember that when there are a number of sellers of a singular property the payment or non-payment of the real estate will be determined by the total sales price of the property and not by the individual’s share. In the case of supplies, condos, and other styles of living arrangements are made in a singular property and have different owners; again the withholding exception will be decided based on the collective selling price of the property.

- If the property belongs to the state or under the possession of the District of Columbia or belongs to a political subdivision or to any other instrumentalities, then there will be no obligation of withholding.

- If the property is being sold according to a deed in place of foreclosure or being sold according to the power of sale under mortgage or deed of trust then withholding does not imply.

Exemptions to Withholding

While exceptions completely liberate the seller from any kind of withholding payment, exemptions allow the seller to qualify for partial or no withholding at all. Here are the exemptions:

- When the seller has lived in the property as their main residence for at least two years during the five-year period, ending that ends by the end of the sale.

- When the property in question is attested as the primary residence of the seller

- When the seller was using the property as his primary residence before selling then there will be an exemption(not counting the two-year period rule)

- In the scenario where the property was sold for exactly the same price as it was bought for or less, then the seller will be exempted from withholding. No profit and gain mean no withholding.

- There are exceptions to withholdings when the exchange of property is involuntary or is conducted for moving from one primary residence to another that has exactly the same services, and the exchange involves no profit or gain but simply moving the seller from one residence to another without much benefit in terms of monetary or in lifestyle.

- When the property is offered in partnership in exchange for a partnership interest, then there will be no withholding payment.

- When the real state property is transferred to a corporation in control of the transferor, then rules of exemptions apply.

- In case the property belongs to an entity, then federal and state laws exempt it from withholding.

- When the seller aims to share a plan or invest in a charitable trust, qualifies for a pension plan, retirement account, or an insurance company, then they are subject to an exemption.

- There will be a partial exemption if the sale of the property is through an installment sale.

Which Form To Fill For The Real Estate Withholding Certificate?

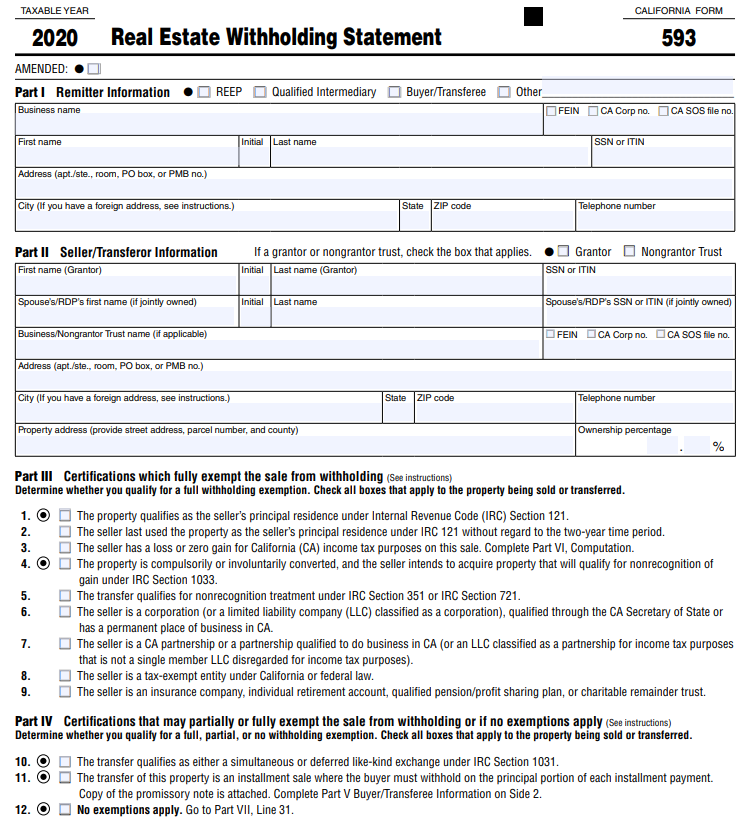

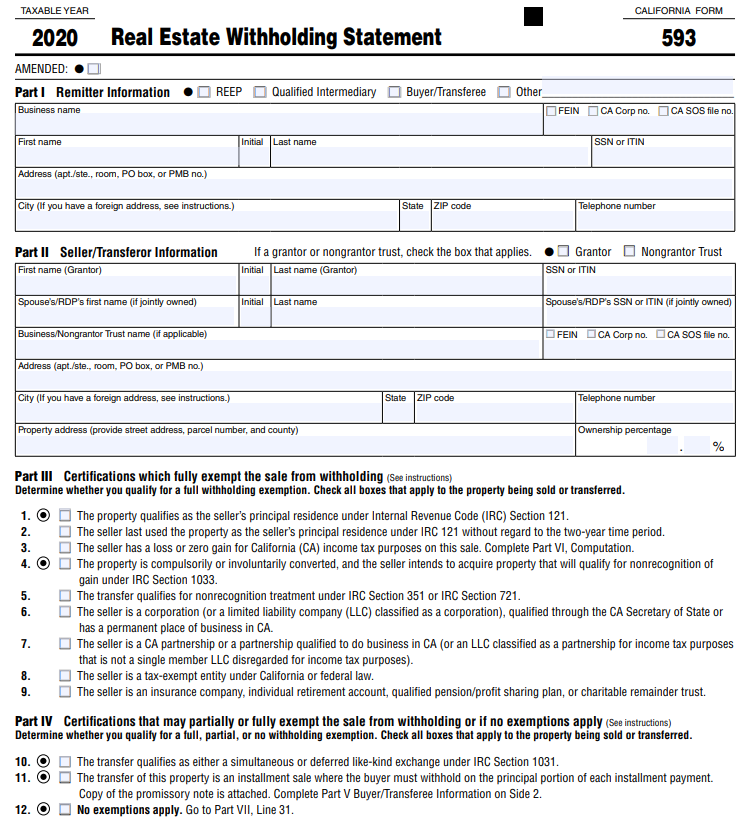

Before we move forward with learning how to fill out a real estate withholding certificate, we first need to understand the kind of forms we need to fill in each case. When the seller qualifies for withholding, then form 593-C will be filled. However, when the seller is fully or partially exempted from the withholding, then form 593-E will also be filled out alongside 593-C.

Completing the 593-C Form and Rules:

The amount to withhold upon sales transaction of property on U.S soil is 3 1/3% of the gross sales prices. In case the seller is falling on the requirements of sales price then another claim form will be filled in addition to the withholding certificate form 593-C and 593-E respectively. Also, in the case of partial exemption, the rates of the withheld amount would be different. These percentages can be determined through the form where it is mentioned in detail.

Two of the most important requirements of the form are the Social Security number (SSN) or the Individual Tax identification number (ITIN) for the individual taxpayers. Without these two, the process can be complete. In the case of spouses and registered domestic partners who are selling their property, the name and the SSN number of the spouse are also required. In the case of multiple sellers who are not married partners, the 593-C form will be filled individually.

Structure of Form 593-C:

Form 593-C is the one everyone needs to fill when selling property. The form constitutes of three parts.

Part I: Transferor or seller’s basic info

- Name,

- Spouse’s name

- Address

- Location details (address, ZIP Code, State, etc)

- SS or ITIN

- Spouse’s SSN or ITIN

Part II:

To ensure and to find out whether or not a person is falling under the benefits of exemption the second part asks the seller to tick nine boxes such:

- Who is the owner of the property

- The seller mentioning the estate as a primary residence for the last two years

- The seller or transferor is not liable to pay taxes under state or Federal LAW

- The seller is a

- Corporation

- Partnership business

- Charitable trust

- Insurance company

- Any other such entity

Part III:

The third part asks three questions to determine if the seller or transferor is subject to a partial or full exemption.

- Simulations like-kind exchange

- Deferred like-kind exchange

- Seller is paid in installments

After filling the form properly, the seller will have to sign, and mention their name, and the date of the agreement. The rest of the form consists of detailed information for both buyers and sellers and even tells the procedure that involves claiming for the withholding back.

Structure of Form 593-E:

When the seller is exempted from the tax on the basis of no gain and no loss, then they’ll have to fill out 593-E. It will to understand how to fill out real estate withholding certificate when you know the requirements beforehand. The form constitutes of two parts.

Part I:

- Name,

- Spouse’s name

- Address

- Location details (address, ZIP Code, State, etc)

- SS or ITIN

- Spouse’s SSN or ITIN

Part II:

- The depreciation cost

- Any other decrement

- Total decrease to the basic cost

- The selling price of the property

- Any cost incurred for improvements or additions

- Any other increment to the basic cost

- The adjusted basic

- The selling expenses incurred during the process

- The total amount realized (this will be done by subtracting the expenses from the selling price)

- The purchasing price

- The points paid to the seller or the transferor then

What is Individual Tax Identification Number (ITIN)?

Every form of IRS related to tax requires for Individual tax identification number. Every person in the USA requires ITIN when they want to pay their taxes in a lawful and legal manner. The ITIN numbers are assigned by the IRS to every individual to keep a track of their taxation history and help them pay taxes without much hassle. Because of the fact that the Internal Revenue Service of the USA has to manage a bulky database of taxpayers to keep an eye on all, minimize tax evasion, and regulate systemized functionality, they assign numbers to work as identification for the taxpayers instead of names.

This ITIN number is necessary for every resident and non-resident population of the USA. Foreign investors cannot pay any tax without TIN number and without paying taxes they won’t be able to invest. The individual Tax identification numbers can be achieved by filling out the W-7 form available on the IRS’s official website. Once the form is filled with accurate and truthful information, it has to be submitted back to the IRS. Foreigners who are doing business in the USA while staying in their own country can also easily apply for the TIN number from their place of residence. Any city where U.S consular offices are situated can provide its citizens with ease of application.

Who needs to apply for ITIN?

Before you learn how to fill out a real estate withholding certificate or think of selling your property, make sure you apply for the Individual Tax Identification Number. Every person who does not qualify for SSN needs to apply for ITIN. This identification number will also be required when a person is claiming their withholding tax back or claiming a refund. Here is the list of people who need to apply for ITIN before filling out any tax-related form:

- Dependant or spouse of the non-resident alien visa holder.

- Dependant or spouse of U.S. citizen and resident alien.

- Non-resident aliens filing a U.S. tax return but are not eligible for SSN

- S. resident aliens filing a U.S. tax return but are not eligible for SSN

What if the seller fails to provide an ITIN on Form 593-C?

In the situation where the seller or transferor fails to provide an ITIN number on the form, they won’t be qualified for exemption (even if they fulfill the requirement) or any other certification. Also, 3 1/3 % of the gross sales price will be withheld.

What is Social Security Number (SSN)?

SSN is short for Social Security number that is assigned to all U.S. citizens and permanent residents of the state. This 9-digit number is also issued to the temporary residents of the state who are there for work purposes.

How Can an Immigrant Apply For Social Security Number?

There are two methods of application for an immigrant. One method involves applying from their home country before immigrating to U.S. The immigrant can apply for the SSN at the same time as they apply for their immigration visa. When this approach is taken, the immigrant won’t have to physically visit the social security office in the USA.

The other method involves arriving in the USA and visiting the social security office in person with all the documents and legal requirements.

What Is The Penalty For Wrong Filling Of Real Estate Withholding Certificate?

We imply forcefully not to fill the form until and unless you have gone through every instruction and understand how to fill out the real estate withholding certificate properly. In case of any misinformation or shortcomings, there will be penalties.

According to the California taxation law, if a seller or transferor fills a fake form on purpose to evade withholding tax even when they are not falling under any of the exemption rules, they’ll be penalized with $1,000 or 20% of the required withholding amount, whichever is greater.

Now that you know all the requirements and how to fill out a real estate withholding certificate, make sure you do it properly; take care of exemptions, and don’t use illegal means or try to evade it. In any case, where you use wrongful means for selling properties and gaining profit not only will you be ethically and morally wrong but will also get caught and will have to pay heavy penalties. If convicted of such misconduct many times again, you could be banned from investing or selling properties forever.

If you need a FIRPTA tax withholding certificate, please call us at 407-502-2400, or email us at [email protected].

Read more about FIRTPA: